As Kent Halliburton stood in a bathroom at the Rosewood Hotel in central Amsterdam, thousands of miles from home, running his fingers through an envelope filled with €10,000 in crisp banknotes, he started to wonder what he had gotten himself into.

Halliburton is the cofounder and CEO of Sazmining, a company that operates bitcoin mining hardware on behalf of clients—a model known as “mining-as-a-service.” Halliburton is based in Peru, but Sazmining runs mining hardware out of third-party data centers across Norway, Paraguay, Ethiopia, and the United States.

As Halliburton tells it, he had flown to Amsterdam the previous day, August 5, to meet Even and Maxim, two representatives of a wealthy Monaco-based family. The family office had offered to purchase hundreds of bitcoin mining rigs from Sazmining—around $4 million worth—which the company would install at a facility currently under construction in Ethiopia. Before finalizing the deal, the family office had asked to meet Halliburton in person.

When Halliburton arrived at the Rosewood Hotel, he found Even and Maxim perched in a booth. They struck him as playboy, high-roller types—particularly Maxim, who wore a tan three-piece suit and had a highly manicured look, his long dark hair parted down the middle. A Rolex protruded from the cuff of his sleeve.

Over a three-course lunch—ceviche with a roe garnish, Chilean sea bass, and cherry cake—they discussed the contours of the deal and traded details about their respective backgrounds. Even was talkative and jocular, telling stories about blowout parties in Marrakech. Maxim was aloof; he mostly stared at Halliburton, holding his gaze for long periods at a time as though sizing him up.

As a relationship-building exercise, Even proposed that Halliburton sell the family office around $3,000 in bitcoin. Halliburton was initially hesitant, but chalked it up as a peculiar dating ritual. One of the guys slid Halliburton the cash-filled envelope and told him to go to the bathroom, where he could count out the amount in private. “It felt like something out of a James Bond movie,” says Halliburton. “It was all very exotic to me.”

Halliburton left in a taxi, somewhat bemused by the encounter, but otherwise hopeful of closing the deal with the family office. For Sazmining, a small company with around 15 employees, it promised to be transformative.

Less than two weeks later, Halliburton had lost more than $200,000 worth of bitcoin to Even and Maxim. He didn’t know whether Sazmining could survive the blow, nor how the scammers had ensnared him.

Directly after his lunch with Even and Maxim, Halliburton flew to Latvia for a Bitcoin conference. From there, he traveled to Ethiopia to check on construction work at the data center facility.

While Halliburton was in Ethiopia, he received a WhatsApp message from Even, who wanted to go ahead with the deal on one condition: that Sazmining sell the family office a larger amount of bitcoin as part of the transaction, after the small initial purchase at the Rosewood Hotel. They landed on $400,000 worth—a tenth of the overall deal value.

Even asked Halliburton to return to Amsterdam to sign the contracts necessary to finalize the deal. Having been away from his family for weeks, Halliburton protested. But Even drew a line in the sand: “Remotely doesn’t work for me that’s not how I do business at the moment,” he wrote in a text message reviewed by WIRED.

Halliburton arrived back in Amsterdam in the early afternoon on August 16. That evening, he was due to meet Maxim at a teppanyaki restaurant at the five-star Okura Hotel. The interior is elaborately decorated in traditional Japanese style; it has wooden panelling, paper walls, a zen garden, and a flock of origami cranes that hang from string down a spiral staircase in the lobby.

Halliburton found Maxim sitting on a couch in the waiting area outside the restaurant, dressed in a gaudy silver suit. As they waited for a table, Maxim asked Halliburton whether he could demonstrate that Sazmining held enough bitcoin to go through with the side transaction that Even had proposed. He wanted Halliburton to move roughly half of the agreed amount—worth $220,000—into a bitcoin wallet app trusted by the family office. The funds would remain under Halliburton’s control, but the family office would be able to verify their existence using public transaction data.

