President Trump’s tariff standoff with China has caused chaos, confusion, and major delays for companies of all shapes and sizes. As everyone waits to see what happens next, some businesses that depend on international trade are already feeling major impacts, saying that they might not meet their production deadlines. And one of those deadlines is pretty important: Christmas. Today on the show, we’re joined by WIRED’s senior business editor Louise Matsakis to talk through the latest on tariffs.

Mentioned in this episode:

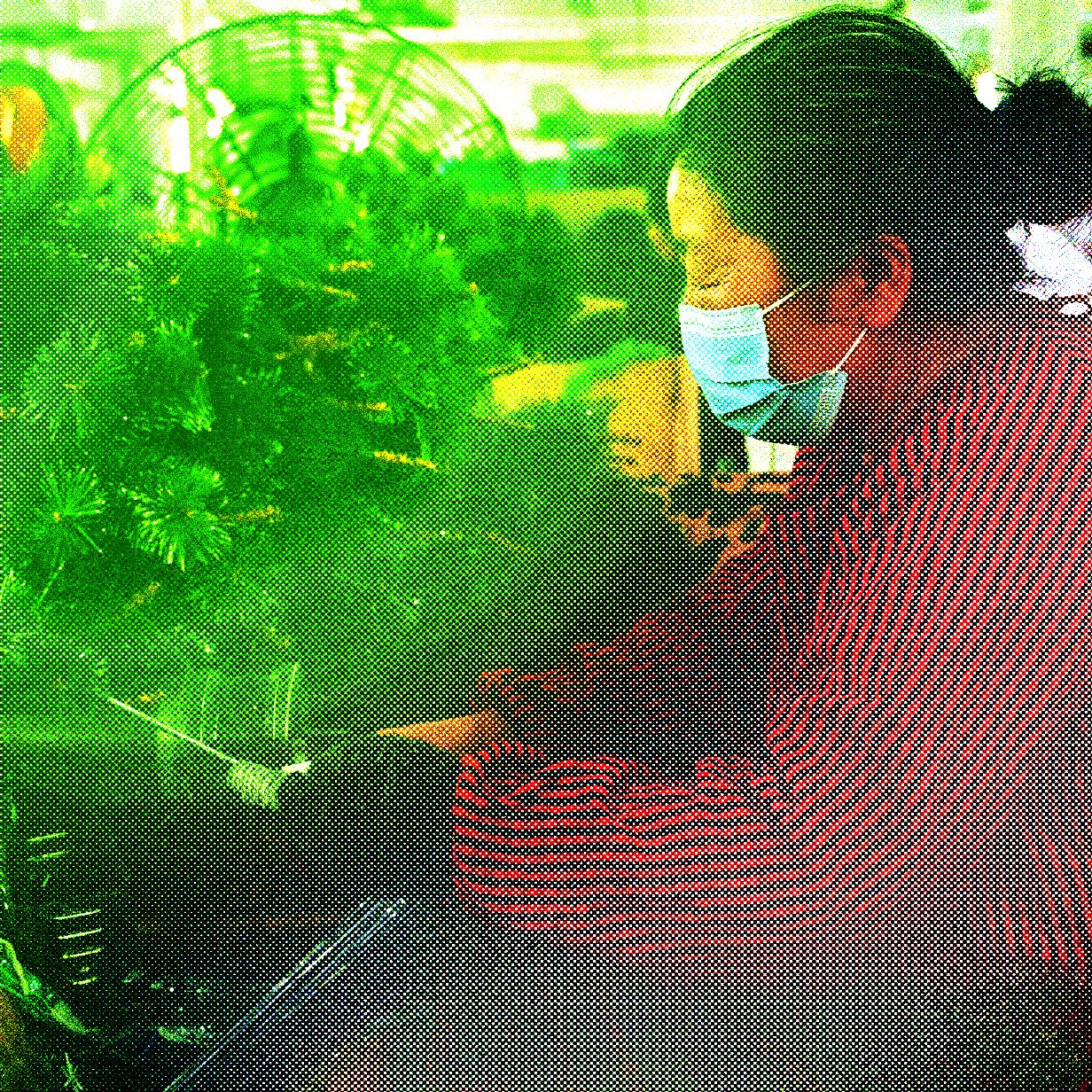

Donald Trump Is Already Ruining Christmas by Zeyi Yang

OpenAI Adds Shopping to ChatGPT in a Challenge to Google by Reece Rogers

The Agonizing Task of Turning Europe’s Power Back On by Natasha Bernal

You can follow Zoë Schiffer on Bluesky at @zoeschiffer and Louise Matsakis on Bluesky at @lmatsakis. Write to us at uncannyvalley@wired.com.

