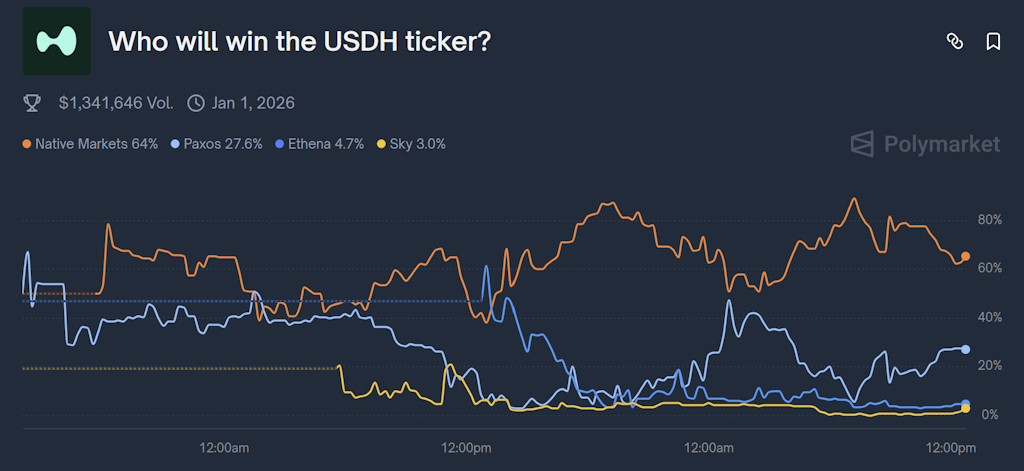

Polymarket crystallizes what the past couple days of X speculation and tea-leaf reading only hinted at: Native Markets, in collaboration with Stripe-owned stablecoins infra provider Bridge, is now the clear favorite to win the USDH ticker on Hyperliquid.

As of 12:30 p.m. ET, Polymarket betters gave Native around 65% odds, with Paxos a distant second, and Ethena, Frax, Agora, and Sky all but written off.

That lines up with early validator signaling. Infinite Field and CMI Trading have both publicly committed to voting for Native, citing its Hyperliquid-alignment and execution speed. Voting is now open, and final vote tallies are expected Sunday.

Paxos is still in the running. After an initial pitch centered on regulatory pedigree, the issuer revised its proposal Wednesday, pledging a larger share of reserve yield to Hyperliquid’s Assistance Fund and deferring any issuer take until the product scales.

Source: Polymarket

Source: Polymarket

The shift made their offer more competitive, and gives them a plausible path to upset if validator sentiment swings.

But for now, the debate’s center of gravity has shifted firmly toward Native.

What validators heard in the roundtable

Much of that momentum was shaped in real time during yesterday’s multi-hour community roundtable. Three themes consistently rose to the surface.

Being “Hyperliquid-first” isn’t just a slogan. Validators pressed each bidder on how exactly they’d issue USDH. Native made clear it would mint directly on HyperEVM and anchor issuance to Hypercore from day one, with no wrapping or cross-chain friction.

Frax, initially planning to mirror frxUSD, reversed course and committed to native issuance after community feedback. Paxos emphasized it would also mint directly on-chain, with full fiat and brokerage rails attached. The message bubbling up from community feedback: USDH must behave like a system-native asset, not a bridged approximation. That alone seems to be enough to derail Sky’s bid, since its core protocol is on Ethereum mainnet.

Second, transparency and enforceability mattered more than raw numbers. Nearly all bidders promised a high percentage of reserve yield routed back to Hyperliquid — whether through buybacks or contributions to the Assistance Fund — but validators wanted more than vague percentages.

Native said its split would be contractually hard-coded. Frax leaned on its track record of on-chain streaming and dashboard visibility. Paxos offered monthly transparency reports and a rising allocation toward the Assistance Fund, now beginning at 50% and scaling toward 90–95%. For a validator set tasked with securing the economic base of the platform, the pitches that pointed to auditability rather than just “trust us,” are preferable.

