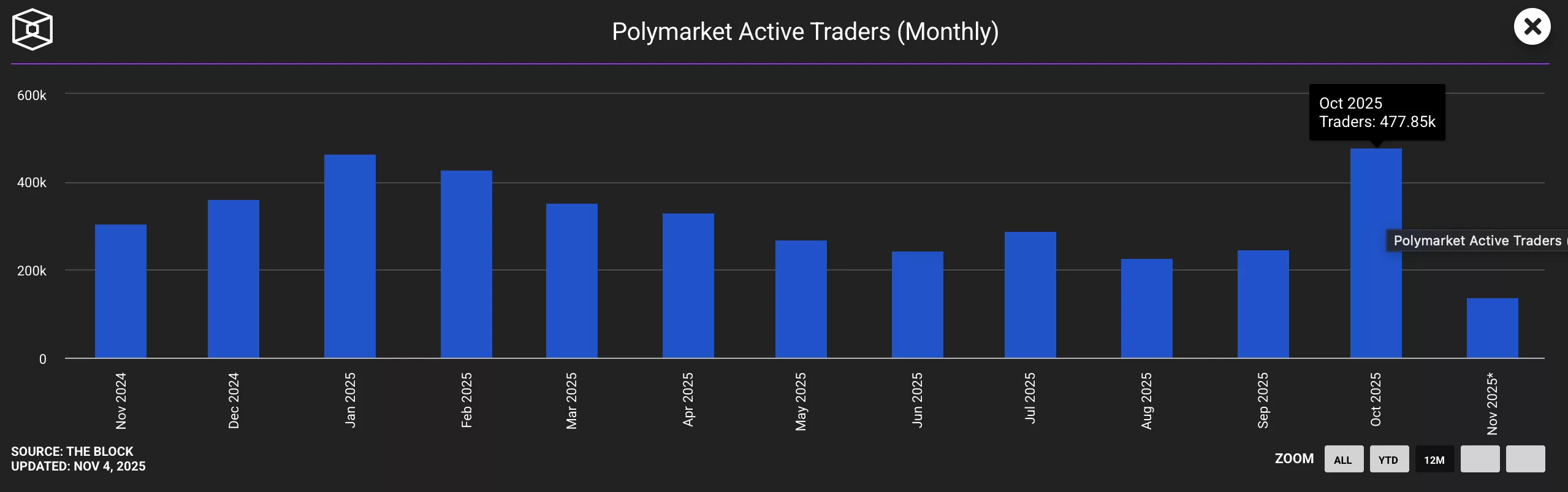

Polymarket hit record highs in October for volume, active traders, and new market launches, driven by the POLY token announcement, U.S. market re-entry plans, and a potential $15B fundraising round.

Summary

- Polymarket saw over 477,000 active traders and more than $3 billion in trading volume, surpassing the prior January peak.

- The surge was likely fueled by the POLY token announcement and airdrop, plans to re-enter the U.S. market, and a potential $15 billion fundraising round.

- Prediction markets overall experienced strong growth, with Kalshi trading over $4.4 billion and attracting fresh VC interest.

Polymarket reached record highs in October, with over 477,000 active traders—the platform’s largest monthly user base to date. This represents a 48% increase from September and surpasses the previous peak of approximately 462,000 traders seen during the U.S. election in January, according to data from The Block.

Trading volume and new market creation also set monthly records, with more than $3 billion traded, more than double the total from the prior month.

The surge in activity on the leading prediction market platform coincides with several key developments. In October, Polymarket announced the POLY token and an accompanying airdrop. Around the same time, the platform revealed plans for its re-entry into the U.S. market.

Additionally, Polymarket’s potential fundraising round valuing the company at $15 billion may have encouraged market makers and liquidity providers to seed additional markets.

The October spike aligns with broader growth in the prediction-market sector. Kalshi prediction market operator also reported record activity, with over $4.4 billion traded in October. The firm is also attracting fresh VC interest at valuations exceeding $10 billion, according to recent reports from Bloomberg.

According to The Block’s Data & Insights newsletter, “October’s spike looks less like a one-off and more like a step-change for prediction markets, as token expectations likely keep activity elevated in the short and medium term.”