Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

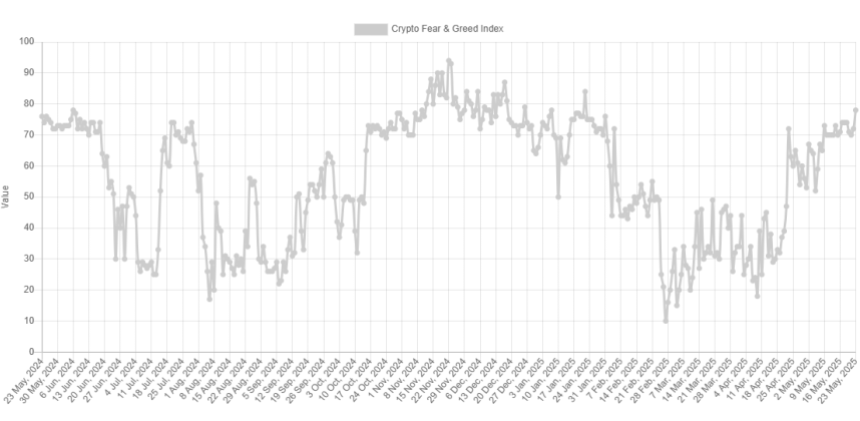

Data shows the Bitcoin market sentiment has broken into the extreme greed territory following the cryptocurrency’s new high above $111,000.

Bitcoin Fear & Greed Index Has Shot Up Recently

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the sentiment held by the average trader in the Bitcoin and wider cryptocurrency markets. The metric uses a numerical scale running from 0-100 in order to represent the sentiment. All values above 53 represent greed among the investors, while those below 47 indicate fear. The index lying between these two cutoffs implies a net neutral mentality.

Besides these three main zones, there are also two ‘extreme’ regions called the extreme greed (above 75) and extreme fear (below 25). At present, the market sentiment is inside the former of the two, according to the latest value of the Fear & Greed Index.

Historically, the extreme sentiments have held much significance for Bitcoin and other digital assets, as they have been where major tops and bottoms have tended to form. The relationship has been an inverse one, however, meaning that an overly bullish atmosphere makes tops likely and an excess of despair bottoms.

Some traders exploit this fact in order to time their buy and sell moves. This trading technique is popularly known as contrarian investing. Warren Buffet’s famous quote sums up the core idea: “be fearful when others are greedy, and greedy when others are fearful.”

With the Bitcoin sentiment now making a return into the extreme greed region, it’s possible that followers of this philosophy may be starting to look toward the exit.

That said, the Fear & Greed Index has a value of ‘just’ 78 at the moment. For comparison, the December top occurred at around 87 and the January one at 84. Earlier in the rally, the metric even hit a much higher peak of 94 in November.

As such, it’s possible that the current market may not be quite that overheated in terms of sentiment just yet, assuming demand from the investors doesn’t let off. It only remains to be seen, though, how Bitcoin and other cryptocurrencies would evolve under this extreme greed.

Speaking of demand, whales have just made a significant amount of withdrawals from the Binance platform, as CryptoQuant community analyst Maartunn has pointed out in an X post.

The indicator displayed in the chart is the “Exchange Netflow,” which tells us about the net amount of Bitcoin that’s moving into or out of the wallets associated with a centralized exchange, which, in this case, is Binance.

Clearly, the Binance Exchange Netflow has observed a large negative value, implying that the investors have shifted a notable amount of coins out of the exchange. More specifically, net outflows for the platform have stood at 2,190 BTC or about $237 million.

This could potentially indicate demand from the big-money investors for HODLing the cryptocurrency in self-custodial wallets.

BTC Price

At the time of writing, Bitcoin is floating around $108,400, up over 4% in the last seven days.

Featured image from Dall-E, CryptoQuant.com, Alternative.me, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.