Despite macroeconomic uncertainty, Bitcoin miners are showing confidence in further upside, as stable reserves signal their belief in continued market growth.

Bitcoin (BTC) miners have shown no significant signs of capitulation, with on-chain data continuing to signal a bullish outlook, analysts at Bitfinex Alpha wrote in a recent research report.

They noted that despite macroeconomic turbulence and a 32% drop from Bitcoin’s all-time high in 2024, miner reserves have remained stable. As of May 5, reserves were at 1,808,674 BTC, showing little fluctuation from December 2024 levels, suggesting a cautious holding strategy, with miners refraining from significant selling.

“Given that miners typically need to liquidate a portion of their holdings to finance operational

expenses — such as electricity, maintenance, and salaries — their continued restraint from selling

speaks volumes about expectations of future price appreciation.”Bitfinex Alpha

The analysts noted that the fact miners are still holding onto the recent 32% recovery from the April lows supports the idea that, despite recent volatility and macro uncertainty, “we may not have seen the final leg of the current bull cycle.”

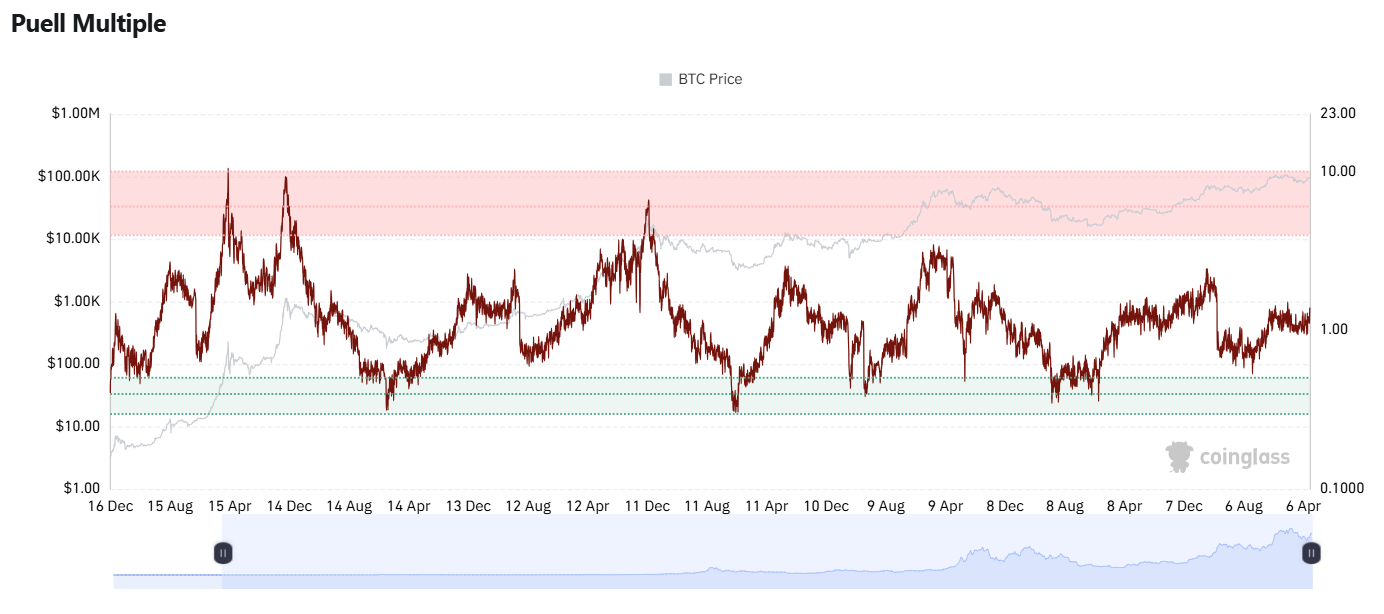

The Puell Multiple, a key indicator of miner profitability, also remains well below historically elevated thresholds, further confirming miners’ lack of incentive to sell. Typically, values above 2 signal an increase in selling activity, but the current level of the Puell Multiple suggests that large-scale miner selling is unlikely.

These stable reserves and low selling pressure reinforce the idea that Bitcoin miners remain confident in the asset’s potential for future gains. While the market remains susceptible to short-term fluctuations, the structural signals suggest that the current cycle may still have room to grow, with miners holding onto their positions in anticipation of further upside, the analysts explain.