PUMP price rallied over 70% in the past week, driven by its aggressive buyback strategy, even as whales booked profits en masse.

Summary

- PUMP price is up over 70% on the weekly time frame.

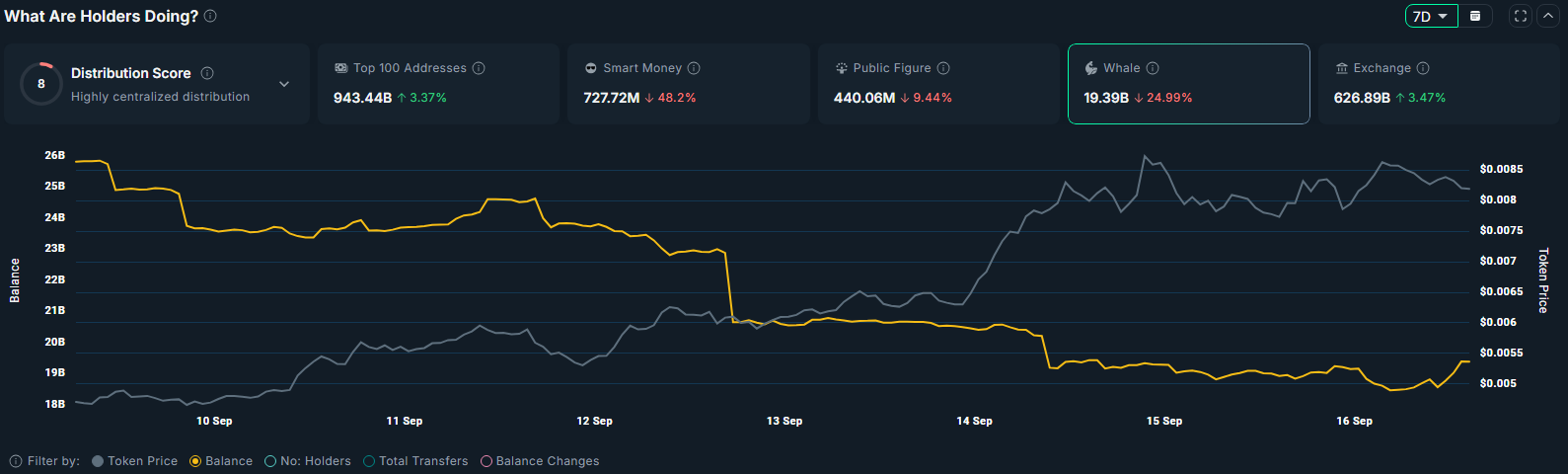

- Whales and smart money have been dumping their PUMP holdings.

- PUMP is trading within an ascending parallel channel pattern, which could position it for a 20% upside rally.

According to data from crypto.news, Pump.fun (PUMP) was trading at $0.0083 last check Sep. 16 afternoon Asian time, up 71% over the past week and 260% from its lowest point in July. At this price, the token is just 5.4% below its recent all-time high of $0.0088.

However, PUMP’s current rally could face the risk of a pullback as whales have started offloading their holdings lately.

Data from Nansen shows that the total amount of tokens held by whale wallets has dropped 25% over the past seven days to 19.39 billion. At the same time, tokens held by Smart Money wallets and public figures’ wallets have also declined by 48% and 9%, respectively.

Even though sell-offs from whales and high-profile holders often trigger retail FOMO, which leads to increased selling pressure, so far, it has failed to hamper PUMP’s upside rally.

Pump’s price rally over the past week has been fueled by several catalysts, with the most prominent being Pump.fun’s aggressive buyback program initiated in early July. As per reports, the project has purchased nearly $95 million worth of PUMP tokens from the open market since it began the strategy.

When a project repurchases its own tokens, it reduces the number of tokens available in circulation. Such a reduction in supply increases scarcity, which can help support the token’s price if demand continues to remain high, as is the case with PUMP.

Another factor that has been fueling PUMP price is the introduction of a new creator revenue-sharing program along with the reactivation of its livestreaming feature on the platform. Notably, Pump.fun now allocates 50% of its PumpSwap DEX revenue directly to builders on the platform, giving them a strong incentive to remain active within the ecosystem.

In a recent X announcement, the platform revealed it paid out over $4 million to creators this week alone, the majority of which went to first-time creators. The development suggests that Pump.fun is aiming to support emerging builders on the platform, which has helped enhance user engagement and add further hype around the token.

Other bullish developments include PUMP securing a listing on Binance, the world’s largest crypto exchange, and its mobile app nearing the top 100 ranks. Both milestones have boosted the token’s visibility, which in turn could attract more investors.

That being said, once selling pressure wanes, the bullish developments surrounding the token could provide the foundation for its next leg higher.

PUMP price analysis

On the 4-hour chart, PUMP price has formed an ascending parallel channel pattern over the past week. An ascending parallel channel is a bullish continuation pattern formed when an asset’s price trades within a channel formed by higher highs and higher lows.

In the meantime, PUMP’s 50-day simple moving average was above the 200-day SMA, thereby completing a golden cross. When this signal appears, it is often a sign that market sentiment may be shifting from bearish to bullish.

On the daily timeframe, the MACD lines have formed a positive crossover. This adds to the bullish bias, reinforcing the possibility of continued upward momentum as traders respond to improving technical conditions and renewed buying interest.

Provided PUMP remains within the ascending parallel channel, the next target is the psychological resistance at $0.01, about 20% above the current level. A breakout above this with strong volume would put the token into short-term price discovery.

On the other hand, if the price falls below $0.007, the 78.6% Fibonacci retracement level, the setup would be invalidated and could lead to a drop toward $0.0065, the next retracement support.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.