Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to a recent CryptoQuant Quicktake post by on-chain analyst BorisVest, Ethereum (ETH) appears to be stuck in a state of limbo. While retail investors are increasingly sending ETH to exchanges such as Binance – typically a sign of selling pressure – large investors are steadily withdrawing ETH from these platforms, indicating accumulation and long-term confidence.

Ethereum Stuck In A Tug-Of-War

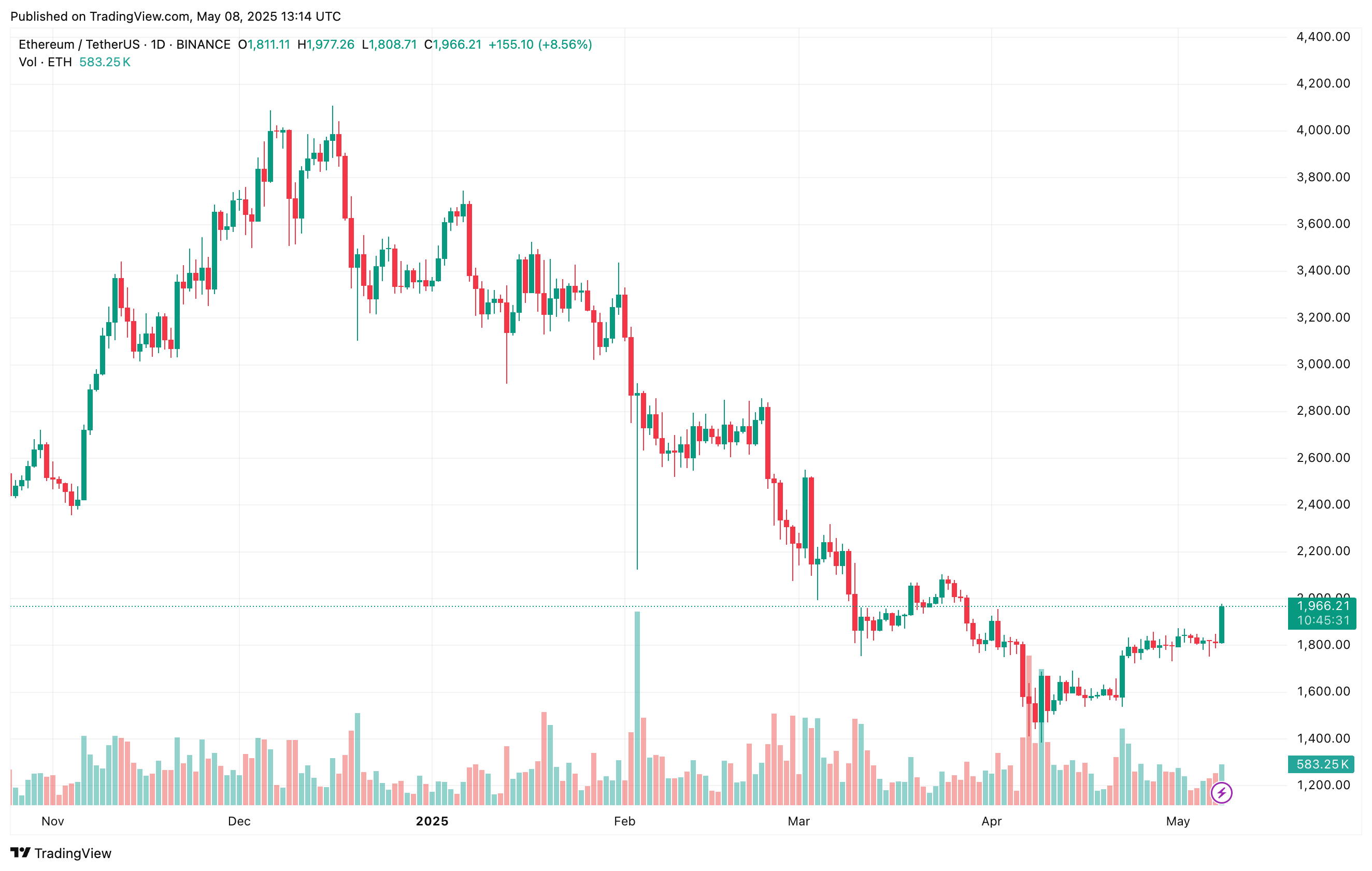

As ETH inches closer to the $2,000 mark for the first time since March 27, market sentiment appears to be shifting. Optimism is building around the potential for a trend reversal, but on-chain data continues to deliver mixed signals regarding Ethereum’s short- to medium-term direction.

