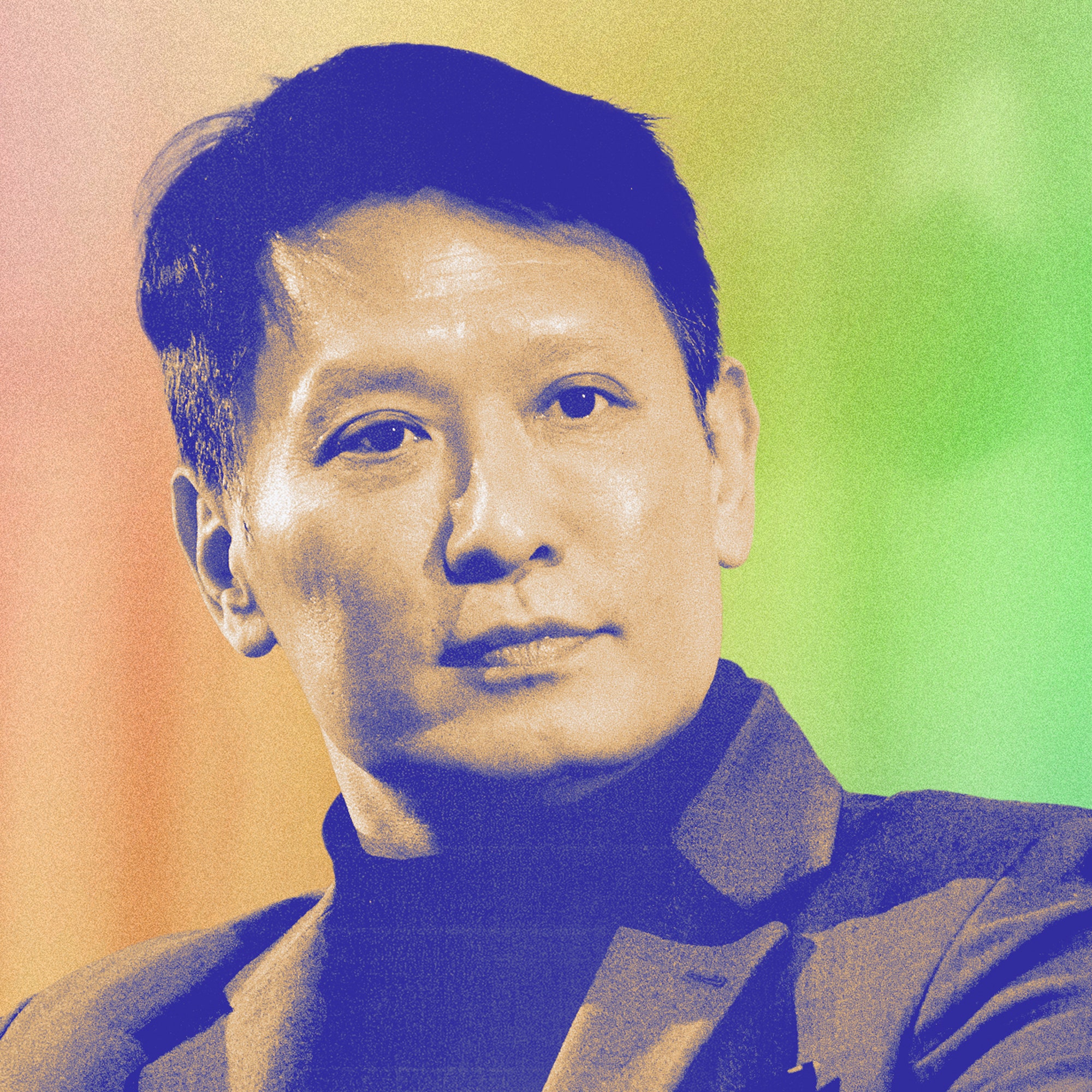

Richard Teng would rather not be compared with Changpeng Zhao, his predecessor as chief executive at crypto exchange Binance. He intends to wear his own shoes, he says, not fill anybody else’s.

Teng took charge at Binance in November 2023 after Zhao—who goes by CZ—pleaded guilty to violating anti-money laundering laws and US sanctions. The plea formed part of a sweeping settlement agreement with the US Department of Justice that brought an end to years of speculation about criminal wrongdoing at Binance. CZ was later sentenced to four months in federal prison, which he has since served.

CZ, who founded Binance in 2017, is something of a legendary figure in crypto circles for his bullish pronouncements and flair for social media. But Teng—softly spoken, with an easy manner and disarming smile—was a popular choice as successor among Binance staff, sources told WIRED at the time he took over.

Formerly a regulator by trade in Singapore and the United Arab Emirates, Teng has tried to remodel Binance from a rule-bending upstart with an inscrutable corporate structure and no global headquarters into something more of an open book. The exchange is now licensed by regulators in a greater number of countries than any competitor, Teng claims. In March, Binance named its first board of directors, made up predominantly of company executives.

Under Teng’s supervision, helped along by a rampant crypto market, Binance has grown its customer base from around 170 million to roughly 240 million people. Almost 30 percent of those users signed up in 2024, Teng claims. Despite the run-in with the DOJ, Binance remains comfortably the world’s largest crypto exchange.

But for all of Teng’s work in charting a new path for Binance, CZ continues to loom large. Although CZ is not permitted under the terms of the DOJ settlement to manage the company, in late January he took an advisory role at venture capital outfit Binance Labs, newly rebranded as YZi Labs. The head of YZi Labs, Ella Zhang, insists the outfit has been operationally independent of Binance since it was created in 2018, contrary to reporting, but it is funded “primarily from individual assets of Binance founders,” she says.

