CEX.IO exchange released a report showcasing growing stablecoin adoption, with bots still dominating transaction volumes.

Summary

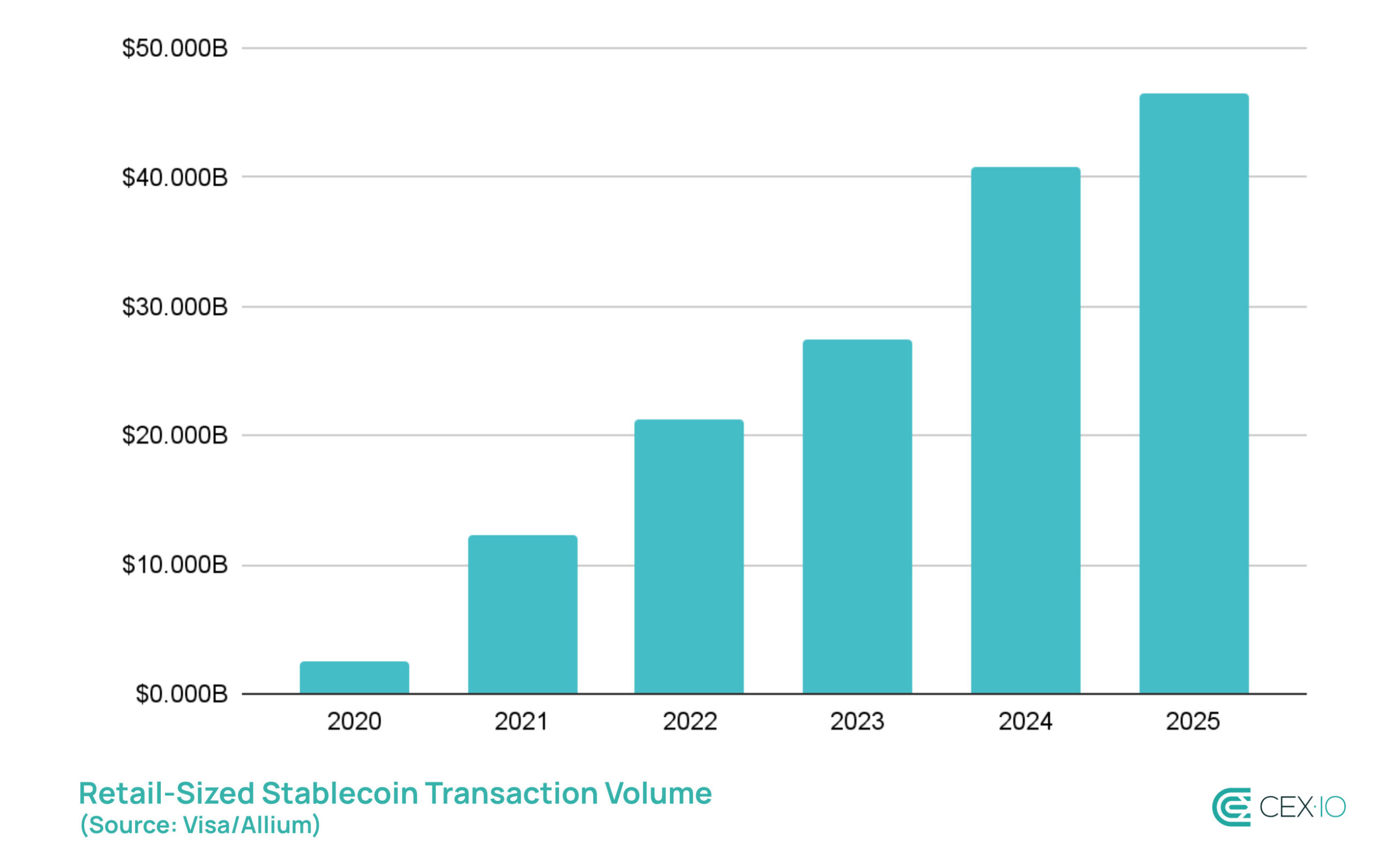

- Retail stablecoin use reached an all-time high, on track to surpass $60M by year’s end

