The S&P 500 fell -2.4% yesterday, and BTC plunged -5.2% to $80K today

JHVEPhoto/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

It was a rough Thursday, with major indices sliding across the board. The tech-heavy S&P 500 fell -2.4%, the Nasdaq dropped -3.8%, and even Gold edged lower by -0.60%. BTC took the biggest hit, falling -5.2% and briefly touching the $80,000 level earlier today.

The selloff came despite a strong earnings report from Nvidia, which makes the market reaction harder to pinpoint. The United States unemployment rate for September ticked up to 4.4% even as job growth beat expectations. At the same time, the odds of a December rate cut have fallen sharply from 45.4% last week to 28% now, and that shift in macro expectations is likely contributing to the recent weakness.

Across crypto sectors, everything finished in the red. Two areas held up relatively well: Gaming at -2.8% and the Revenue sector at -3.2%.

On the other side, Crypto Equities and Miners were the hardest hit, falling -10.3% and -13.2%, respectively. The monthly picture is even more painful, with HOOD at -17.6%, COIN at -27%, and GLXY at -38%. Miners remain weighed down by skepticism around the AI trade and whether the pivot to AI data centers will deliver returns.

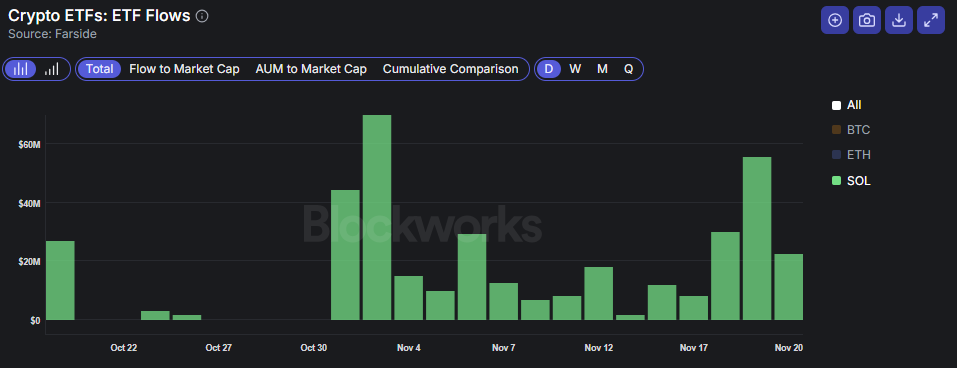

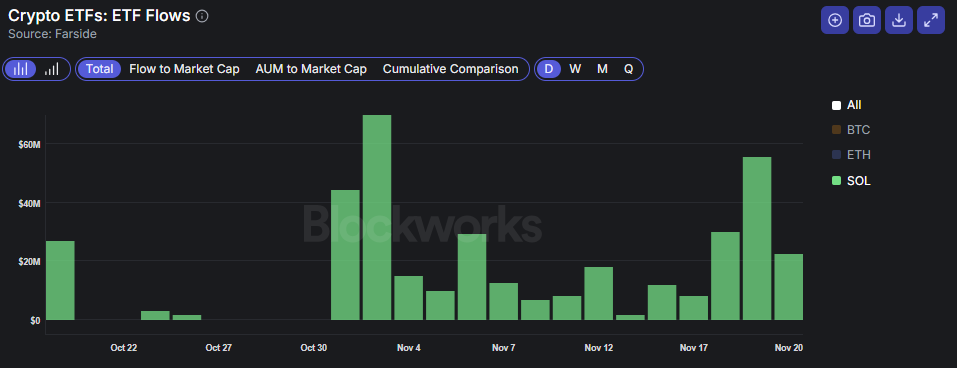

One bright spot remains Solana ETF flows. While BTC and ETH ETFs have seen consistent outflows since Oct. 28, SOL ETFs just logged their 14th-straight day of inflows following the launch of BSOL. Roughly $500 million worth of SOL is now held across these ETFs, with more issuers having entered the staked SOL ETF race.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

Decoding crypto and the markets. Daily, with Byron Gilliam.

Javits Center North | 445 11th Ave

Tues – Thurs, March 24 – 26, 2026

Blockworks’ Digital Asset Summit (DAS) will feature conversations between the builders, allocators, and legislators who will shape the trajectory of the digital asset ecosystem in the US and abroad.

Research

Nubank has scaled to 127M customers with a sub-$1 cost-to-serve, driving industry-leading profitability and a 31% ROE. Its model blends rapid monetization, strong operating leverage, and expanding verticals, from AI-driven lending to crypto, insurance, telco, and premium offerings like Ultravioleta. With 6.6M crypto users and new stablecoin payment pilots, Nu is becoming a major digital-asset gateway in LATAM. Despite rising NPLs and rate volatility, its efficiency and growth momentum support upside potential.

news

Breaking headlines across our core coverage categories.

Markets retreated on Monday amid renewed macro uncertainty, with every index in the red except crypto minders

The need for a public, verifiable ledger system may have prompted the creation of an ancient mountain site