Maple Finance reached a major milestone, largely due to significant growth in its yield-bearing stablecoin.

Maple Finance (SYRUP) has seen significant growth over the past month, which boosted the token’s value. On Wednesday, April 16, SYRUP was up 25%, reaching a daily high of $0.1419, before stabilizing at $0.131.

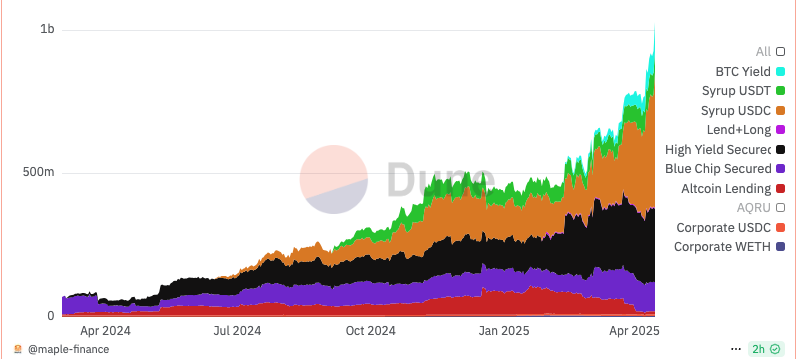

The catalyst for the price was a major milestone for the platform, which reached $1 billion in total value locked. According to data from Dune Analytics, platform TVL has more than doubled since January, when it hovered around the $450 mark.

This growth was largely due to the growth of its yield-bearing stablecoins, as well as its high-yield secured lending product. Notably, Syrup USDC went from a $123 million supply in January to its current supply of $391 million.

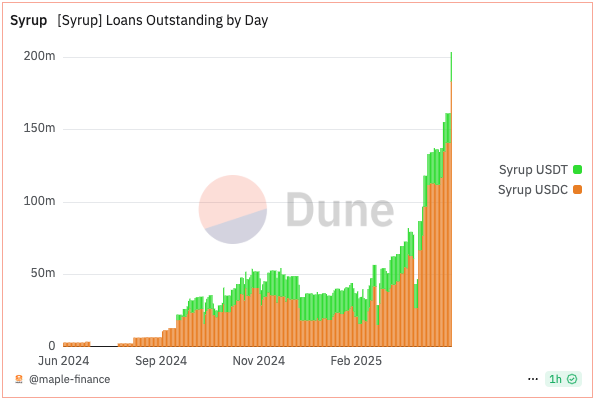

At the same time, lending in Syrup USDC rose sharply since January. At the time, the token was at near parity with Syrup USDT, Tether’s version of the yield-bearing stablecoin. Since then, Syrup USDC has achieved dominance, with $183 million in outstanding loans, compared to just $20 million for Syrup USDT.

USDC achieves dominance in the market

Both of these stablecoins offer retail users a way to access the platform yield that Maple Finance achieves through lending to institutional investors. The platform focuses on institutions with known reputations, offering them loans at manually priced rates.

Maple Finance’s Bitcoin-linked yield product has also achieved significant growth since its launch in January. This product, which enables users to earn yield on their held Bitcoin, reached a TVL of $75 million.

Despite the growth in platform TVL, protocol revenue has been down since January. Revenue fell from $409,628 in January to $370,860 in March 2025.