My iPhone Wallet stores theater and transit tickets and all of my credit and debit cards, and it lets me sashay like a boss through my gym’s turnstile. The tech works flawlessly, requiring only my proximity or the merest tilt of the device toward my face. Biometric goodness means I have few worries about security, even accessing my bank accounts.

So … why am I still opening my EV with a key?

OK, it’s more than just a metal key; it’s a passive electronic fob with proximity-based radio signaling, which means I don’t have to press anything to unlock my car. But it’s nevertheless a bacteria-rich, easily lost, marque-branded plastic blob that, in truth, I no longer need. And I haven’t needed it for some years.

BMW 5 Series owners have been using smartphones to unlock, start, and digitally share access to their luxury vehicles since 2021, the year after Apple’s introduced its plainly titled Car Key. Audi, Kia, and Hyundai later implemented support for the feature. During the WWDC 2025 keynote in June, Apple said that 13 additional vehicle brands would “soon” join them, including Chevrolet, Cadillac, GMC, and Porsche. “Soon” appears to mean 2026.

Tesla Model 3 owners have had digital key access since 2017, when the midsize sedan launched without a fob; it could only be opened with a smartphone. Subsequently, digital-native carmakers Rivian and Polestar also enabled digital key use. (“Digital Key has been removed from the upcoming 2025.34 software update for further testing,” noted a recent update from Rivian. The company’s comms team tells WIRED it’ll be available again “soon.”)

Owners of the latest high-end Ford vehicles can use digital keys. Still, the Dearborn, Michigan, company clearly isn’t ready to ditch fobs—in October it launched the $200 Truckle, an ornate Western-style belt buckle with a cavity to fit the oversized F-150 fob, so it need never get lost or spoil the line of your jeans.

Courtesy of Ford

Digital for All

Phone-as-a-key functionality isn’t just for select luxury cars. The wire-in MoboKey device turns a smartphone into a digital key and can be fitted by an auto electrician to almost any modern car, gas or electric.

Similarly, KeyDIY, a Chinese smart key maker, sells a USB-powered box of tricks that allows almost any car to operate with a digital key. The box grabs car connectivity signals–Flipper-Zero-style–emulating the rolling codes that key fobs use to foil signal boosting “relay” attacks where criminals use antennas and extenders to capture the signals from a car’s key fob. (Always store your fob in a Faraday cage.) KeyDIY’s box, which lives in the car, is actuated by a device connected momentarily to the vehicle’s onboard diagnostic port.

The Key to Meaning

In short, the picture here is that digital key tech is mature and (mostly) secure, and we’re perfectly happy using Bluetooth Low Energy, near-field communication (NFC), and ultra-wideband (UWB) in the rest of our life—unless you’re a conspiracy theorist who clings to cash, that is—so why are so many of us still seemingly so attached to our physical car fobs?

“Most people are reluctant to go without the physical backup of an actual key,” says Sean Tucker, managing editor of automotive research company Kelley Blue Book. And, he adds, picking up a fob is now an ingrained habit. There are also emotional factors to consider.

“A car key is full of meaning,” says Stefan Gössling, a professor at Linnaeus University, Sweden, and author of The Psychology of the Car. “Jingling them gives some motorists the opportunity to show off their automobile, even if the car is not close by. Car keys are also comforting to some, a physical reminder that your vehicle is there to take you away; to protect you.”

No amount of digital doohickeys will convince those who view branded physical fobs as a status signifier or who fondle fobs like automotive rosary beads. For the rest of us, going digital has its benefits. One can share digital keys with trusted individuals, allowing, say, a smartphone-packing child to hop into a family car while not allowing them to start the engine. Digital is also cheaper—a BMW i8 replacement fob costs up to $650.

Yes, you can perform many actions (such as scheduling air conditioning) with configurable button presses on a key fob, but who’s got the mental bandwidth to memorize a suite of such sequences? It’s so much easier to do it with a smartphone.

There’s no rule against using a car’s smartphone app and a physical key, but going fully digital makes life easier, especially for multi-car households where cars must be moved around when their owners are elsewhere.

