Dutch cryptocurrency firm Amdax raised 30 million euros to start its Bitcoin treasury initiative AMBTS. The firm aims to covet 1% of the total BTC supply.

Summary

- Dutch crypto firm Amdax has completed its €30 million ($35 million) funding round to launch Amsterdam Bitcoin Treasury Strategy.

- The firm aims to accumulate up to 210,000 BTC, potentially becoming the second-largest corporate Bitcoin holder after MicroStrategy

On Oct. 7, Reuters reported that the Dutch crypto firm has recently finished its funding round for its Bitcoin treasury initiative, having reached its initial target of achieving 30 million euros ($35 million). Now it prepares to launch its standalone treasury company, Amsterdam Bitcoin Treasury Strategy.

According to a statement from the company, the team is now ready to proceed with purchasing BTC (BTC) for its treasury. CEO and AMBTS co-founder Lucas Wensing called the end of the funding round an “important milestone” in the company’s quest to accumulate Bitcoin.

“We now move forward with our bitcoin strategy, aiming to offer investors transparent access to this unique asset class,” said Wensing in his statement.

Amdax joins the ever-growing list of major companies which have added BTC to their corporate reserves. Another Dutch firm that also strives to build a BTC treasury is the firm Treasury, which is backed by the Winklevoss twins. Unlike AMBTS, Treasury has gotten a head start with a balance of 1,000 BTC.

Amdax’s bid for BTC domination

Based on previous reports from crypto.news, the Dutch crypto asset service initially aimed to close its funding at €23 million before they raised the stakes to €30 million in September 2025. The capital will fuel an initial buying spree ahead of its intended public listing on Euronext Amsterdam. The move would serve to provide the European market with a new BTC-based vehicle.

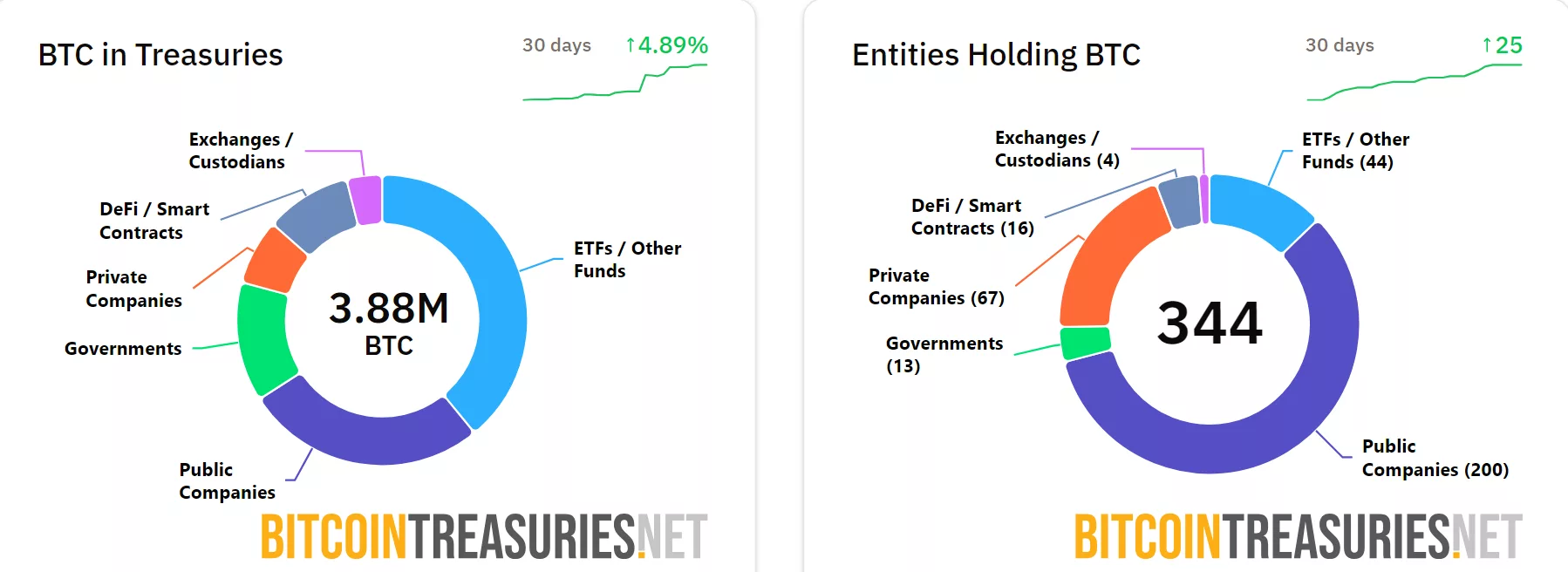

Through its BTC treasury initiative, Amdax aims to stockpile at least 210,000 BTC. If the company does manage to accumulate that much Bitcoin, it would have garnered at least 1% of the total global BTC supply. At press time, the only entity holding above 210,000 BTC is Michael Saylor’s Strategy, which currently owns 640,031 BTC or more than 3% of the total 21 million BTC supply. Strategy’s trove is worth around $73 billion.

Most recently, Bitcoin reached a new all-time high at $126,080, breaking past the previous highest peak at $125,500. The token has recently retreated back to the $123,879 range following the surge. However, it has managed to stay well above the $120,000 threshold.

With $35 million worth of funding, Amdax would be able to purchase at least 282,533 BTC at current prices. This amount would not be enough to topple Strategy off its throne, but it would be enough to position AMBTS as the second largest Bitcoin treasury firm in the world.