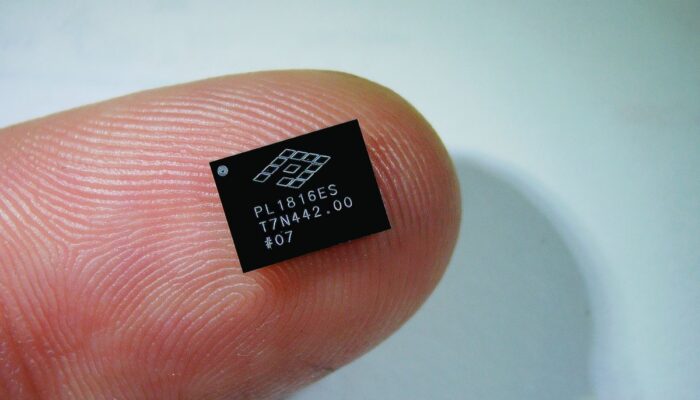

Halliburton thumbed open his iPhone. The app, Atomic Wallet, had thousands of positive reviews and had been listed on the Apple App Store for several years. With Maxim at his side, Halliburton downloaded the app and created a new wallet. “I was trying to earn this guy’s trust,” says Halliburton. “Again, a $4 million contract. I’m still looking at that carrot.”

The dinner passed largely without incident. Maxim was less guarded this time; he talked about his fondness for watches and his work sourcing deals for the family office. Feeling under the weather from all the travel, Halliburton angled to wrap things up.

They left with the understanding that Maxim would take the signed contracts to the family office to be executed, while Halliburton would send the $220,000 in bitcoin to his new wallet address as agreed.

Back in his hotel room, Halliburton triggered a small test transaction using his new Atomic Wallet address. Then he wiped and reinstated the wallet using the private credentials—the seed phrase—generated when he first downloaded the app, to make sure that it functioned as expected. “Had to take some security measures but almost ready. Thanks for your patience,” wrote Halliburton in a WhatsApp message to Even. “No worries take your time,” Even responded.

At 10:45 pm, satisfied with his tests, Halliburton signaled to a colleague to release $220,000 worth of bitcoin to the Atomic Wallet address. When it arrived, he sent a screenshot of the updated balance to Even. One minute later, Even wrote back, “Thank yiu [sic].”

Halliburton sent another message to Even, asking about the contracts. Though previously quick to answer, Even didn’t respond. Halliburton checked the Atomic Wallet app, sensing that something was wrong. The bitcoin had vanished.

Halliburton’s stomach dropped. As he sat on the bed, he tried to stop himself from vomiting. “It was like being punched in the gut,” says Halliburton. “It was just shock and disbelief.”

Halliburton racked his brain trying to figure out how he had been swindled. At 11:30 pm, he sent another message to Even: “That was the most sophisticated scam I’ve ever experienced. I know you probably don’t give a shit but my business may not survive this. I’ve worked four years of my life to build it.”

Even responded, denying that he had done anything wrong, but that was the last Halliburton heard from him. Halliburton provided WIRED with the Telegram account Even had used; it was last active on the day the funds were drained. Even did not respond to a request for comment.

Within hours, the funds drained from Halliburton’s wallet began to be divided up, shuffled through a web of different addresses, and deposited with third-party platforms for converting crypto into regular currency, analysis by blockchain analytics companies Chainalysis and CertiK shows.

A portion of the bitcoin was split between different instant exchangers, which allow people to swap one type of cryptocurrency for another almost instantaneously. The bulk was funneled into a single address, where it was blended with funds tagged by Chainalysis as the likely proceeds of rip deals, a scam whereby somebody impersonates an investor to steal crypto from a startup.

“There’s nothing illegal about the services the scammer leveraged,” says Margaux Eckle, senior investigator at Chainalysis. “However, the fact that they leveraged consolidation addresses that appear very tightly connected to labeled scam activity is potentially indicative of a fraud operation.”

Some of the bitcoin that passed through the consolidation address was deposited with a crypto exchange, where it was likely swapped for regular currency. The remainder was converted into stablecoin and moved across so-called bridges to the Tron blockchain, which hosts several over-the-counter trading services that can be readily used to cash out large quantities of crypto, researchers claim.

