President Donald Trump wants to transform the U.S into a ‘Bitcoin superpower’. He believes that harnessing the crypto industry is the key to beating China and other countries.

Summary

- President Trump vows to make the United States a “Bitcoin superpower” as well as the crypto capital of the world, in hopes of dominating the global crypto industry before China or any other country can.

- As of Nov. 6, the U.S holds approximately 326,588 BTC or equal to $33.69 million, making it the largest government to hold BTC compared to China, the U.K and UAE.

Speaking at the two-day America Business Forum in Miami, Florida, President Donald Trump called for business leaders and the wider nation to embrace crypto, particularly Bitcoin. He also emphasized the crypto industry’s role in advancing the U.S economy, particularly by taking pressure off the U.S dollar.

“We’re making the United States the Bitcoin superpower, the crypto capital of the world,” said Trump in Miami, Florida. He also added that the U.S is also the “undisputed leader in artificial intelligence.”

Trump also took the opportunity to bring up growing global competition, as more and more governments have jumped on the crypto bandwagon. He explicitly mentioned China as one of the U.S’ key contenders for the title of “crypto capital of the world.”

“And don’t forget, if we don’t do the crypto properly, China … China wants to do it. They’re starting it, but they want to do it. Other countries want to do it. If we don’t do it properly, it’s a big industry,” warned Trump.

China’s stance on crypto has shifted from hard opposition to somewhat lukewarm after stablecoin adoption rapidly increased worldwide, with U.S dollar-backed tokens leading the charge. In fact, experts have been pushing for China to collaborate with Hong Kong to issue yuan-backed stablecoins to topple the U.S dollar’s dominance over the sector.

Last month, JPMorgan analysts predicted that the rise of stablecoin adoption worldwide could generate around $1.4 trillion in demand for the U.S dollar by 2027.

During his speech, Trump commended his administration for reversing the damage done to the crypto industry by the Biden administration. Financial regulators and officials under the previous Presidential term were notorious for being anti-crypto and worked to criminalize major players in the crypto industry, most notably Binance, Coinbase and Ripple.

“I’ve also signed historic executive orders to end the federal government’s war on crypto. Crypto was under siege. It’s not under siege anymore,” said Trump, referring to his executive orders that called for the creation of a Strategic Bitcoin (BTC) Reserve and a U.S Digital Asset Stockpile.

How much Bitcoin does the U.S hold?

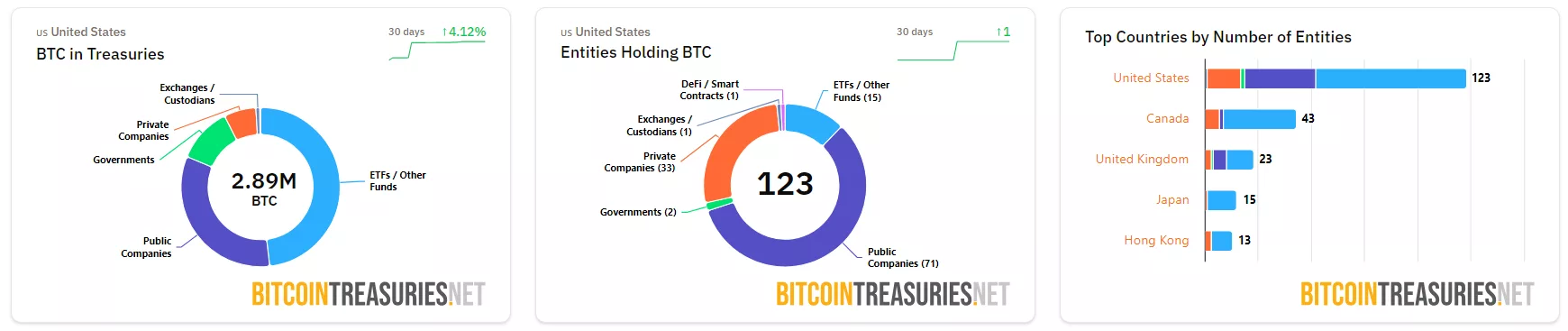

At press time, the U.S remains the largest government entity holding BTC. According to data from Bitcoin Treasuries, the U.S government currently holds around 326,588 BTC or equal to $33.69 billion. This trove mostly comes from seized BTC from criminal violations and forfeitures, representing about 1.55% of the total BTC supply. So far, the U.S has not made any moves to purchase BTC.

China is currently in second-place with its BTC holdings amounting to 190,000 BTC. Like the U.S, China’s BTC holdings were accumulated from seized BTC collected over the years by authorities.

The U.S is also the country with the highest number of BTC-holding entities on the map. As of Nov. 6, there are a total of 123 U.S companies stockpiling BTC. The top three corporate holders of BTC, Strategy, MARA Holdings, and XXI, are all based in the U.S. Meanwhile, Canada only has 43 companies holding BTC and the U.K hosts 23 companies.

Aside from BTC holdings, the U.S is also one of the top countries in terms of cryptocurrency adoption. On the Chainalysis 2025 Global Crypto Adoption Index, the U.S was ranked number two in terms of overall crypto adoption. The country came second place only to India, which ranks first in all categories.

Despite this, the U.S dollar still holds dominance over the stablecoin market, contributing to more than 90% of the total market cap.