Home » Markets » Bitcoin liquidation risk spikes with nearly $2B in longs at stake if price falls to $80K

Powered by Gloria | Edited by

Leveraged bets in Bitcoin expose traders to a cycle of forced selling as volatile swings threaten cascading liquidations across exchanges.

Key Takeaways

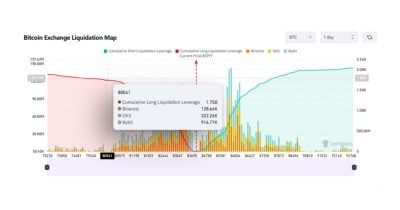

- Nearly $2 billion in leveraged Bitcoin long positions are at risk of liquidation if price falls to $80,000.

- The current exposure reveals high-risk concentration within Bitcoin’s derivatives markets.

Share this article

Bitcoin traders are facing heightened liquidation risk, with nearly $2 billion in leveraged long positions vulnerable to forced selling if the cryptocurrency’s price falls to $80,000.

The substantial exposure highlights the concentrated risk in Bitcoin’s derivatives markets, where traders using borrowed funds to amplify their bets face automatic position closures when prices move against them.

Bitcoin traded around $84,550 at press time, showing a mild bounce following its flash drop to $82,000 on Friday.

Bitcoin has experienced sharp price declines recently, driven by flight from risk assets amid economic uncertainties. Leveraged long positions in Bitcoin have faced major liquidation events in recent weeks, exacerbating downward price pressure.

The heightened volatility has amplified liquidation risks for leveraged positions across exchanges, creating potential cascading effects as forced selling can trigger additional price drops and further liquidations.