Court win, sports deals, and surging volumes lift prediction-market Kalshi as venture capital considers new funding

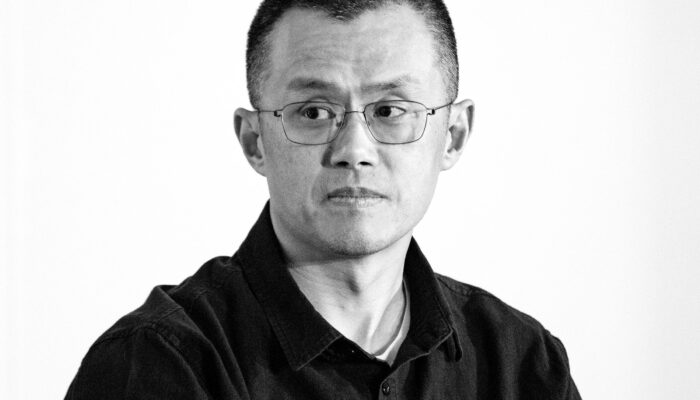

Kalshi co-founder and CEO Tarek Mansour | Permissionless IV by Ben Solomon for Blockworks

Prediction market operator Kalshi is receiving investor offers valuing the company at more than $10 billion, according to a Bloomberg report.

That valuation would make Kalshi one of the largest prospective valuations yet for a regulated event-trading platform.

The offers come just weeks after Kalshi closed a $300 million round co-led by Andreessen Horowitz and Sequoia Capital, which pegged the New York-based startup at around $5 billion.

Founded in 2018, Kalshi lets users trade contracts tied to real-world outcomes — from U.S. elections and economic data to sports contests and government shutdown durations.

The company operates under a Commodity Futures Trading Commission (CFTC) license, distinguishing it from crypto-native venues such as Polymarket, a major rival. After a court victory in October 2024 allowed Kalshi to list presidential-election contracts, trading volumes surged to new highs.

Chief executive Tarek Mansour said this month the exchange has reached an annualized volume of $50 billion.

The competition in prediction markets is intensifying. Intercontinental Exchange, owner of the New York Stock Exchange, recently pledged up to $2 billion in Polymarket at an $8 billion valuation. The National Hockey League became the first major sports league to partner with both Kalshi and Polymarket under multiyear agreements announced this week.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Michael McSweeney before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.

Decoding crypto and the markets. Daily, with Byron Gilliam.

Javits Center North | 445 11th Ave

Tues – Thurs, March 24 – 26, 2026

Blockworks’ Digital Asset Summit (DAS) will feature conversations between the builders, allocators, and legislators who will shape the trajectory of the digital asset ecosystem in the US and abroad.

Research

Meteora’s TGE will take place on Thursday, October 23. At launch, 48% of MET’s supply will be circulating, a relatively high float compared to other notable token launches on Solana. Meteora has become a key player in Solana’s DEX landscape, strengthening its distribution via Jupiter and its partnership with select launchpad partners like Believe, positioning as the go-to venue for high profile launches like TRUMP and WLFI. In our view, a P/S between 6x and 10x is most likely for MET at launch based on how RAY and ORCA have been historically priced by the market. As such, we could reasonably expect MET to trade between $450M and $1.1B after TGE (circulating market cap).

news

Breaking headlines across our core coverage categories.

From The DAO to Mango Markets, a documentary puts the spotlight on whether immutability should trump intent

Digital asset firm reports record quarterly earnings with $11.5B in assets, boosted by trading, inflows, and Helios expansion