Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes has a clear answer to the market’s favorite bar fight. In an August 21 interview with Ran Neuner, the BitMEX co-founder said both Ethereum and Solana will rally hard, but he is explicitly tilted toward ETH for the remainder of the cycle. “Do I believe Solana is going to go up? Absolutely it’s going to go up. Do I believe it’s going to go up more than ETH? I don’t know. Probably not,” Hayes said. When pressed on portfolio construction, he didn’t hedge: “In terms of a position… you’d be more overweight ETH? Correct. Yes.”

Ethereum Vs. Solana: Who Wins This Cycle?

Neuner framed the context that has flipped the conversation from “Solana-only” to an Ethereum-led trade, citing a sequence of catalysts—from stablecoins to marquee advocates—that has turned ETH into “the darling asset of Wall Street.” Hayes didn’t contest the premise. Instead, he described the contest between the two chains as a “race” increasingly defined by the scale of capital now zeroing in on Ethereum: “ETH is a bigger asset to move, but there’s a lot of money chasing it. So it’s going to be [an] interesting race.” In other words, size is not a bug if flows are thick enough; it’s the feature that channels the largest bid.

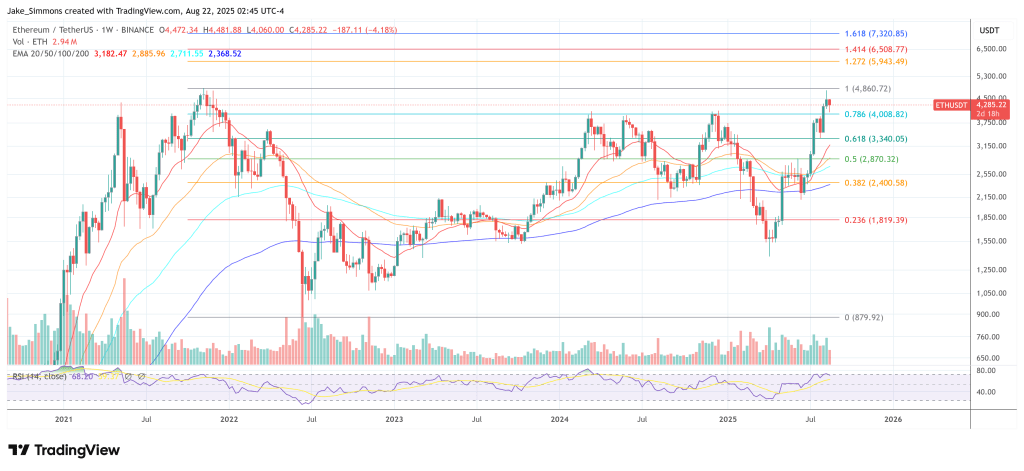

That flows-first view also explains why Hayes sees ETH’s upside accelerating once resistance is convincingly cleared. Responding to Neuner’s observation that Bitcoin sits well above its prior all-time high while ETH had been “struggling to break,” Hayes raised his sights beyond catch-up toward open-ended momentum: “I think ETH goes to $10,000 [or] 20,000 before the end of the cycle… once it’s broken through, then… it’s a gap of air to the upside.” He added that on shorter time frames, “the chart says it’s going higher now,” noting he had “bought back some of the ETH” he previously sold.

None of this means Hayes is bearish on Solana. He disclosed he advises Upexi, a Nasdaq-listed company with a Solana-focused treasury, and reiterated his expectation that SOL will benefit from the same risk-on currents: “They’re both going to go up. The question is which one goes up more.” But even with that proximity to the Solana ecosystem, he returned to the relative case: “Do I believe [Solana]’s going to go up more than ETH?… Probably not.”

Neuner summarized the narrative shift bluntly—ETH “caught this massive Wall Street narrative,” with stablecoins, tokenized assets and high-profile champions such as Joseph Lubin and Tom Lee putting a megaphone behind Ethereum, after a period when “it’s a SOL cycle” dominated discourse.

Hayes’ answer was not to relitigate the tech stack—Neuner even joked about Solana as the “fast monolithic chain”—but to anchor the ETH-over-SOL call in the mechanics of capital formation and passive demand now assembling around Ethereum’s market structure. In his telling, as institutional vehicles and public ETH treasury companies marshal fresh inflows, the “bigger asset to move” becomes the natural sink for the thickest flows.

Hayes’ comparative view therefore rests on three on-record pillars. First, positioning: he is overweight ETH versus SOL on a percentage basis. Second, flows: he expects more money to chase ETH in this phase of the cycle, despite (and because of) its larger base. Third, trajectory: once ETH sustains a breakout, he sees “the sky’s the limit” dynamics taking over, with a cycle target of $10,000–$20,000 for ETH. The respect for Solana’s upside remains, but the winner—on Hayes’ numbers and his own book—is Ethereum.

At press time, ETH traded at $4,285.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.