Since September, short-term holders have accumulated over 1.5 million bitcoin.

Updated Feb 14, 2025, 11:32 a.m. UTCPublished Feb 14, 2025, 10:25 a.m. UTC

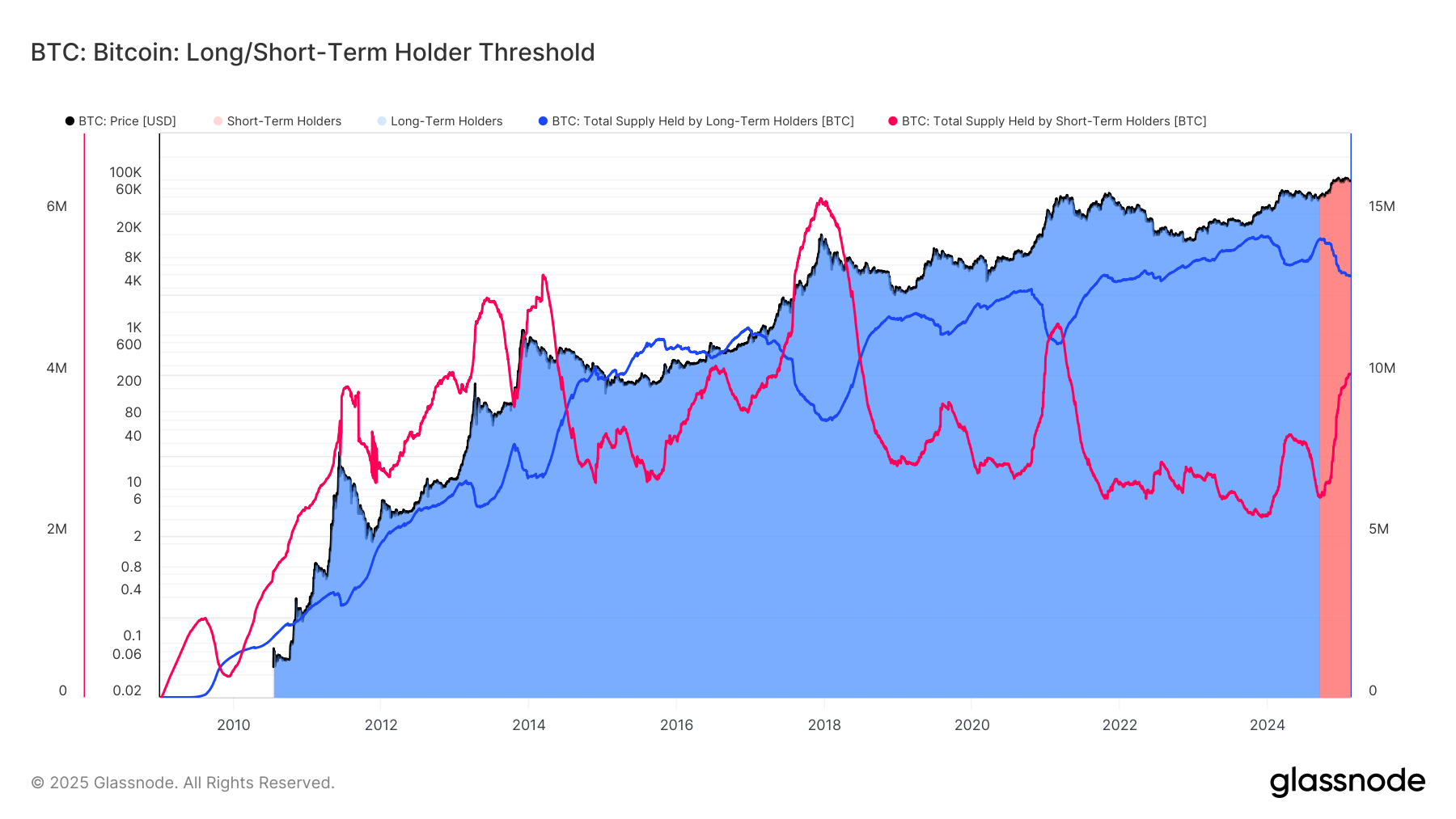

Short-term bitcoin (BTC) holders (STHs) have added 1.5 million bitcoin (BTC) since September taking the total to over 4 million bitcoin, according to Glassnode.

This equates to an average accumulation of approximately 300,000 BTC per month. During this period, bitcoin surged from $60,000 to $109,000 before pulling back below $100,000. Glassnode defines STHs as those who have held bitcoin for less than 155 days.

Historically, in previous bull market cycles, bitcoin’s price tends to peak when STHs exhaust their buying momentum, leading to a slowdown in price appreciation. This pattern has played out in 2013, 2017, and 2021.

However, STHs held significantly more bitcoin at these cycle peaks: 5 million BTC in 2013, 6.2 million BTC in 2017, and 4.6 million BTC in 2021. Compared to the current 4 million BTC, the current STH holdings are relatively low, suggesting that new market entrants could continue accumulating, meaning the cycle may still have room to grow.

Meanwhile, long-term holders (LTHs) — investors who have held bitcoin for more than 155 days — have distributed 1.2 million BTC during the same period. This indicates significant profit-taking following bitcoin’s strong rally since November.

The continued offloading by LTHs has been a major factor in bitcoin’s stalled price action since mid-November.

James Van Straten

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system. In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).