Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to a CryptoQuant Quicktake post published today, Bitcoin (BTC) may still be undervalued based on several on-chain metrics. Crypto on-chain analyst BorisVest explained that data suggests bullish sentiment remains intact for the leading cryptocurrency.

On-Chain Metrics Suggest Bitcoin Still Undervalued

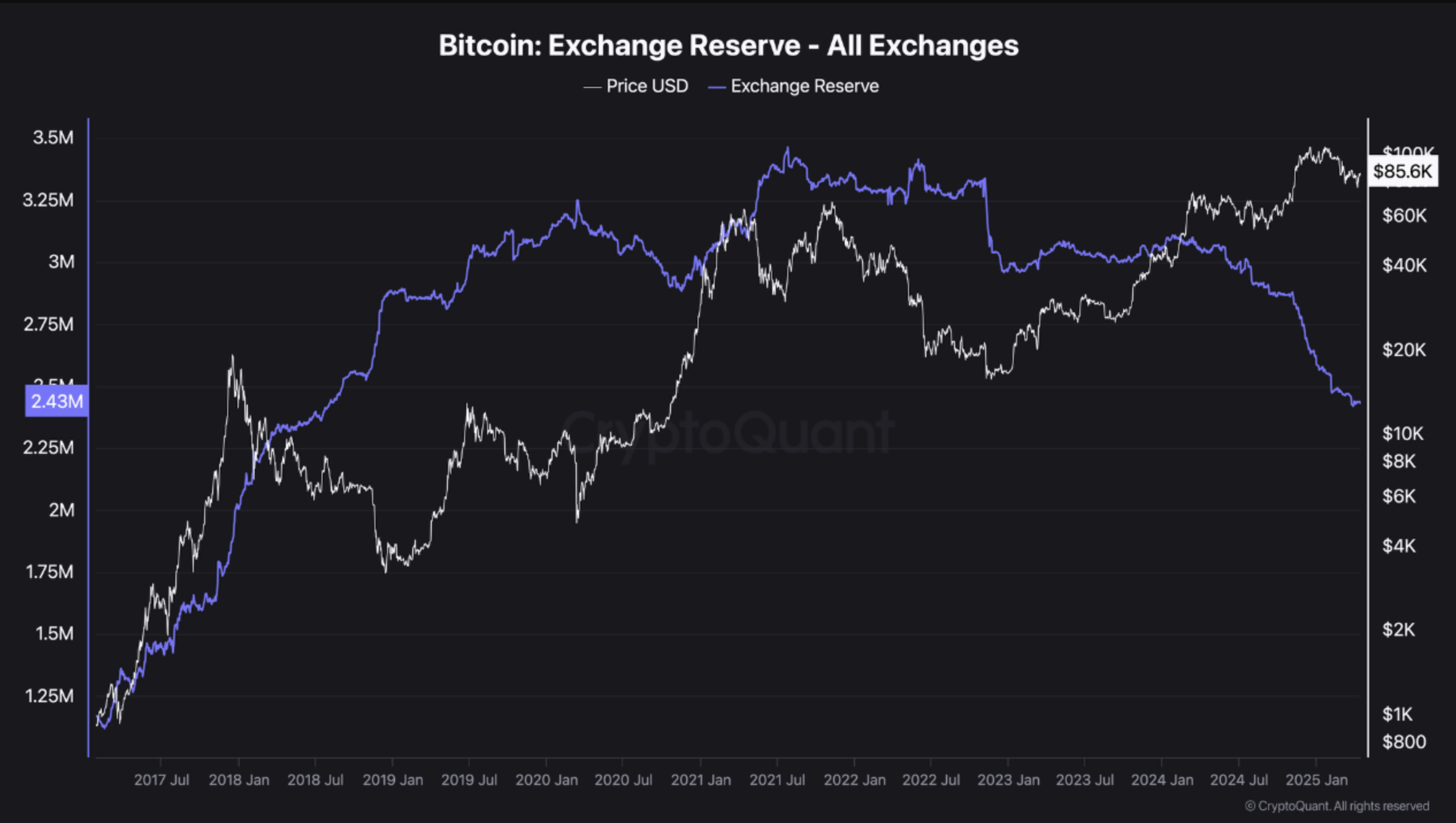

BorisVest pointed to two key on-chain metrics suggesting that BTC’s current price might be below its fair value. First, the analyst highlighted the decline in Bitcoin’s exchange reserves.

According to recent data, BTC exchange reserves – the amount of BTC available on cryptocurrency exchanges – are currently hovering around 2.43 million BTC, a sharp decline from the 3.40 million BTC on exchanges during the 2021 bull run. The analyst noted:

The Bitcoin exchange reserve data shows that Bitcoin is being withdrawn from exchanges after seven years. The fact that Bitcoin is not readily available for sale suggests it is being held for the long term. A decrease in Bitcoin supply supports a potential price increase.