In his analysis, BorisVest highlighted that Ethereum metrics from Binance are sending ‘mixed signals.’ While short-term indicators reveal underlying weakness and investor indecision, longer-term metrics point to resilience and strength.

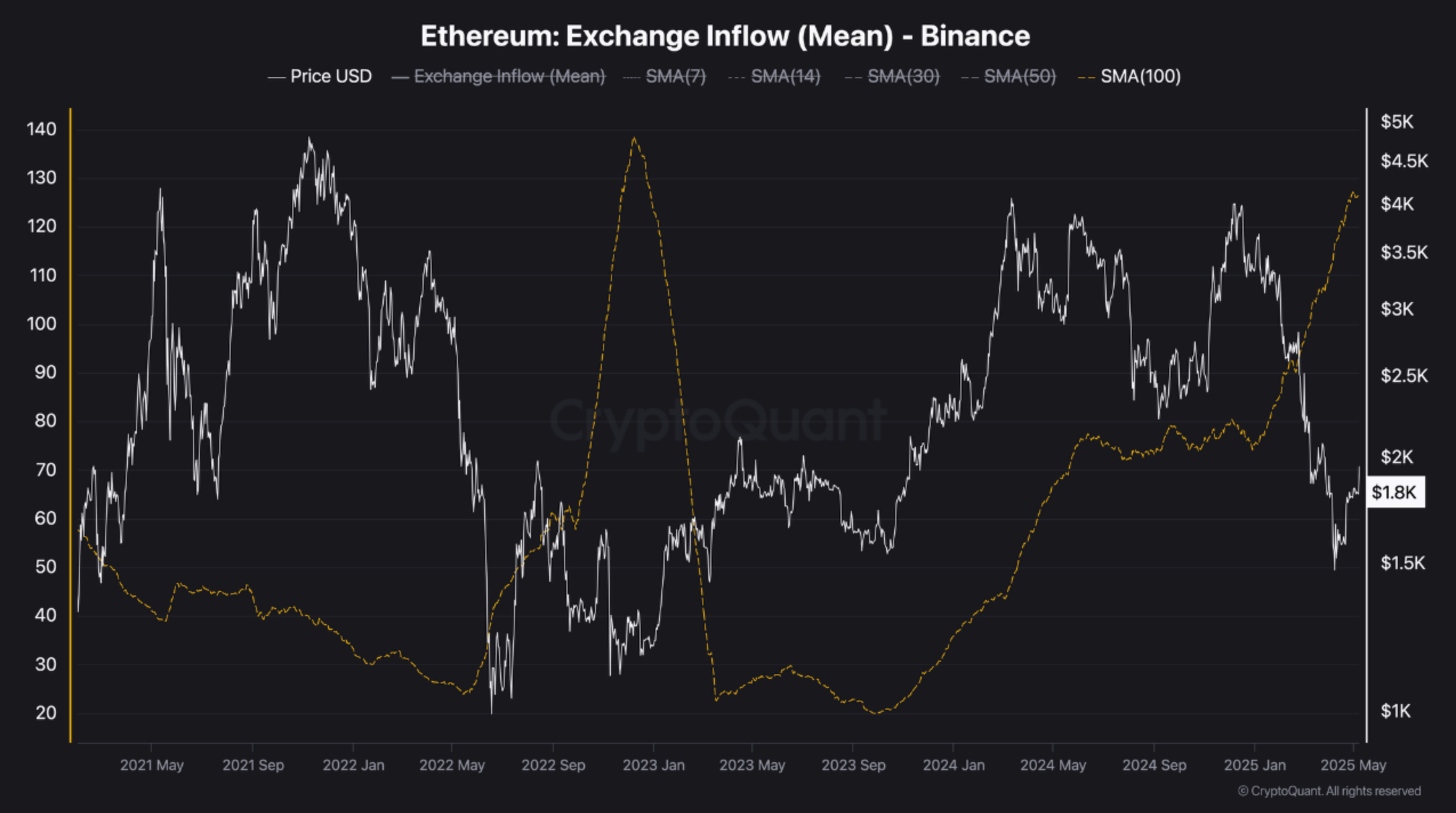

Notably, mean exchange inflows have increased significantly since late 2024, suggesting growing sell pressure from retail traders. This pattern resembles the behavior seen during 2022–2023, when a surge in ETH deposits to exchanges preceded a steep price decline.