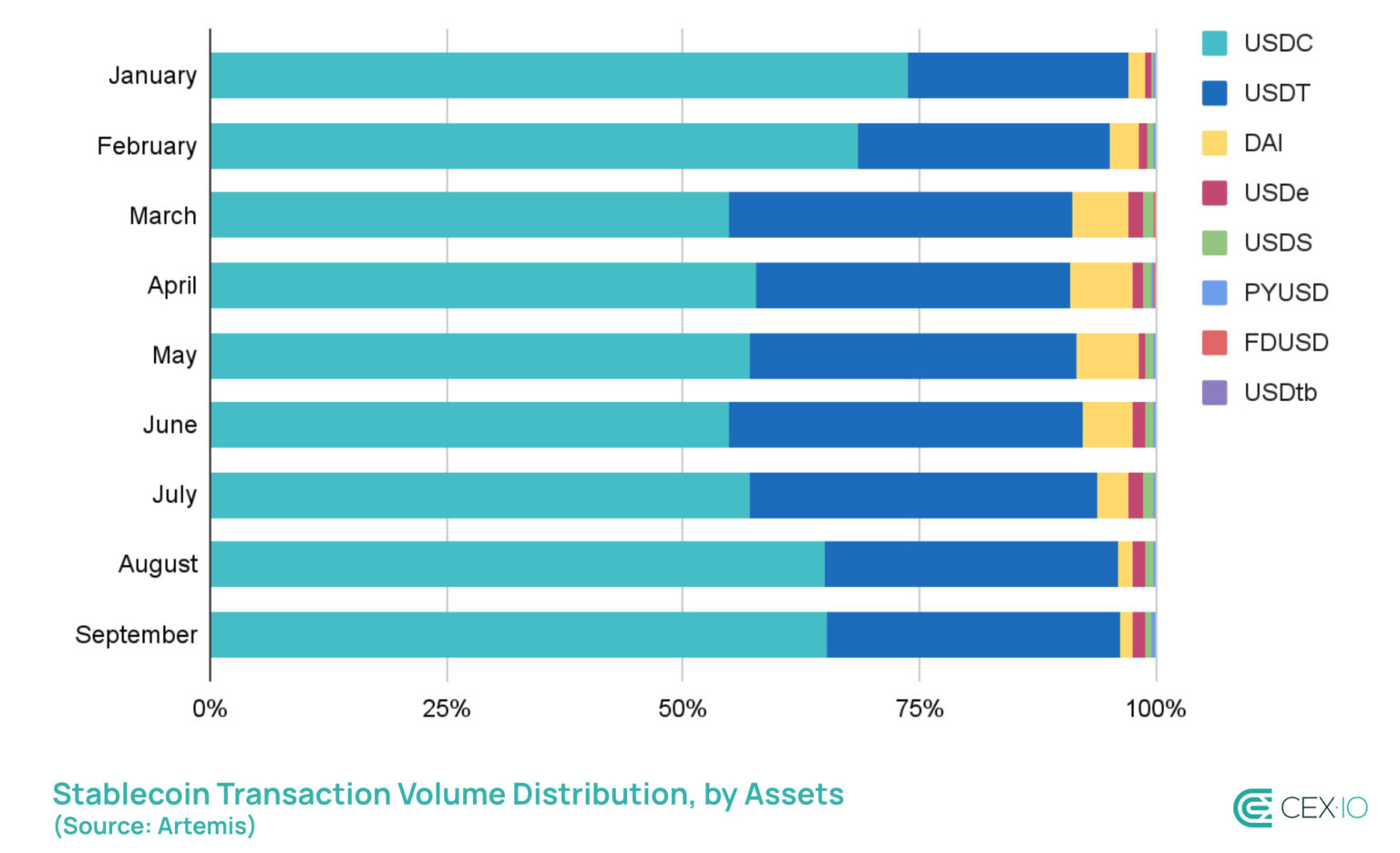

- USDC dominates volumes, with Tether in close second

- Base and Ethereum account for the majority of stablecoin transfers, with Solana falling off since January

Stablecoins just had their biggest quarter in history. On Wednesday, Oct. 1, CEX.IO published a report showcasing significant growth in both volume and total value. Still, questions remain about the large share of bot transactions in trading.

According to the report, the stablecoin market cap rose by $45 billion to approach $300 billion. At the same time, on-chain transfers hit a record $15.6 trillion. In terms of volume, USDC continued to dominate, accounting for 63% of volume in the third quarter of 2025. USDT was in second place at 32.5%.

Still, the report notes that most of USDC’s surge came from bot activity, which rose by 80% to 83% over the past three months. At the same time, USDT was the main driver of organic traffic in stablecoins.

Retail stablecoin transfers reach an ATH

One of the biggest trends is the rise in retail-sized transfers, or those worth $250 or less. These transfers reached an all-time high, both in September and in Q3 2025. According to CEX.IO, retail-sized transfers are on track to surpass $60 billion by the end of 2025.

However, retail transfers account for just 30% of all stablecoin transfer volume, which reached an all-time high of $15.6 trillion in Q3. Moreover, according to CEX.IO, bot transactions accounted for 70% of this figure, encompassing both retail and large transfer volumes.

“The surge of bot activity and unlabeled high-frequency transfers could raise questions about a potential increase of wash trading and non-economically-valuable transfers within the stablecoin space,” the report wrote.