How to Listen

You can always listen to this week’s podcast through the audio player on this page, but if you want to subscribe for free to get every episode, here’s how:

If you’re on an iPhone or iPad, open the app called Podcasts, or just tap this link. You can also download an app like Overcast or Pocket Casts and search for “uncanny valley.” We’re on Spotify too.

Transcript

Note: This is an automated transcript, which may contain errors.

Zoë Schiffer: Welcome to WIRED’s Uncanny Valley. I’m WIRED’s director of business and industry Zoë Schiffer. Well, we’re 100 days in to Trump’s second term in office and we’re all waiting to see what happens with the tariff standoff with China. Especially for businesses of all sizes that absolutely depend on international trade. In some cases, the setbacks have been so significant that businesses with set production cycles are saying that might not even meet their deadlines. One of those deadlines is pretty important because it’s Christmas. Today on the show, I’m joined by WIRED’s senior business editor Louise Matsakis to talk the latest on tariffs. Welcome to Uncanny Valley, Louise.

Louise Matsakis: Hey, Zoë. Thanks for having me.

Zoë Schiffer: Let’s dive right in because we had some reporting on WIRED this week about Christmas specifically. I guess the first question to kick things off is is Christmas canceled?

Louise Matsakis: Well, it definitely could be. I think that we’re certainly in danger of missing a bunch of deadlines for, like you said, production cycles for things like artificial trees to be produced, decorations, toys for kids to put under the tree. All of those things start happening now in April.

Zoë Schiffer: I think that that’s a little bit counterintuitive for a lot of people. It definitely was for me when Zeyi, our reporter, started working on this story. The idea that these companies in the United States need to anticipate what they’re going to need for Christmas now is mind-blowing.

Louise Matsakis: Totally. If you think about it though, it makes a lot of sense. The first thing you need to do is negotiate with the suppliers, agree on designs, finalize product orders. Then it takes about two to three months for the manufacturing to actually happen. For all of those ornaments to be produced, for the decorations to put on, for everything to be packaged. Then it can take another one to two months just for those items to cross the Pacific Ocean and get to the US, and then be distributed to different retailers and warehouses across the country from there. That gets us to about mid-September to October. By, I feel like it gets earlier and earlier every year, but around November, Christmas stuff starts hitting shelves.

Zoë Schiffer: It seems like there are also a bunch of products where consumers might be able to eat the cost, but when we’re talking about ornaments, and trees, and stuff like that, you just really can’t set the price that much higher, right?

Louise Matsakis: Yeah. These are essentially non-essentials. These are the types of items that you don’t necessarily need to buy, but that make life more fun, or perhaps make Christmas magical.

Zoë Schiffer: Based on Zeyi’s reporting, how are manufacturers doing right now?

Louise Matsakis: There’s two sides of the coin. On one side are the business owners, the retailers in the US, and then there are the manufacturers in China. The retailers are basically saying, “These tariffs are so high that we have to cancel or pause our orders.” The manufacturers are saying, “Well, without orders, we have to close down our production lines.” Or in a lot of cases, they’re trying to pivot to other markets. Zeyi Yang, our senior China reporter, had this amazing anecdote about people in China who make Santa decorations, Santa figurines. They’re trying to make Santa’s face more European. Apparently, it’s a slightly wider Santa in Europe that they prefer, an old-school Santa look. They’re trying to pivot to making more figurines like that, instead of the chubby, jolly Santa that we prefer in the United States.

Zoë Schiffer: Oh my gosh, OK. Is anyone winning as a result of these tariffs? Is this a total boon to people who manufacture ornaments in the United States? Or is that market just incredibly small?

Louise Matsakis: I think aside from really small crafters who make ornaments and maybe other sorts of decorations here, it’s basically a non-existent market. Even those crafters and small businesses, they’re probably getting their craft supplies from China in the first place. This is not really benefiting any US manufacturing. There’s not a renaissance of Christmas decorations happening.

Zoë Schiffer: While I’m curious to see how this all plays out, I feel like if there’s anything that will get Americans to riot in the streets, it’s prices on Amazon going on, and/or their Christmas decorations getting too expensive. We’ll take a quick break. When we come back, we’ll talk about the impact on ecommerce goods in particular. Welcome back to Uncanny Valley. This weekend, we saw companies like Shein and Temu hike their prices as a result of Trump’s 145% tariffs on China. Let’s talk about the impact of tariffs on ecommerce. Louise, I feel like this is maybe a core area of expertise for you. Can you get us started?

