Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows the Bitcoin short-term holder whales have recently been entering at three times higher prices than the cost basis of the long-term holder whales.

New Bitcoin Whales Have Cost Basis Around $91,900

In a new post on X, CryptoQuant author Axel Adler Jr has discussed how the Realized Price compares between the two major sides of the whale cohort on the Bitcoin network. The “Realized Price” here refers to an indicator that keeps track of the cost basis or acquisition level of the average investor in the BTC market.

When the value of this metric is above the spot price of the asset, it means the holders as a whole are carrying a net unrealized loss. Similarly, the indicator being under the coin’s value suggests the dominance of profit among the investors.

In the context of the current topic, the Realized Price of the entire sector isn’t of interest, but rather that of two specific investor cohorts: the short-term holder and long-term holder whales.

The short-term holders (STHs) and long-term holders (LTHs) make up the two main divisions of the BTC network based on the basis of holding time. All investors who purchased their coins within the past 155 days are put into the STHs, while those who surpass this threshold mature into the LTHs.

The STHs and LTHs of focus here aren’t just any ordinary investors, but rather the “whales,” entities who are carrying more than 1,000 BTC ($103.3 million) in their balance.

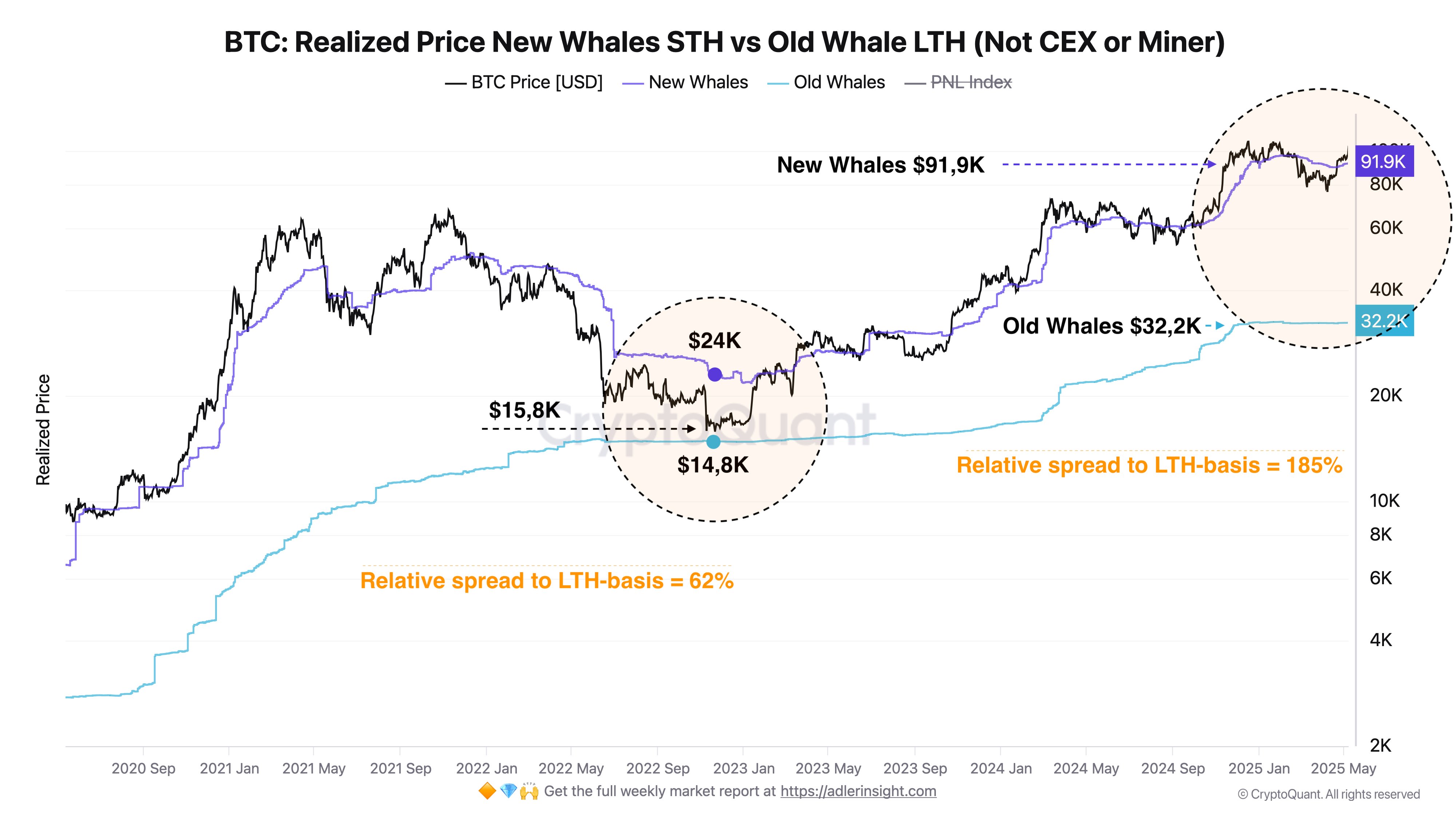

Now, here is a chart that shows the trend in the Bitcoin Realized Price for the STH and LTH whales over the past few years:

As is visible in the above graph, the Bitcoin Realized Price of the whales who got in during the past 155 days stands at $91,900 at the moment. With BTC’s recent recovery rally, the spot price has gained a notable distance above this line, so the cohort should be comfortably in the green now.

That said, their situation is nowhere near as good as that of the veteran whales, who have their cost basis at just $32,200. This indicates that there is a spread of a whopping 185% between the bottom line of the two groups.

According to the analyst, this indicates a growing confidence and FOMO among the investors, which is driving them to buy at even the recent high prices. This trend is in sharp contrast to the 2022 bear market, where the difference between the cost basis of the two groups fell to just 65%.

It now remains to be seen whether demand from the new whales will continue to be strong in the near future, potentially driving up the spread between the cohorts further. Back in the 2021 bull market, the gap peaked at 437%.

BTC Price

With the latest continuation of the recovery rally, Bitcoin has managed to reclaim the $103,000 level.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.