Arbitrum could be positioned for a major rally if it confirms a breakout from a long-forming bullish reversal pattern.

According to data from crypto.news, Arbitrum (ARB) surged nearly 46% to an intraday high of $0.38 before retracing slightly to $0.35 at press time. Its market capitalization climbed above $1.7 billion, overtaking tokens like Sky (SKY), Render (RENDER), and Sei (SEI) in the rankings.

The rally occurred in a high-volume trading environment. CoinGecko data shows that ARB’s daily spot trading volume jumped over 450% in the past 24 hours, with $658 million worth of tokens changing hands. Derivatives activity also surged, up 42% from the previous day, while a long/short ratio above 1 across major exchanges suggests bullish positioning among leveraged traders.

Much of the recent momentum has been driven by growing speculation that Robinhood may tap Arbitrum to develop a blockchain infrastructure enabling EU-based users to trade U.S. equities onchain.

Earlier reports suggested that Robinhood was evaluating both Arbitrum and Solana as candidates, though final decisions were still pending.

Investor buzz picked up after Robinhood announced that its Crypto GM, Johann Kerbrat, and A.J. Warner, CSO of Offchain Labs, the non-profit that stewards Arbitrum ecosystem governance, will join Ethereum co-founder Vitalik Buterin for a fireside chat on Monday. The event, hosted by Robinhood Europe in Cannes, is being hyped as the stage for the company’s biggest crypto announcements of the year.

The development comes shortly after Arbitrum was selected by crypto exchange Gemini as the settlement layer for its tokenized shares of Strategy’s MSTR stock, with plans to expand to additional assets and networks over time.

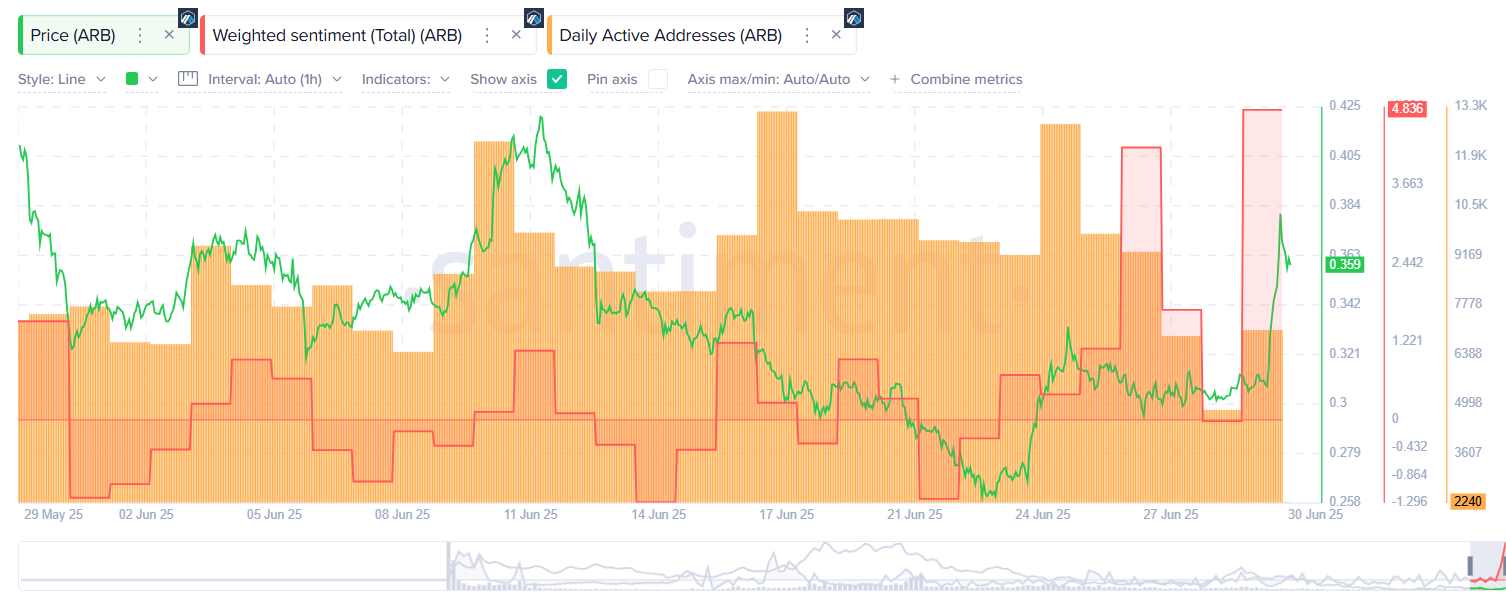

Beyond fundamentals and headlines, on-chain indicators further support the bullish case. Data from Santiment shows a sharp uptick in daily active addresses on the Arbitrum network alongside a shift in social sentiment from negative to positive, both typically seen as precursors to sustained price rallies.

Arbitrum price analysis

On the 1-day/USDT price chart, ARB is nearing the upper boundary of a large falling wedge pattern that has been developing since January of last year. A confirmed breakout above this resistance trendline would likely signal the end of its long-term downtrend and the beginning of a new bullish phase.

The token currently trades above its 50-day exponential moving average, indicating strengthening medium-term bullish momentum. Additionally, momentum indicators support this view, most notably, the MACD has flipped into positive territory, suggesting a shift in trend direction.

The Aroon Up indicator stands at 92.86%, while the Aroon Down is at 42.86% which points to a strong uptrend with declining bearish pressure, typically seen in early stages of trend reversals.

If the breakout from the wedge is confirmed, the next likely upside target for ARB lies at $0.75, which corresponds with the 23.6% Fibonacci retracement level drawn from the macro high to recent lows.

A clean breakout from that level could set it up for a rally to $1, which would represent gains of 185% from the current levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.