Louise Matsakis: Yes. What’s happening on Shein and Temu is my personal Roman Empire. What we’re seeing, particularly on Temu thus far, is that they are actually adding a line item when you go to check out that shows the price of the tariffs. Yesterday, I just added about $32 worth of random goods to my shopping cart, and then I could see that there was a $44 tariff charge that was added on top. I think that’s a really savvy move because it shows consumers exactly why they’re seeing a price increase. I think it’s also helpful for Shein and Temu, which have been pivoting even before these tariffs were announced to other markets, like Europe and Latin America. Those goods can stay roughly the same price in those markets, but it’s just the American consumers that will see that added charge near where you see the added taxes.

Zoë Schiffer: Got it, OK. Obviously, that makes sense for logistical reasons. It’s easier to just add a tariff charge than raise the price of individual goods. But is it also a way to subtly exert pressure on the Trump Administration, or am I over-interpreting things?

Louise Matsakis: I don’t think that you are. I think it sends a pretty clear political message. That these charges are because your country has these really high tariffs. I think it’s definitely a subtle message that these companies are sending. I think Temu in particular is a mystery. They don’t have any lobbyists on Capitol Hill. They rarely if ever respond to media requests from journalists like me. It’s interesting to see them I think doing something that is politically savvy in this case, whereas most of the time they’re either silent or they’re policy decisions seem a little bit haphazard.

Zoë Schiffer: Like you said, for at least Temu and Shein, it’s a line item right now. We’re not seeing the price of individual goods really change at this point. But is that true across the board, or are there some items in particular that we should be worried about?

Louise Matsakis: The types of items that you should look out for are things that really can’t be made anywhere else. That’s stuff like electronics, anything that’s plastic. A lot of stuff for parents. Strollers, baby gear, baby toys, baby clothes, all of those things are almost entirely made in China. These are also product categories where the margins are already pretty thin, so there’s not that much wiggle room for the manufacturer or the American brand to eat the cost themselves. These are items that are often already somewhere between 10 to $30.

Zoë Schiffer: Right, OK. Well, I won’t put you on blast and make you talk about the things that you’ve stocked up on recently.

Louise Matsakis: I’m happy to share with our dear readers that I sent Zoë a horrifying photo the other day of an ungodly number of makeup sponges that I panic ordered on Temu the other day, because I refuse to go back to spending, whatever, $11 that Sephora charges for one of these.

Zoë Schiffer: 100%. This is a little bit of a pivot, but I feel like you and I have talked a lot about how it’s not as simple as just opening up production facilities in the United States. There’s a lot that goes into China being so dominant in the space. I’m wondering if you can just talk us through that briefly?

Louise Matsakis: I think that there’s this narrative that all these jobs left the United States and they went to China when China joined the World Trade Organization at the turn of the century. But that’s a really simplistic narrative. The reality is that 20 years ago, a lot of the products that we’re talking about right now, makeup sponges, iPhones, small electronics, the insulated Stanley cup that I’m looking at right now on my desk, these products literally did not exist. It’s not as though these supply chains moved from the US to China, it’s that they were built entirely from the ground up in China. That includes things like the machinery. How do you do an injection molding to make this plastic cup out of a mold? Those machines were built, designed, manufactured, and maintained in China from the time that they were invented. It’s really difficult to move that entire supply chain to the US. In China, the government has totally organized itself around supporting this type of enterprise. Where, in the US, we just don’t have any of that infrastructure in place, whether it’s even the most basic things. Roads, ports, land available to open giant factories, talent pipelines. We don’t have a high school you can go to here to become a garment worker, which is a very common thing in China.

Zoë Schiffer: Yeah. I think it’s so interesting, because I feel like prior to talking to you for many hours a day, I had the misconception that a lot of people have, that made in China was a synonym for cheaply made. But you’ve told me again and again that actually, the quality of manufacturing in China is far superior. When you talk to companies in the United States that have tried to source from the US versus China, what they’ll say is that the US quality just absolutely isn’t there.

