Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An analyst has explained how a moving average (MA) that has historically served as the boundary for bear markets is situated at this level.

Bitcoin 50-Week MA Is Currently At $75,195

In a new post on X, analyst James Van Straten has shared a couple of important MAs related to Bitcoin. An “MA” is a technical analysis (TA) tool that calculates the average value of any given quantity and as its name implies, it moves in time along with the quantity and updates its value accordingly.

MAs can be taken over any window of time, whether that be just 10 minutes or 10 years. The main use of this indicator is for studying long-term trends, as it helps filter out any short-term deviations in the chart.

Here is the chart shared by the analyst, that shows the trend in the 50-week and 200-day MAs of the Bitcoin price over the past year:

As is visible in the above graph, the Bitcoin price has dropped below the 200-day MA after the recent market downturn, meaning that the asset’s value now is lower than the average for the last 200 days.

In TA, the 200-day MA is often looked at as a boundary line between bearish and bullish trends, with a breakdown of the level being considered a bad sign. Thus, it would appear that BTC has lost this important level with its latest plunge.

Another level that may divide macro trends, however, is the 50-week MA, which the cryptocurrency still remains above. “Below 50WMA is a bear market,” notes Van Straten. At present, the level is situated around $75,195.

If BTC’s current bearish trajectory continues, it’s possible that this line might be put to test. The analyst has pointed out, though, that the coin has dropped under the 200-day MA a few times before and managed to recover before breaking below the 50-week MA. It now remains to be seen whether a similar pattern would play out this time as well or not.

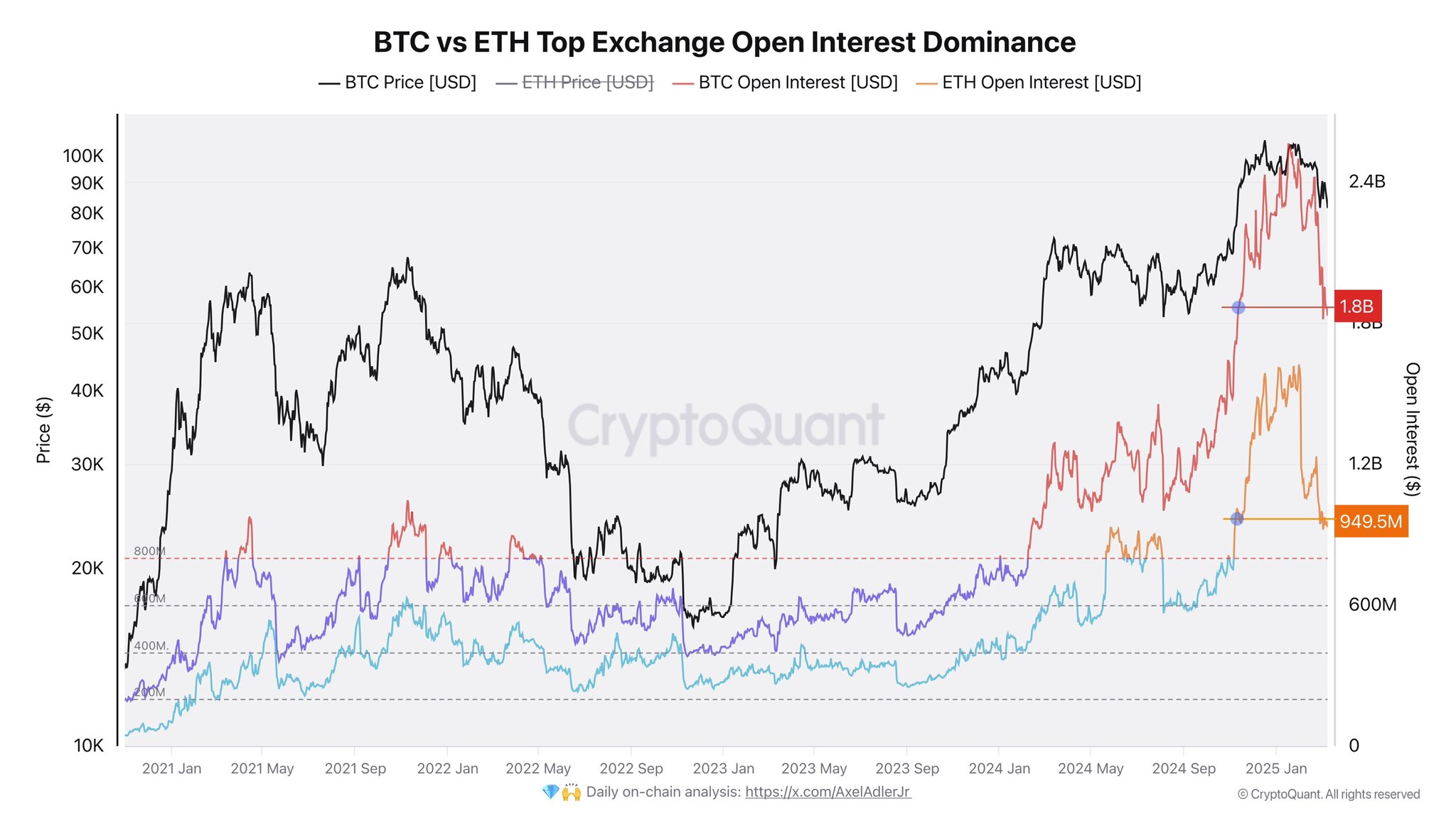

In some other news, the downwards trajectory of the market has meant that a leverage flush has occurred over on the derivatives side of the sector, as CryptoQuant author Axel Adler Jr has shared in an X post.

In the chart, the analyst has attached the data for the “Open Interest,” an indicator that measures the total amount of derivatives positions related to a given asset that are currently open on all centralized exchanges.

It would appear that the metric has plunged by $668 million for Bitcoin and $700 million for Ethereum.

BTC Price

Bitcoin has made some recovery during the last 24 hours as its price has jumped 7%, reaching the $83,000 level.

Featured image from Dall-E, CryptoQuant.com, Glassnode.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.