Meanwhile, as Binance’s largest shareholder, CZ continues to wield influence on decisions that affect the company, potentially limiting the scope of any changes that Teng can make.

In January, Teng spoke to WIRED at CfC St. Moritz, a conference in Switzerland. The following interview has been edited for brevity and clarity.

WIRED: CZ has now served his time. He remains the largest Binance shareholder. Are you in regular contact with him? What will his involvement in Binance look like moving forward?

RICHARD TENG: My senior management team and I report to the board of directors. CZ is not on the board. I don’t have regular communications with him.

But he is the largest shareholder and retains shareholder rights. Even for a large listed company globally, shareholders can vote on which way the company should go.

But do you expect to find it difficult to bring about a new era at Binance when the founder—who is synonymous with the company—remains the largest shareholder?

We are very clear in terms of what we are trying to build: a best-in-class, sustainable and global platform. Again, I work very closely with the senior management and board of directors on that front.

How would you like people to think about the difference between the CZ era and the Richard Teng era?

CZ started building the company in 2017, when the landscape was totally different: no institutions were embracing this, and there were no rules and regulations. It was a very, very different environment.

When I took over, we had to adapt the company to the new environment—one that is going to be much more compliant in nature. There is going to be much more regulatory clarity, even though there will be inconsistency and a lack of harmonization [between jurisdictions.]

We have invested very heavily into our compliance program. We are now the most regulated exchange globally, with twenty-one different regulatory approvals. This is the path forward.

What particular changes have you implemented to ensure that the kinds of things that have landed Binance in trouble in the past—that led CZ to serve jail time—cannot recur at the company?

Last year, I believe we held close to one hundred different courses and programs for law enforcement agencies about investigation techniques. Crypto is a traceable technology. We want to highlight the ways to use this technology to deter, detect and prevent bad actors in the space.

We want to work very closely with our competitors and law enforcement agencies globally to make sure that we have a sustainable future and can keep out all these illicit financial crimes.

Under the settlement with the US Department of Justice, Binance has to submit to oversight by external bodies. What does that look like from a practical perspective?

We have two sets of external monitors: one appointed by the DOJ and one by the Financial Crimes Enforcement Network. We work closely with both sets.

Our interests are aligned: to make sure that we invest in and enhance our compliance program. If there are any blind spots that we don’t pick up, the compliance monitors are there to help. They go through what we have, ask for data, and make recommendations on areas that we need to improve upon.

To me, it’s very useful, because it’s not just us beating our chest, but having an independent lens to say we are doing all the right things.

In the past, Binance has cast itself as a global company without headquarters. How has that changed under your leadership?

This is something that we are paying a lot of attention to. As we get regulated globally, the two fundamental things that regulators will ask is for a board of directors—which we appointed—and a global headquarters.

The deliberations [over the location of a global headquarters] are necessarily complex, with multiple factors: whether we can base our talent in that country, what is the regulatory framework, and so on. But we are in deep discussion with several jurisdictions.

What is Binance’s US strategy with the arrival of a new Trump administration?

The US is not something we are focusing on now. Whether that is something we revisit down the road depends on how the regulatory framework pans out. We are going to focus our energy on big pockets of growth globally.

But 2024 was a landmark year, with the approval of bitcoin ETFs in the US and subsequently in many different jurisdictions around the world. Institutions started to take a keen interest, going from skeptics to believers. People that used to sit on the sidelines—family offices, foundations, endowments etc.—are now starting to do allocation to crypto.

We believe that momentum will carry into 2025 with a pro-crypto president being elected in the US.

What does it mean for the US to have a pro-crypto administration for the broader crypto industry?

For the longest time, crypto has been fighting for credibility—asking for clear rules and regulations. The US has an outsized influence globally.

Under the new administration, President Trump is going to appoint very pro-crypto regulators. His discussion of a bitcoin strategic reserve has changed the psyche of sovereign wealth funds around the world. Once the US is considering this, many other countries around the world are going to consider it.

Policymakers will be looking with interest at President Trump appointing an AI and crypto czar. There must be smart reasons for doing so. They are going to consider the same for their own country.

Anything that is good for the industry will be good for us.

Do you have a relationship with David Sacks, the AI and crypto czar? What did you make of his appointment?

Our one-on-one meetings are always private.

Let’s change gear–I want to ask about threats to the exchange business model. In the last year, ETFs have provided an alternative route into crypto for investors. For the first time, peer-to-peer exchanges took a fifth of the market in trading volume. How are you thinking about those pressures?

We believe there is a very high liquidity cost to assuming crypto exposure via ETFs. They are traded only Monday to Friday, but the news flow is 24/7. In terms of hedging and managing risk, the ETF is not the best mechanism. ETFs represent the first entry point, not the destination.

With greater mainstreaming and institutionalization of crypto, I believe that both centralized and decentralized exchanges will continue to grow.

To grow to a billion users, which is the goal, we need to continue to introduce new product features. Last year, we introduced a wallet and Binance Square, [a crypto-focused social network platform.] Payments is a big area of growth: Since we introduced Binance Pay in the last two years, we are close to $26 billion in volume.

Beyond trading fees, which is the main thing as with any exchange, we’ll continue to explore whether there are other avenues that will help users in their crypto journey.