SOL has overtaken BNB to become the fifth-largest crypto by market cap, with Solana price testing $240 and targeting $260.

Summary

- SOL now valued at $128.67B, overtaking BNB’s $125.87B as Solana price pushes into $240 resistance.

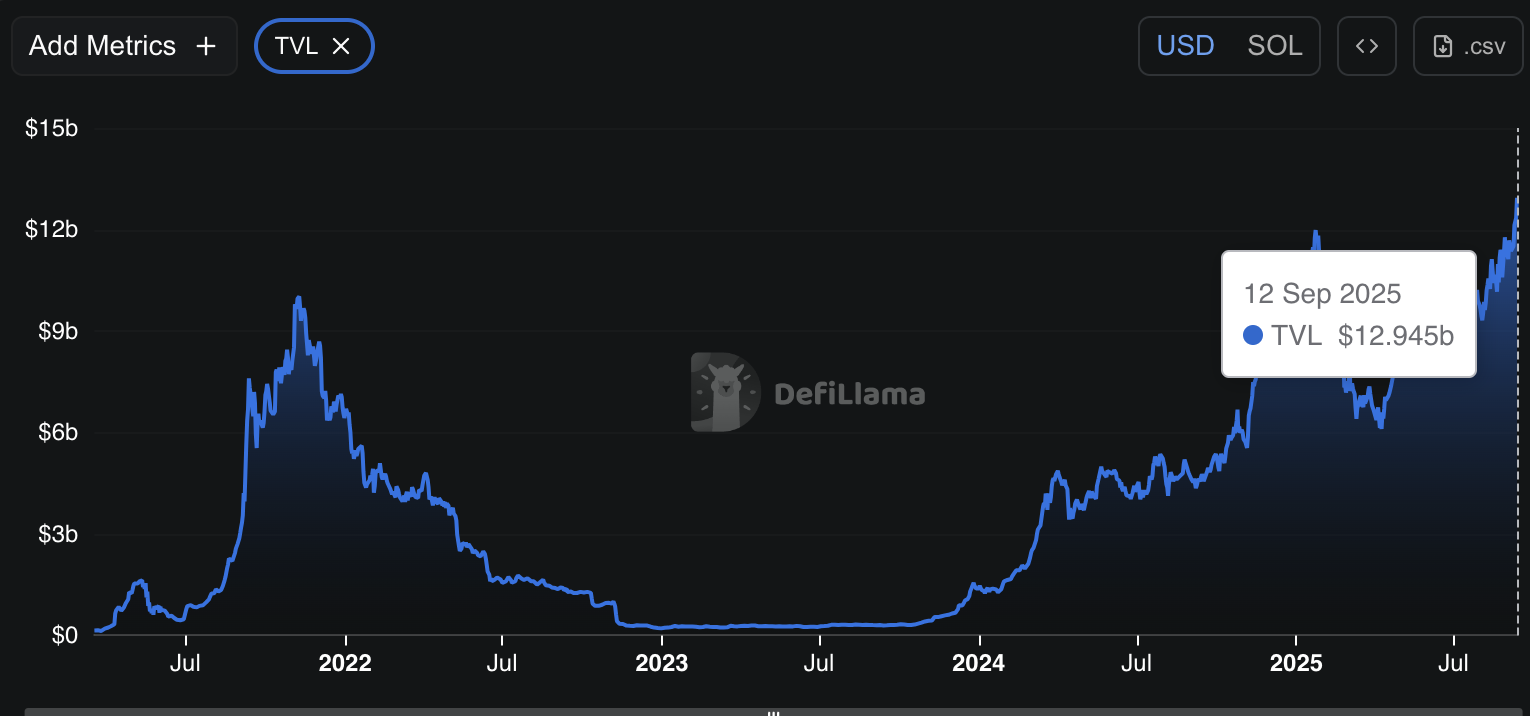

- Solana’s TVL hit a record $12.95B, up ~20% in 30 days, surpassing Ethereum’s combined L2s.

- Solana memecoins’ market cap jumped ~80% to $13B since June.

Solana (SOL) has been in a strong uptrend since breaking above the $205–210 resistance band, which aligned with the 0.382 Fib retracement. The rally has carried price up to the key $240 level, where SOL was trading in late January, while consistently printing higher lows since mid-June. This momentum has lifted Solana’s market cap to $128.67B, allowing it to surpass BNB at $125.87B and claim the position of the fifth-largest cryptocurrency by market cap.

That said, SOL price now looks overextended relative to both the 20-day EMA and the breakout zone, with the RSI nearing 70, signaling stretched momentum. A pullback appears likely, with $218 as the first support, followed by the $208–210 region (Fib + 20-day SMA). Holding these levels would keep the broader bullish structure intact and set up potential continuation towards $260.

What’s driving Solana price?

Apart from bullish technicals, Solana’s fundamentals have been strengthening rapidly. TVL on the network has recently reached a record high of $12.95 billion, up about 20% over the past 30 days alone. This surge in locked capital reflects deeper liquidity and growing confidence in Solana’s DeFi ecosystem, pushing it ahead of most competing layer-1 chains and even surpassing Ethereum’s combined L2 TVL, which includes Base, Optimism, and Arbitrum.

At the same time, Solana’s memecoin sector has seen explosive growth, with the total market cap of Solana memecoins climbing to $13 billion, up from $7.3 billion in late June — a nearly 80% increase in less than three months.

Finally, Solana is increasingly becoming a preferred asset for corporate crypto treasuries, with the number of publicly listed companies holding SOL in their reserves rising to 13, according to the latest reports.