But what if your smartphone runs out of battery? Apple says that Car Key can work for up to five hours after an iPhone’s battery runs out, and it’s the same for other smartphones. Rely on valet parking? Digital keys usually feature “valet mode.”

Slow Adoption

Despite previous heady predictions from the car industry, most drivers have yet to go fob-free. There are no stats available on digital-key adoption in the US, but Alysia Johnson, president of Oregon’s Car Connectivity Consortium (CCC)—a mix of 300 device-to-car electronics companies and automotive suppliers, including carmakers—says “the number of digital keys in use [will] increase significantly in the years ahead, both in the US and globally.” She bases that claim on the 2025 S&P Global Mobility report, which notes that the annual volume of connected cars is estimated to increase from 56 million two years ago to 76 million by 2030.

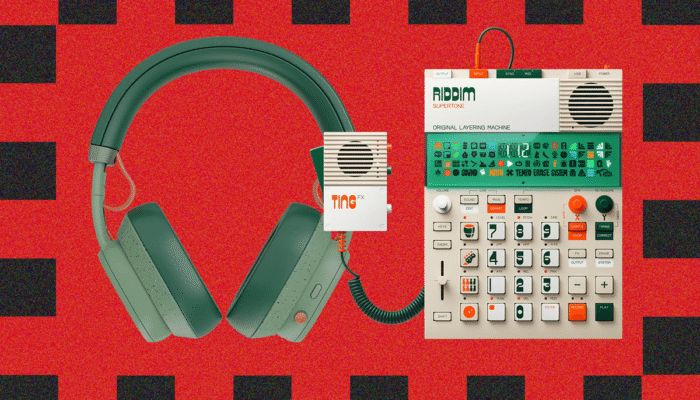

Three options for unlocking.

Courtesy of Hyundai

Kelley Blue Book’s Tucker cautions against suggesting digital key use will go mainstream by then.

“The rolling fleet on the road turns over very slowly,” he says. “There are a little under 300 million cars registered in the US right now, and, in an average year, we buy 16 million more and retire 12 million. So, at that rate, the actual turnover in the fleet is about 4 percent every year. The average car on American roads is about 13 years old, so most of [today’s] fleet cannot be accessed with digital keys.”

Even for those cars that sport all the latest doodads, too many feature proprietary connectivity tech, a digital downer for many consumers. The Car Connectivity Consortium advocates for a common global standard for digital keys. Since last year, the organization’s Digital Key Certification has complied with the standards of the German Federal Office for Information Security, becoming the first and only digital key standard to receive this critical designation.

The CCC states that adhering to the standard would mean carmakers “can ensure users are able to securely and safely access their vehicles, create and delete digital keys, share a digital key with others, and start their vehicle.”

The universal standard is intended to have cross-platform interoperability at its core. “Interoperability is what makes it possible to easily share a digital key with friends or family,” CCC’s Johnson tells WIRED. “Not all digital key implementations are interoperable yet. Imagine you are a parent of two kids in high school who share a vehicle and want to start using digital keys. They have different brands of smartphones, and the car’s digital key technology only works with one smartphone brand. This makes wider adoption of digital keys in the family more difficult.”

Security, too, should be more trustworthy through the adoption of a universal standard. “Manufacturers must ensure,” says CCC, “that their implementations are designed to prevent known hardware- and software-based attacks, such as tampering, storage intrusion, cloning, relay attacks, and unauthorized access.”

Consortium members include the main smartphone players (Apple, Google, and Samsung) as well as automakers such as Ford, GM, BMW, and Honda. Volkswagen is represented by its troubled software brand, Cariad. Rivian’s Digital Key solution is built on the CCC standard and also supports Apple and Android digital keys.

Looking to Asia, however, and major player BYD might not be a CCC member, but there are many Chinese companies who have signed up with the Consortium, including Geely, Zeekr, and Nio. Several Chinese component suppliers are undergoing CCC’s certification program, with Indeek Security the first Chinese OEM to meet the standard, gaining the right to use CCC’s digital key logo in September.

