The global economy is about to undergo a major shift—and it’s going to be centered around cryptocurrency, according to Jeremy Allaire, cofounder and CEO of Circle, a software company that built one of the world’s top stablecoins. To facilitate this transition, Circle is creating what Allaire calls an “economic OS for the internet.”

“Basically, there are new operating system paradigms that emerge all the time. The web is one, mobile is one, cloud is another, AI is another OS paradigm,” Allaire told WIRED’s editor at large, Steven Levy, onstage at the Big Interview event in San Francisco on Thursday. “And these blockchain networks are economic OS paradigms, at least what we’re doing.”

Circle is best known for USDC, the second-largest stablecoin by market capitalization, which is currently worth around $78 billion. Unlike most cryptocurrencies, including Bitcoin, stablecoins are designed to have limited price fluctuations. USDC is backed by the US dollar, meaning if you own one USDC, you can exchange it for $1. Allaire touted USDC and stablecoins broadly as a better, faster way to transfer money across borders, and an attractive option for people who live in countries with less stable currencies than the US dollar.

But according to Allaire, stablecoins are just the beginning. The next evolution in the cryptocurrency space, he said, is “money as an app platform,” on which a new, digital-only economy will grow.

Circle’s vision for an “economic OS” is Arc, what the company describes as a “trusted, neutral” platform that aims to be a platform for the entire swath of blockchain-based technologies and, thus, the “foundation” of a “new internet financial system.” According to Allaire, the transition to this new economic system “is going to be a huge part of what unfolds for the internet over the next five to 10 years.”

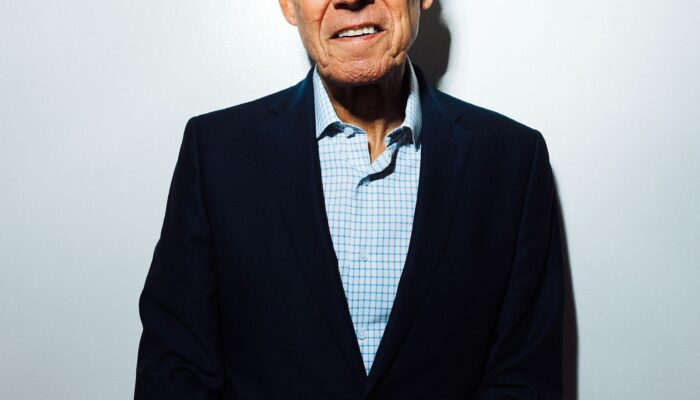

Photograph: Annie Noelker

Central to Circle’s efforts is functional government regulation. Allaire described the company on Thursday as “the largest stable network by far”—a thinly veiled dig at Tether, the most-used stablecoin and a USDC competitor. Unlike Circle, Tether has historically avoided US government regulation. Circle, by contrast, was a vocal supporter of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which Congress passed into law in mid-July. The law established regulations for launching stablecoins and was viewed as a boon for the US crypto economy in general. Tether now plans to launch a GENIUS Act-compliant stablecoin, USAT, in the US.

For Allaire, the increased competition the GENIUS Act inspired is a boon for Circle and a necessary step in the digital economy revolution he imagines on the horizon.

“I think when you have a clear set of rules of the road, it’s going to invite a ton of companies. And in fact, we’ve seen lots of big public companies, big private companies, banks, consortiums, others entering this market,” Allaire said Thursday. “It’s exactly what good regulation that is designed to create clear roads will do. That’s excellent, but at the same time, it also validates those who have built infrastructure in this space.”

In other words, it’s good for Circle and its “economic OS” ambitions.