Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to recent technical analysis, Ethereum (ETH) may be gearing up for a major breakout that could propel the cryptocurrency close to the $4,200 mark. Meanwhile, ETH continues to attract growing institutional interest, with Ethereum exchange-traded funds (ETFs) outperforming their Bitcoin (BTC) counterparts.

Ethereum Headed For A Breakout?

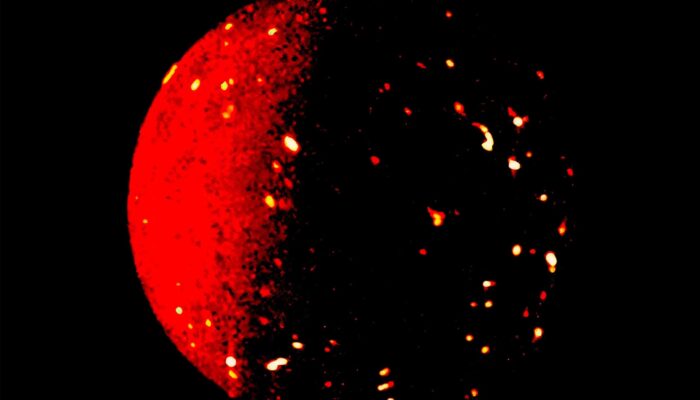

In a recent X post, noted crypto analyst Titan of Crypto highlighted that ETH is climbing within a massive weekly broadening wedge structure. The analyst shared the following chart and suggested that ETH could be targeting the $4,200 level – marking the top of the wedge.

For the uninitiated, a broadening wedge is a chart pattern characterized by diverging trendlines, where price makes higher highs and lower lows, forming a megaphone-like shape. It typically indicates increasing market volatility and can signal a potential breakout, with the direction depending on the prevailing trend and breakout confirmation.

Fellow crypto analyst Master of Crypto echoed a similar outlook, stating that ETH is “setting up for a big move,” especially with over $2.2 billion in short positions clustered near the $3,000 level.

If Ethereum breaks above $3,000, it could trigger a short squeeze, potentially accelerating ETH’s rally. At the time of writing, ETH is trading 43.7% below its all-time high (ATH) of $4,878, recorded in November 2021.

Capital flows also indicate rising institutional interest in Ethereum. Crypto market commentator Ted Pillows recently pointed out that spot ETH ETFs attracted $240.3 million in inflows yesterday, compared to $164.6 million for spot BTC ETFs.

The stronger performance of ETH ETFs suggests that capital may be rotating from Bitcoin to Ethereum. It’s worth noting that while BTC is up 54% since June 2024, ETH is still down 24.6% during the same period.

Crypto trader Merlijn the Trader shared the following monthly BTC/ETH chart showing two consecutive red candles, signaling a potential shift in momentum as BTC weakens relative to ETH. The trader noted that a similar capital rotation in 2020 preceded a “monster altseason.”

Things Look Positive For ETH

While altcoins like Solana (SOL), Tron (TRX), and SUI created fresh ATHs in 2024, ETH’s performance did not live up to expectations. As a result, the broader sentiment in the Etheruem ecosystem took a hit.

However, 2025 appears to be ushering in a more favorable outlook. On-chain data reveals that ETH faces no major resistance until the $3,417 level.

Additionally, ETH recently flashed a golden cross on the daily chart – a bullish technical signal that could indicate an impending rally. At press time, ETH trades at $2,756, down 1.7% in the past 24 hours.

Featured image from with Unsplash, charts from X and TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.