The effect of the many hops, shuffles, conversions, and divisions is to make it more difficult to trace the origin of funds, so that they can be cashed out without arousing suspicion. “The scammer is quite sophisticated,” says Eckle. “Though we can trace through a bridge, it’s a way to slow the tracing of funds from investigators that could be on your tail.”

Eventually, the trail of public transaction data stops. To identify the perpetrators, law enforcement would have to subpoena the services that appear to have been used to cash out, which are widely required to collect information about users.

From the transaction data, it’s not possible to tell precisely how the scammers were able to access and drain Halliburton’s wallet without his permission. But aspects of his interactions with the scammers provide some clue.

Initially, Halliburton wondered whether the incident might be connected to a 2023 hack perpetrated by threat actors affiliated with the North Korean government, which led to $100 million worth of funds being drained from the accounts of Atomic Wallet users. (Atomic Wallet did not respond to a request for comment.)

But instead, the security researchers that spoke to WIRED believe that Halliburton fell victim to a targeted surveillance-style attack. “Executives who are publicly known to custody large crypto balances make attractive targets,” says Guanxing Wen, head of security research at CertiK.

The in-person dinners, expensive clothing, reams of cash and other displays of wealth were gambits meant to put Halliburton at ease, researchers theorize. “This is a well-known rapport-building tactic in high-value confidence schemes,” says Wen. “The longer a victim spends with the attacker in a relaxed setting, the harder it becomes to challenge a later technical request.”

In order to complete the theft, the scammers likely had to steal the seed phrase for Halliburton’s newly created Atomic Wallet address. Equipped with a wallet’s seed phrase, anyone can gain unfettered access to the bitcoin kept inside.

One possibility is that the scammers, who dictated the locations for both meetings in Amsterdam, hijacked or mimicked the hotel Wi-Fi networks, allowing them to harvest information from Halliburton’s phone. “That equipment you can buy online, no problem. It would all fit inside a couple of suitcases,” says Adrian Cheek, lead researcher at cybersecurity company Coeus. But Halliburton insists that his phone never left his possession, and he used mobile data to download the Atomic Wallet app, not public Wi-Fi.

The most plausible explanation, claims Wen, is that the scammers—perhaps with the help of a nearby accomplice or a camera equipped with long-range zoom—were able to record the seed phrase when it appeared on Halliburton’s phone at the point he first downloaded the app, on the couch at the Okura Hotel.

Long before Halliburton delivered the $220,000 in bitcoin to his Atomic Wallet address, the scammers had probably set up a “sweeper script,” claims Wen, a type of automated bot coded to drain a wallet when it detects a large balance change.

The people the victim meets in-person in cases like this—like Even and Maxim—are rarely the ultimate beneficiaries, but rather mercenaries hired by a network of scam artists, who could be based on the other side of the globe.

“They’re normally recruited through underground forums, and secure chat groups,” says Cheek. “If you know where you’re looking, you can see this ongoing recruitment.”

For a few days, it remained unclear whether Sazmining would be able to weather the financial blow. The stolen funds equated to about six weeks worth of revenue. “I’m trying to keep the business afloat and survive this situation where suddenly we’ve got a cash crunch,” says Halliburton. By delaying payment to a vendor and extending the duration of an outstanding loan, the company was ultimately able to remain solvent.

That week, one of the Sazmining board members filed reports with law enforcement bodies in the Netherlands, the UK, and the US. They received acknowledgements from only UK-based Action Fraud, which said it would take no immediate action, and the Cyber Fraud Task Force, a division of the US Secret Service. (The CFTF did not respond to a request for comment.)

The incredible volume of crypto-related scam activity makes it all but impossible for law enforcement to investigate each theft individually. “It’s a type of threat and criminal activity that is reaching a scale that’s completely unprecedented,” says Eckle.

The best chance of a scam victim recovering their funds is for law enforcement to bust an entire scam ring, says Eckle. In that scenario, any funds recovered are typically dispersed to those who have reported themselves victims.

Until such a time, Halliburton has to make his peace with the loss. “It’s still painful,” he says. But “it wasn’t a death blow.”