Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

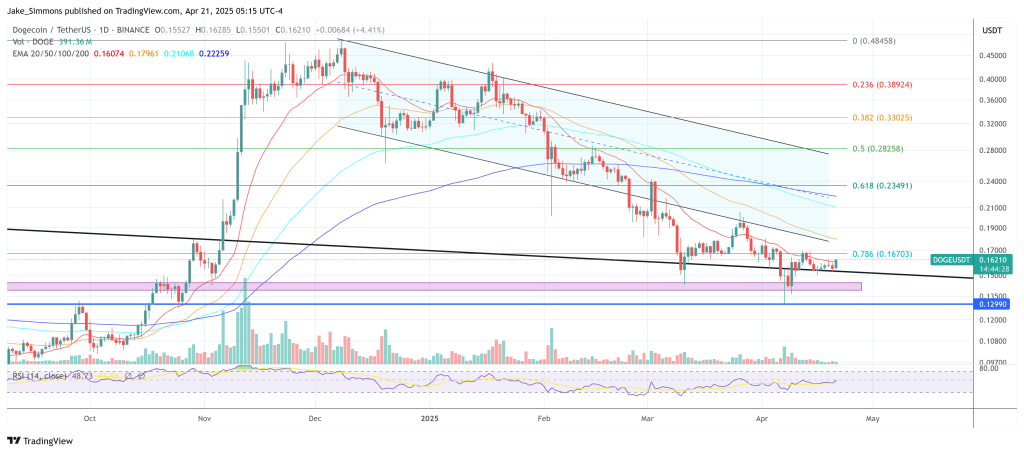

Dogecoin’s chart has turned into what independent market analyst Kevin calls “literally doing nothing” for almost a month and a half. In a broadcast on X, the veteran technician recounted that the memecoin’s last decisive move was a sharp sell‑off more than six weeks ago; since then price has compressed into a narrow band, threatening to lose the structural support it reclaimed at the end of March.

Dogecoin Momentum Still Weak

Kevin has been monitoring the same horizontal levels for “weeks.” The upper bound of the range is the post‑bear‑market breakout retest around $0.156, while the key Fibonacci retracement “macro 0.382” sits lower at $0.138 — a zone he has repeatedly described as his “line in the sand.” Only a weekly candle close beneath that level would convince him that the rally that began in late 2023 has fully broken down. “If Dogecoin breaks $0.138 on weekly closes, then it’s probably over,” he cautioned.

Momentum signals are failing to provide early confirmation either way. Commenting on the much‑watched 3-day MACD, Kevin pushed back against social‑media claims that a bullish cross is already in play. “People don’t know how to read this indicator properly,” he said. “Technically, yes, by definition it’s a cross, but it’s really not a cross […] You have to have expansion of the moving averages in order to have a confirmed cross.” Without that expansion, he warned, the fledgling uptick in the histogram could “easily just roll right over.”

With spot price inertia now stretching to 42 days, risk‑reward has compressed as well. Kevin frames the decision tree in stark terms: hold the $0.156–$0.138 congestion and Dogecoin keeps its constructive medium‑term structure; lose it and traders must look down to the psychological $0.10 shelf. Even there, he sees only the possibility of a counter‑trend bounce toward $0.25–0.26.

The broader-market backdrop offers little immediate relief. Using Bitcoin as a leading indicator, Kevin reminds viewers that the entire complex remains in what he calls a “major correctional phase,” triggered when the three‑day MACD crossed down in January 2025. Historical study of Bitcoin’s macro pullbacks suggests they persist “anywhere from 114 to 174 days,” he noted.

“They operate the same way no matter what the economic circumstances are. They last anywhere from 114 to 174 [days]. Every single time whether it’s a bear market [or] bull market. Bad news, good news doesn’t matter. They always last the same amount of time. 174 days being the longest in history, 114 days being the average of every correct major correctional period in history,” Kevin explained.

Should Bitcoin fail to defend $70,000, he argues, odds of a fresh all‑time high in the short run would be quite low. “If Bitcoin breaks $70,000 and goes into the $60,000’s, we’re gonna get a huge bounce out of there. You get a huge countertrend rally. Everything will look rosy again, but the chances are that it makes a new high very slim. Same goes for Dogecoin. If dogecoin comes down to this $0.10 level and it gets a bounce, maybe it comes like a big counter trend rally back up to like $0.25 or $0.26 and then it just rolls over and that’s the end,” Kevin stated.

For Dogecoin, therefore, the next decisive signal is likely to be a hard break of the $0.156–$0.138 corridor or a confirmed momentum resurgence on the higher‑time‑frame MACD — whichever comes first. Until then, the asset remains trapped in Kevin’s words: “We’ve done nothing… there’s not much to talk about.”

At press time, DOGE traded at $0.1621.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.