Louise Matsakis: Totally. I think it’s just we don’t have the supply chains in place. I think in China, you can definitely get cheap manufacturing, but I think that one thing people don’t always understand is that if you’re Walmart, your signature thing is that you have low prices. You’re going to put pressure on your suppliers in China to ensure that prices remain low. If prices are low, then the manufacturing is not going to be high quality. I think that that’s the type of retailer that a lot of people are historically familiar with when it comes to things made in China. But you can go to a much nicer store, and the stuff is still made in China and the prices are higher. It’s just maybe less in your face or it’s less discussed when you go to William Sonoma or to, back in the day we used to call Target Tar-jay when it was the nicer retailer. But it doesn’t mean that it’s coming from a different place, it just depends on the economics of that particular item.

Zoë Schiffer: Then just getting back to the Christmas of it all, if they don’t put in their orders now, those facilities in China that are working 24 hours or whatever, they conceivably would either have to pivot their manufacturing or lay people off. Which would mean that even if the tariff situation is resolved, we won’t be able to get stuff back and working in a timeframe that would allow Christmas to proceed as usual.

Louise Matsakis: Yeah, there’s two things to consider here. One is that, let’s say tomorrow, Trump totally changes his mind, which is perfectly possible. There’s going to be a stampede to resume orders. All of a sudden, these factories that have been sitting idle for almost a month now are going to have to ramp up production immediately. Retailers are going to have to pay a premium to get space on that factory line, or to be prioritized, to have their orders made first and put on ships as quickly as possible. Prices are still going to be higher for consumers. The other thing is that if this goes on for too long and these workers and these factories don’t have jobs anymore, a lot of them are going to go home. In many cases, these are migrant workers who come from more rural parts of China and they actually live onsite often at the factory. They live and work in the same place. They often do these long stints where they’ll work six or sometimes seven days a week for a few months, and then take that money and go back where they’re from, see their kids, see their families. If there’s no more work, there’s no reason for them to stay there. This isn’t their home, this is not where they’re from. It’s really hard when that happens for factories to get those workers to come back immediately.

Zoë Schiffer: Also, very hard to imagine even a remotely similar scenario playing out in the United States if we were able to open big manufacturing facilities here.

Louise Matsakis: Yeah, I can’t see that many Americans wanting to live in a dorm with 12 of their coworkers on the factory line. But let me know! Send me an email if you’re interested in that setup for sure, because I would love to talk to you about it.

Zoë Schiffer: We’re going to take another quick break. Up next, our favorite reads on WIRED.com this week. Welcome back to Uncanny Valley. I’m Zoë Schiffer, WIRED’s director of business and industry. I’m joined today by WIRED’s senior business editor Louise Matsakis. Before we go, Louise, tell our listeners what they absolutely have to read on WIRED.com today. Other than the stories we mentioned in this piece, obviously.

Louise Matsakis: Speaking of online shopping, OpenAI is now getting into the ecommerce business. I highly recommend people read Reese Rogers, another one of our AI reporters, did a deep dive on how OpenAI’s new shopping integration works. It’s super fascinating. I think it’ll be really interesting if, in a few years, when we all want to buy something that is now much higher in price because of tariffs, maybe we all start asking ChatGPT how to find the best deal.

Zoë Schiffer: I’m a little worried about this because I feel like one reason that I like ChatGPT’s search so much better than Google’s is because it doesn’t have horrendous ads all over the place. I feel like we are inevitably inching closer to a world in which they look more similar.

Louise Matsakis: Yeah, I agree.

Zoë Schiffer: OK. The piece that I want to recommend is Natasha Bernal’s piece from yesterday about the major blackout that hit basically the entirety of Portugal and Spain, and also small regions of France. This was obviously major news that we woke up to yesterday. She had a really good angle on it, on basically how difficult it is to get the grid back up and running. Experts she talked to said it will take several hours to several days. There was a quote in there that it’s like “assembling some hellishly complicated Ikea furniture.” That’s worrying.

Louise Matsakis: That’s a great recommendation, Zoë.

Zoë Schiffer: That’s our show for today. We’ll link to all the stories we spoke about in the show notes. Make sure to check out Thursday’s episode of Uncanny Valley, which is about measles and the state of health in the United States under RFK Jr. If you liked what you heard today, make sure to follow our show and rate it on your podcast app of choice. If you’d like to get in touch with us for any questions, comments, or show suggestions, write to us at uncannyvalley@WIRED.com. Kyana Moghadam and Adriana Tapia produced this episode. Amar Lal at Macro Sound mixed this episode. Jordan Bell is our executive producer. Conde Nast’s head of global audio is Chris Bannon. Katie Drummond is WIRED’s global editorial director.