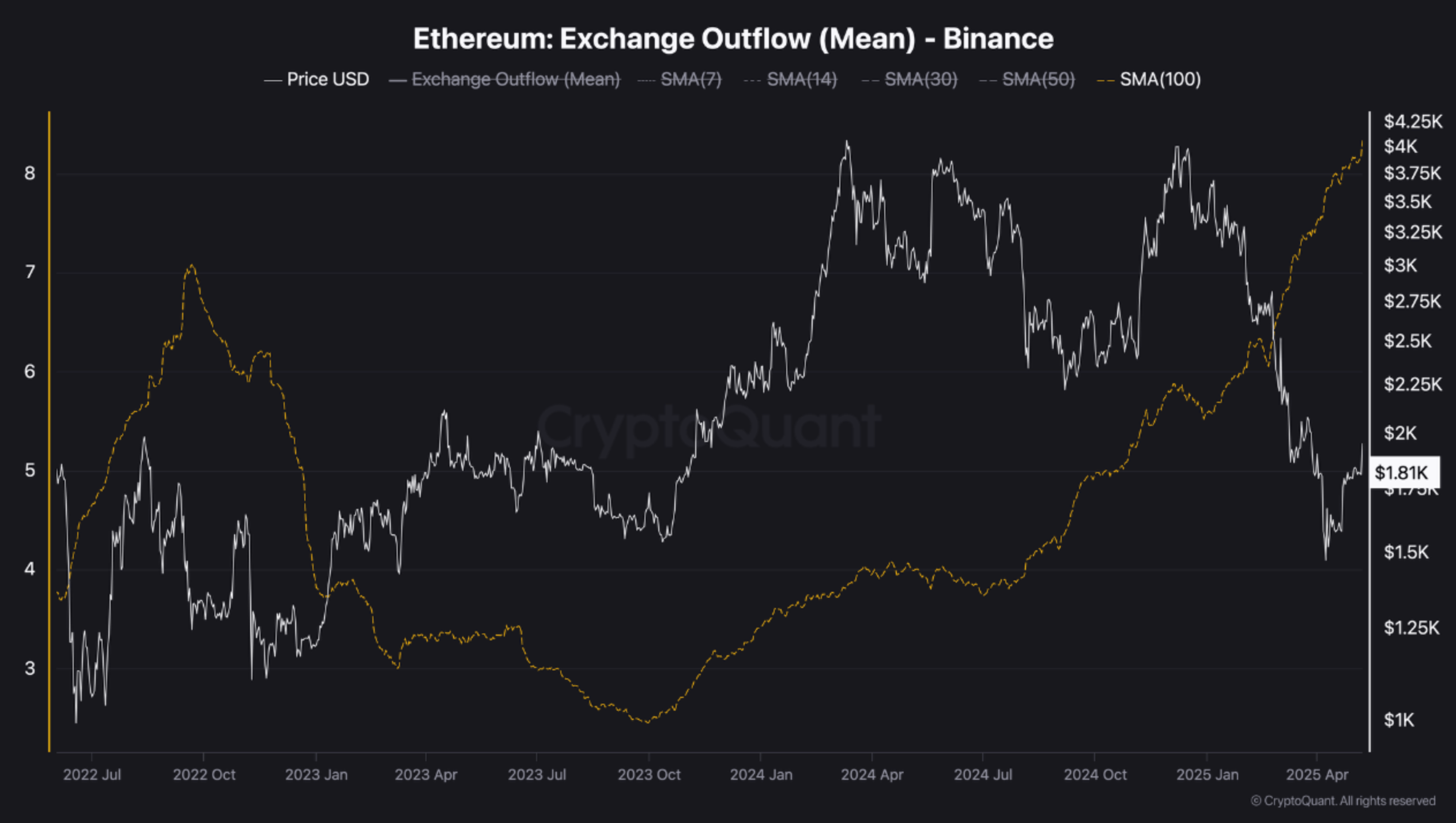

Similarly, mean exchange outflows have also been rising steadily since October 2023. However, these outflows are largely linked to whale wallets – addresses holding large amounts of ETH – implying that high-net-worth individuals are accumulating rather than selling. This divergence highlights a classic tug-of-war between retail fear and institutional confidence.