CCC’s standard should ensure suppliers use the same connectivity language, which will be essential as the technology improves. Automotive suppliers have recently released new NFC chipsets and UWB modules designed to operate in high-temperature, vibration-prone environments common in automotive. (NFC is used for close interactions, and UWB is for secure, precise distance measurements. iPhones have had UWB chips—used for the “Find Me” function—since iPhone 11 in 2019. The first Androids to be so equipped were released in 2020.)

Will carmakers ever play nicely with each other? Kelley Blue Book’s Tucker isn’t so sure. “There’s tension between automakers who may say they want a common standard but who don’t necessarily want to share the data that [digital keys] collect,” he says. “Apple CarPlay was adopted quickly because it’s convenient, and users like it a lot. But automakers realized that Apple collects data on how the car gets used, and automakers would rather collect that data themselves so that they can monetize it. GM said that they’re dropping Apple CarPlay from all of their cars, and I think you’re going to run into a similar issue with digital keys.

“The more that [digital key technologies] are standardized, the more that automakers lose control, and I don’t know if they’re willing to do that.”

Automakers also want to squeeze customers for subscription income, and if they bundle digital key use in with paid-for apps it’s likely that uptake will be stunted. Many manufacturers offer “free” access to their smartphone apps but then two or three years down the road demand monthly subscription fees.

Courtesy of Hyundai

China Is Ahead, Naturally

Digital key technology is evolving especially fast in China. The Beijing company UbiTraq (short for “ubiquitous tracking”) produces a centimeter-accurate UWB-AOA (Ultra-Wideband, Angle of Attack) positioning system for automotive digital key applications. The system knows exactly where the smartphone outside the vehicle is, so, for instance, an owner approaching from behind would trigger the opening of a trunk rather than unlocking the driver’s door.

Similarly accurate positioning tech for automotive digital keys has been developed by China’s YF Tech and Shanghai HiSilicon using the Huawei-developed NearLink short-range wireless protocol (formerly known as Greentooth). Other component suppliers plan to use centimeter-accurate Bluetooth 6.0.

According to China’s Automotive Digital Key Industry Trend Report 2025, nearly 3 million cars in China used digital keys for access in 2024, a 59 percent increase from the previous year. More than 80 percent of China’s cars will sport digital keys within five years, predicts the report.

Moving beyond keys, Zeekr’s 7X is equipped with a facial recognition system for locking and unlocking. And Audi’s collaboration with China’s SAIC—an electric SUV under the brand “AUDI”—was recently spotted testing on public roads packing a facial recognition camera to unlock its doors.

Rental Future

While many of those who have taken the plunge to be sans fob already find digital key use to be worthwhile, the tech really comes into its own for fleet use and car rentals. With digital keys, fleet managers get a centralized overview of who is driving what, where, and when. Fleet drivers benefit from easy access to vehicles without going out of their way for fobs.

Rent a Tesla from Hertz, and you can opt for a digital key. “Tesla’s digital key can transform your rental experience,” the company claims.

Car owners who rent their cars through the peer-to-peer rental service Turo can send digital keys remotely, so they do not need to meet renters in person to hand over fobs. Car rental firms of all stripes can easily revoke digital keys when the hire period is up.

Down to the Dealers

While key fob use will take longer to die out than connected-car analysts expect—and may never disappear completely, especially if an embedded fob keeps your pants up—it looks like that despite being available for some time now, it will take many years before digital keys become the norm outside of China.

“Your phone has replaced your travel pass and your credit card, so why not your car key?” suggests CCC’s Johnson.

For that to happen, the auto industry—especially dealerships—will need to improve at educating consumers about the advantages of digital keys and how to get them. We asked Hyundai if its digital key was part of a subscription or free, as it’s packaged with the brand’s Bluelink app. The representative had to check to be sure. (All model new Hyundais come with a free 10-year subscription to the basic Bluelink LITE; after that there’s a subscription fee.)

Tucker isn’t optimistic. “People already don’t know about loads of features on their cars, and dealers also often don’t know about them or don’t devote enough time to explaining them to consumers. For more than a decade, Ford Lincolns have been able to parallel park themselves, but in recent software updates, Ford discovered that almost no one has ever used the feature. I wonder if there are a lot of Polestar drivers out there who have no idea they have access to a digital key?”