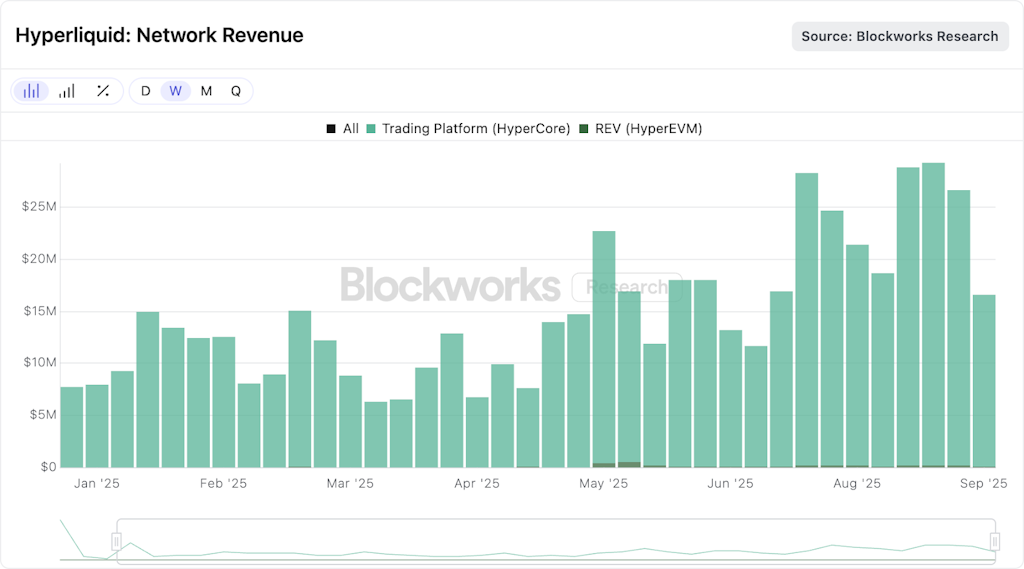

Hyperliquid’s surging protocol revenue underscores why the USDH race has attracted so much attention. As seen in Blockworks Research data, Hyperliquid is now generating over $20 million in weekly revenue, with recent peaks pushing above $25 million. That translates to a projected run rate nearing $1 billion annually, making the platform one of crypto’s most lucrative venues.

Source: Blockworks Research

Source: Blockworks Research

According to Blockworks researcher 0xCarlos, the battle over who gets to issue USDH is ultimately a bet on who can align best with this engine of yield.

“Migrating $5 billion in USDC deposits to USDH could represent an additional $200 million in revenue for Hyperliquid annually,” he noted — roughly an incremental 20% boost. The proposals diverge sharply in how that revenue would flow back into the ecosystem, but Hyperliquid itself looks to be the real winner, regardless.

Finally, the regulatory debate took center stage. Paxos and Bastion both leaned heavily into their NYDFS trust charters, painting them as essential for long-term compliance. Paxos framed many rivals as still “planning to get licensed,” implying a real risk of future shutdowns.

But that framing ran headlong into a different validator concern — sovereignty. Native’s argument was that relying on a single institutional issuer, even one as credentialed as Paxos, simply replaces one dependency (USDC/Circle) with another. Its own architecture, they argued, is issuer-agnostic by design, with contractual off-ramps and modular custody. In other words, any concerns over a risk of Stripe’s influence is contained.

Questions on the process

In such a strong field, the apparent ease of Native’s ascent was bound to raise eyebrows. Dragonfly’s Haseeb Qureshi posted on X that multiple bidders believed the race had been fixed from the start. Native’s initial proposal dropped almost immediately after the RFP was announced, he noted, suggesting advance notice. And while Ethena briefly surged on Polymarket following its detailed entry, odds collapsed just hours later — according to Qureshi, after validators dismissed its chances behind closed doors.

These allegations sparked heated replies. Some questioned Dragonfly’s close association with rival bidders like Ethena and Agora. Others argued that in a system where validators are free to stake based on whatever criteria they choose, early alignment is a feature not a bug.

The structure of the vote itself reinforces that. Delegators are not passive observers. Between September 11, when validator preferences are published, and the final vote on September 14, HYPE holders can re-delegate. If a validator appears unresponsive to its stake base, it can lose part of its power base. In that sense, the system is functioning as designed: a high-stakes political game.

What this episode made clear is that rapid governance timelines leave little tolerance for missteps in optics. With just a four-day window between proposal deadlines and the start of voting, teams already close to the Hyperliquid core had a significant leg up. Native’s deep familiarity with the validator set — and integration into HyperEVM infrastructure — meant its pitch was not just better prepared, but already partially vetted.

What could dent Native’s lead

Native’s offer appears to map cleanly onto the priorities of Hyperliquid’s validator set. The team is known for its ability to ship inside HL for months, and many trust that continuity matters more than a brand name.

But the race isn’t over.

Paxos, after its revised proposal, is increasingly competitive. It offers not only regulatory clarity but global distribution: Integrations with PayPal, Venmo, and top brokerages are on deck. For validators focused on growing USDH volume beyond HL’s internal ecosystem, that might be the more scalable long-term play.

Ethena’s proposal also made waves. While not currently a frontrunner, it introduced several novel elements: a USDtb/BUIDL backing structure, ecosystem-wide basis trade infrastructure, and a plan to finance USDC migration with direct incentives. And it made clear that Ethena would natively mint on HyperEVM and even help launch Hyperliquid’s equities markets. If validator sentiment begins to prioritize aggressive external growth over internal alignment, Ethena could re-enter contention.

The one lingering concern is the Bridge tie-up. Some in the community have raised the alarm about relying on a Stripe subsidiary to manage mint and redemption infrastructure, especially as it now plans to launch its own blockchain.

Native insists that their architecture is designed to be issuer-agnostic, and that swap-in/out functionality can be upgraded over time. Whether that satisfies sovereignty-minded delegates remains to be seen.

All eyes now turn to validator declarations expected Thursday. By then final proposal tweaks will be locked, and the governance machine will start to move toward a decision. It’s worth remembering: This vote is only about the ticker. Quote assets are likely to become permissionless under upcoming governance changes. But in a platform where monetary base, trading flows, and incentive design are so tightly coupled, the USDH decision will be about much more than branding.

At stake is the stablecoin standard that will define not only what many users trade on Hyperliquid, but who benefits from those flows. Native’s pitch is clear and long-standing, and so far the market is buying it. But there’s still time for one of the established players to make the case that long-term scale matters more than early integration and good vibes.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.