The Head of Research at CryptoQuant has revealed why it may be too early to call a bottom for Bitcoin, based on the trend in on-chain data.

Bitcoin MVRV Z-Score Has Plunged Under Its 365-Day MA

In a new post on X, CryptoQuant Head of Research Julio Moreno has talked about why Bitcoin may not have reached a bottom yet. “All valuation metrics are in correction territory,” notes the analyst. “It can take more time.”

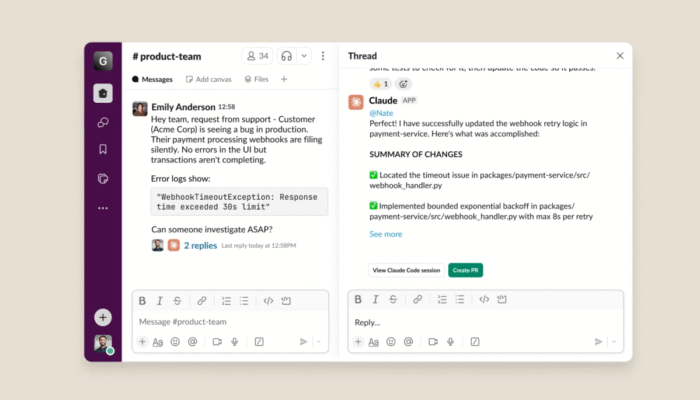

An indicator that Moreno has cited as an example of this trend is the Market Value to Realized Value (MVRV) Z-Score. This metric basically tells us about how the market cap of the asset compares against its realized cap.

The “realized cap” is an on-chain capitalization model that calculates the total value of the BTC supply by assuming that each token in circulation has its ‘true’ value equal to the spot price at which it was last transacted on the blockchain.

In other words, the realized cap sums up the cost basis of the cryptocurrency’s supply. As such, the model can be interpreted as a measure of the total amount of capital the investors as a whole have put into BTC.

Since the MVRV Z-Score compares the market cap, which represents the value the investors are holding right now, against this initial investment, it tells us about the profit-loss status of the cryptocurrency’s user base.

The MVRV Z-Score is similar to the popular MVRV Ratio, but where it differs from the latter is that it also applies a standard deviation test to pull out the extremes from the data.

Now, here is the chart shared by Moreno that shows the trend in the Bitcoin MVRV Z-Score, as well as its 365-day moving average (MA), over the last few years:

As displayed in the above graph, the Bitcoin MVRV Z-Score has recently witnessed a sharp decline. The reason for this drawdown naturally lies in the crash that the asset’s price has just gone through, which has put many investors into a state of loss.

Despite the plummet, though, the metric remains above the zero mark. Below this level, the overall market enters into a state of loss, so the boundary has historically proven to be an important one for the cryptocurrency.

An important level that the metric has indeed lost, however, is the 365-day MA. As the analyst has highlighted in the chart, past breakdowns of the line have generally led to notable periods of struggle for the Bitcoin price.

It only remains to be seen how long BTC would have to stay under the level this time around, before its price reaches a bottom.

BTC Price

At the time of writing, Bitcoin is floating around $86,300, down more than 11% over the last seven days.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.