Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is once again in the spotlight, but for all the wrong reasons. The popular meme coin has experienced massive selling pressure over the last few days, driven by heightened global tensions and ongoing macroeconomic uncertainty. On Monday, DOGE set a fresh local low around $0.129, further confirming the downtrend that has been building over the past few weeks.

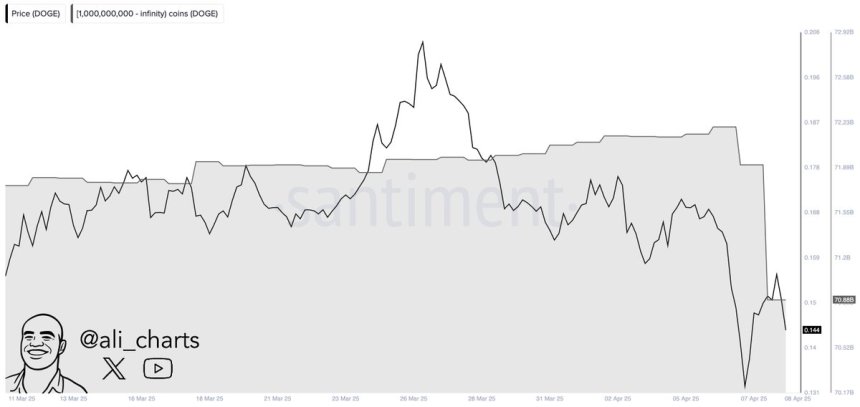

The market sentiment around Dogecoin has quickly shifted from cautious optimism to defensive positioning, as investors react to a risk-off environment affecting both traditional and crypto markets. Adding fuel to the bearish fire, data from Santiment reveals that Dogecoin whales have sold more than 1.32 billion DOGE in the past 48 hours alone — a move that raises questions about broader market confidence.

Is this massive selloff part of a strategic rebalancing from large holders, or is it a sign of panic selling amid deepening volatility? What’s certain is that DOGE is entering a critical phase. If buyers fail to step in soon, the path of least resistance could be lower. As whales exit and prices falter, the coming days could define whether Dogecoin stabilizes — or spirals further.

Dogecoin Slides Further As Whale Selloff Signals Deepening Bear Trend

Dogecoin has now lost more than 70% of its value since December, with no clear signs of a recovery in sight. The meme coin, once a symbol of bullish enthusiasm and retail speculation, is now leading the decline in the altcoin space as market conditions worsen. Growing macroeconomic uncertainty continues to weigh heavily on risk assets, and meme coins like Dogecoin have been the most affected.

The pressure isn’t just coming from within the crypto market. Broader financial instability — particularly triggered by escalating global tensions — is accelerating the selloff. U.S. President Donald Trump’s latest round of aggressive tariffs and China’s retaliatory stance have stoked fears of a full-blown trade war. As global markets reel from this uncertainty, investors are pulling back from speculative assets, sending DOGE deeper into bearish territory.

Adding to the bleak outlook, top analyst Ali Martinez shared data from Santiment revealing that whales have sold over 1.32 billion Dogecoin in just the past 48 hours. This significant outflow is a clear reflection of the risk-off sentiment dominating the market. According to Martinez, this behavior is likely driven by panic and growing expectations that a prolonged bear market is developing.

Until sentiment shifts and macro conditions stabilize, Dogecoin’s path remains precarious. The combination of whale dumping, market-wide fear, and global economic strain may keep DOGE under pressure in the near term. Bulls will need to reclaim key levels quickly to avoid a deeper collapse — but for now, the trend remains firmly bearish.

Bulls Struggle At Key Level As Selling Pressure Persists

Dogecoin is trading at $0.14, nearly 75% below its 200-day moving average around $0.25 — a striking indicator of how far the meme coin has fallen. The downtrend accelerated when DOGE lost support at the $0.25 level, and since then, bulls have failed to mount any meaningful recovery. Continued macroeconomic stress and weak investor sentiment have only added to the selling pressure, dragging prices lower with each passing week.

For Dogecoin to begin a potential recovery phase, holding above the $0.15 level is critical. This zone could act as a short-term support base, giving bulls a chance to regroup. However, merely stabilizing isn’t enough. A push toward the $0.20 mark is needed to reestablish momentum and break the current bearish structure. Reclaiming that level would also bring DOGE closer to its 200-day MA, a key technical milestone for trend reversal.

On the downside, losing the $0.14–$0.15 area could open the door to deeper losses. If support fails to hold, a quick move toward the $0.10 level is possible — potentially signaling a return to bear market lows. For now, DOGE remains under heavy pressure, with bulls on the defensive and time running out to avoid another breakdown.

Featured image from Dall-E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.