To explain further, a decline in BTC exchange reserves means fewer coins are available for sale on centralized exchanges. This suggests that investors are holding rather than selling – a signal of growing confidence and potential undervaluation, as supply tightens while demand may rise.

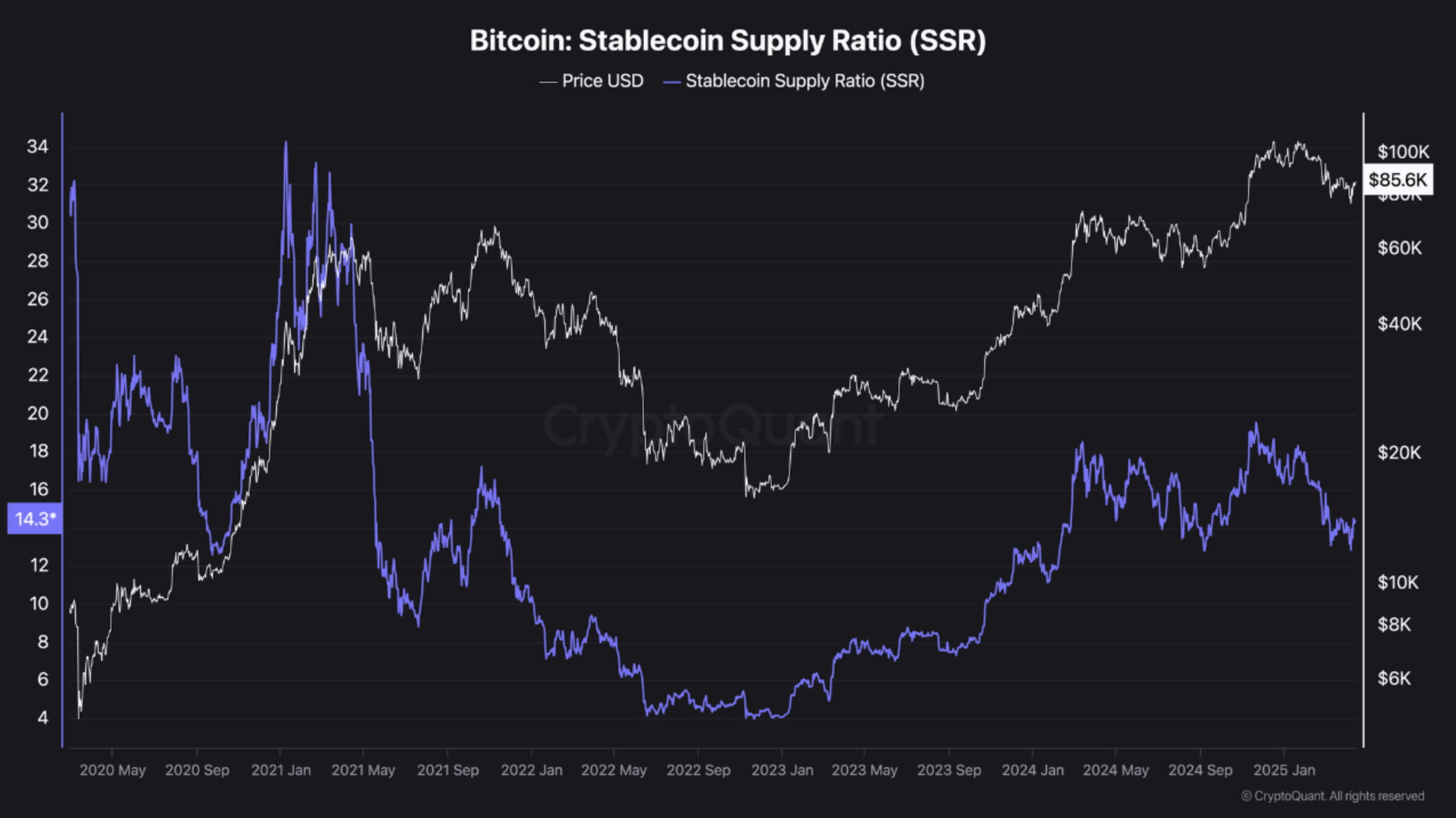

Further, BorisVest pointed to the Bitcoin Stablecoin Supply Ratio (SSR), which currently stands at 14.3. This suggests that even if BTC falls further, there is enough purchasing power among potential investors to prevent a major price decline.

The analyst explained that the SSR increases as the BTC price rises, indicating reduced purchasing power, which may signal that BTC is overvalued at prevailing market prices. The following chart shows that the SSR has not yet reached its 2021 levels – around 34 – hinting that BTC may be undervalued at its current price.