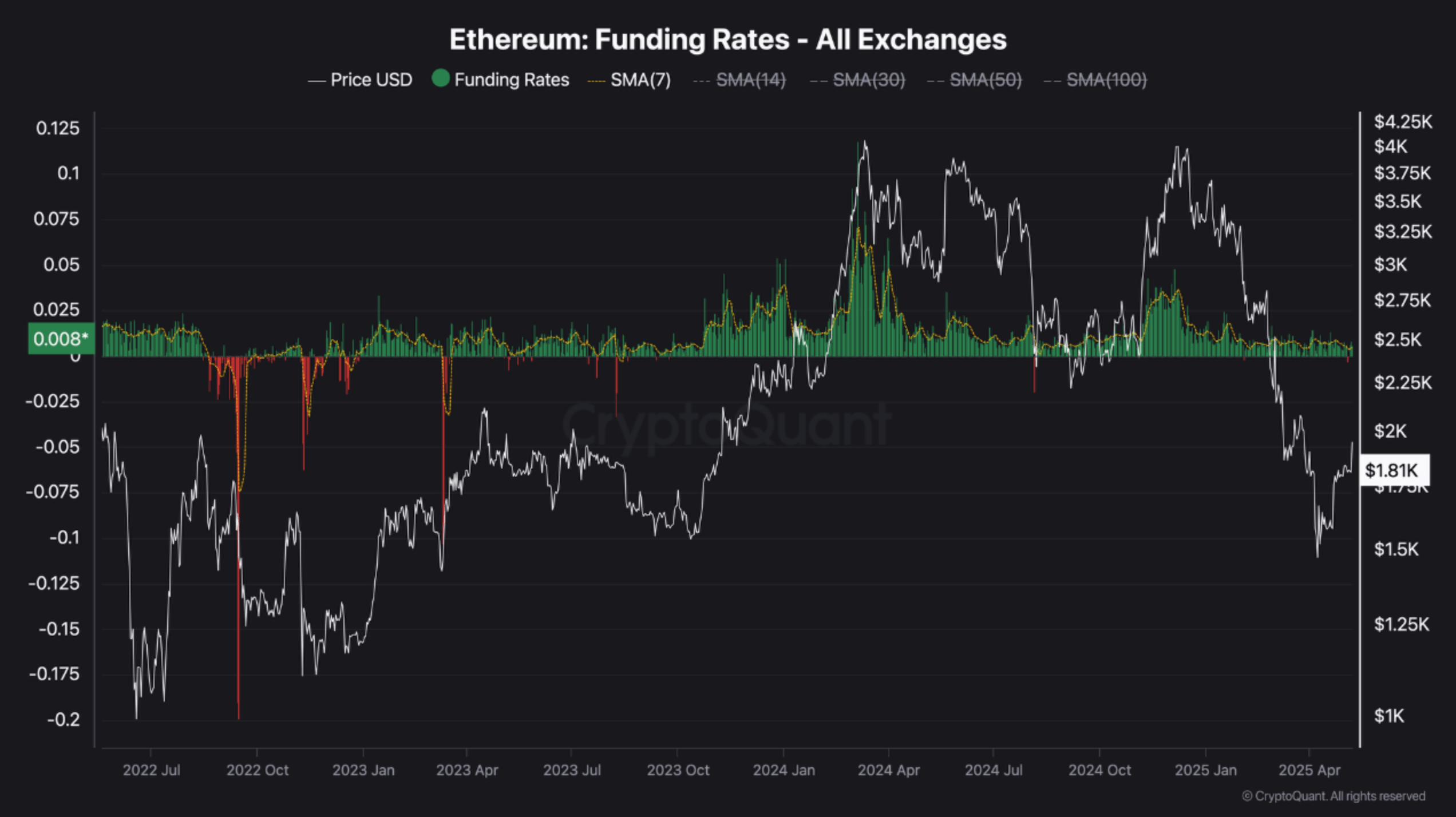

The analyst also pointed to funding rate trends. He noted that during ETH’s rally to $4,000 in early 2025, funding rates became overly positive as bullish sentiment took hold. This over-leveraged long positioning resulted in a sharp correction, driving ETH’s price down to $1,400 by April.

At present, funding rates are hovering in neutral territory, indicating a lack of clear leverage bias. BorisVest noted that if short interest rises and funding rates fall below zero, a short squeeze could ensue – potentially driving prices higher. However, no such setup has formed yet.

Meanwhile, the taker buy/sell ratio, which tracks aggressive market orders, showed heavy selling pressure in late 2024 and early 2025 – right before Ethereum’s steep decline. This ratio is now stabilizing, suggesting that sellers may be exhausted and buyers are gradually regaining strength.

Change Of Fortunes For ETH?

Although ETH is down 34.3% over the past year, several technical and on-chain indicators point toward a potential bullish trend reversal for the second-largest cryptocurrency by market cap.

For instance, Ethereum recently flashed a golden cross on the daily chart, a bullish indicator that typically leads to major upward moves. Further, there are signs that the cryptocurrency may have already bottomed out for this market cycle.

That said, uncertainty remains. Recently, machine learning algorithm CoinCodex predicted that ETH may witness another crash that may push its price down to $1,500. At press time, ETH trades at $1,966, up 7.8% in the past 24 hours.

Featured image created with Unsplash, charts from CryptoQuant and TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.