This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Casey, Felix and I are at the Digital Asset Summit (as promised). We hope you’ve been following along via the livestream, or our X accounts.

But if not, here’s the updates. We got mixed vibes from the event’s first few speakers, with some forecasts to boot.

Blockworks co-founder Michael Ippolito shared an observation to kick off the New York event — noting it’s “a tale of two cities” in the crypto space.

He was referring to new institutions jumping into the segment (or getting ready to). Yet some coins haven’t surpassed previous all-time highs, and there’s a general feeling there hasn’t been much “zero-to-one innovation” of late.

Crucible founder Meltem Demirors took the stage next, highlighting the US government’s planned strategic bitcoin reserve, the president’s memecoin, and the fact that every major financial institution has a crypto strategy.

“Yet here we are, and we have no idea what to believe in,” she said.

Demirors showed a chart with crypto market cap and trading volumes over the last five years (sans BTC and ETH). Growing bitcoin dominance, she argued, is “a sign of stagnation.”

She described institutions buying MSTR and bitcoin ETFs as mercenaries, not missionaries.

“They don’t have the same mission as us,” Demirors said. “They’re here to make money.”

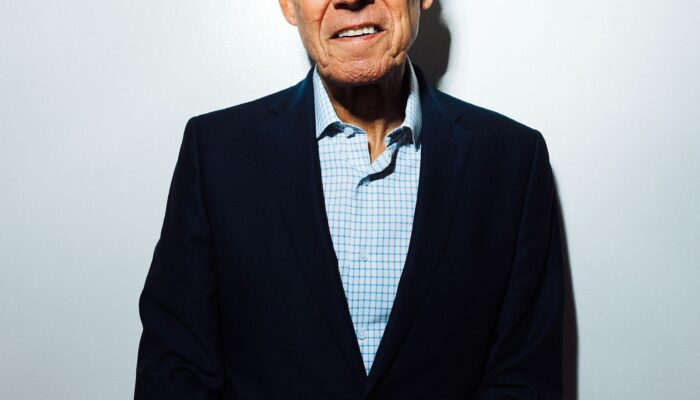

LMAX Group CEO David Mercer gave a different perspective in the next session, trying to lift spirits with some bullish predictions.

Among these was his prediction that digital assets would grow to between $20 trillion or $30 trillion by the end of the decade — roughly 15% of all assets. By 2040, he added, they will represent 80% of assets.

Loading Tweet..

Mercer believes that half of the 40 large global banks he deals with — none of which directly trade spot bitcoin with LMAX today — will “touch” digital assets by the end of 2026.

When Ippolito narrowed the timeframe to the next 12 months, Mercer noted: “A tier-one bank will start to clear major institutions into spot crypto trading. That’s not an ETF. That’s not a dollar-settled security. That’s not a dollar-settled derivative. That’s spot digital assets.”

There was a second part to the answer:

“A bulge bracket bank will offer spot digital asset trading to its customers,” Mercer said. “When that happens, guess what? They all follow.”

Get the news in your inbox. Explore Blockworks newsletters:

- Blockworks Daily: The newsletter that helps thousands of investors understand crypto and the markets, by Byron Gilliam.

- Empire: Start your morning with the top news and analysis to inform your day in crypto.

- Forward Guidance: Reporting and analysis on the growing intersection of crypto and macroeconomics, policy and finance.

- 0xResearch: Alpha directly in your inbox. Market highlights, data, degen trade ideas, governance updates, token performance and more.

- Lightspeed: Built for Solana investors, developers and community members. The latest from one of crypto’s hottest networks.

- The Drop: For crypto collectors and traders, covering apps, games, memes and more.