USDT Dominance Shows Bearish Divergence

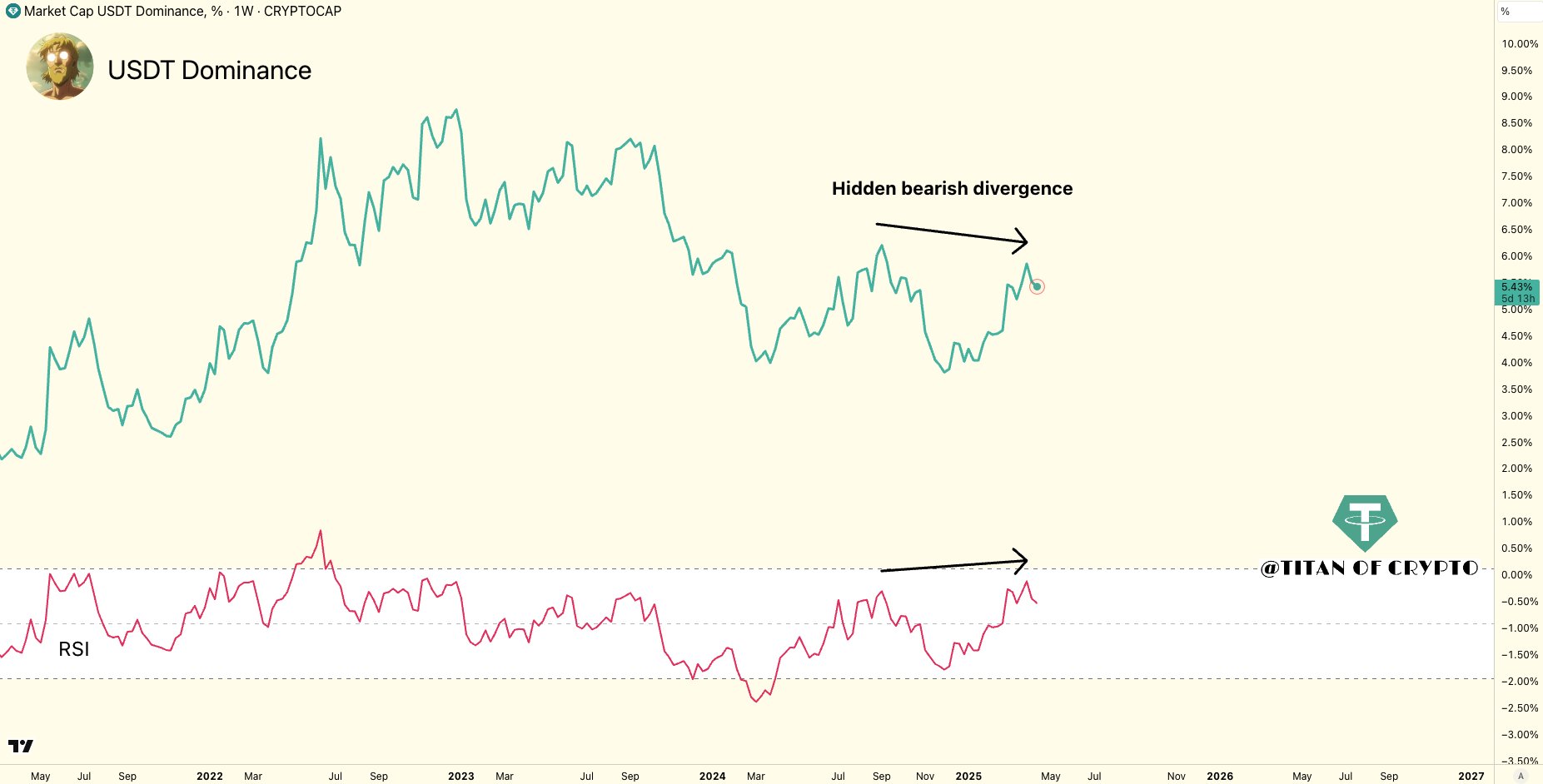

Crypto analyst Titan of Crypto shared an interesting observation regarding the declining USDT dominance on the weekly timeframe. The analyst noted that a hidden bearish divergence may be forming, which could indicate an early signal of risk-on sentiment returning to the market.

A bearish divergence on the USDT dominance chart suggests that investors are becoming less defensive, possibly rotating out of stablecoins and back into risk-on assets like BTC and altcoins. It often signals improving market sentiment and a potential bullish phase for crypto.

Meanwhile, the Bitcoin weekly Relative Strength Index (RSI) recently broke its prolonged downtrend, sparking hopes for a potential price recovery, with some analysts targeting prices beyond $100,000.

Additionally, exchange net flow data suggests that a BTC rally may be closer than most investors anticipate. At press time, BTC is trading at $85,550, up 0.5% in the last 24 hours.

Featured image created with Unsplash, charts from CryptoQuant, X, and TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.