Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced significant volatility in recent days, driven largely by escalating geopolitical tensions in the Middle East. After breaking down from the range that had held since early May, ETH fell sharply to $2,100, triggering widespread concern among investors. The breakdown was largely attributed to the market’s reaction to the US attack on Iranian nuclear facilities, which escalated the conflict between Israel and Iran.

However, markets quickly responded to positive developments. Ethereum rebounded strongly above the $2,400 level following reports that Iran and Israel had agreed to a ceasefire, temporarily easing global risk sentiment. This relief rally brought new optimism to the Ethereum market, especially amid signs of institutional confidence.

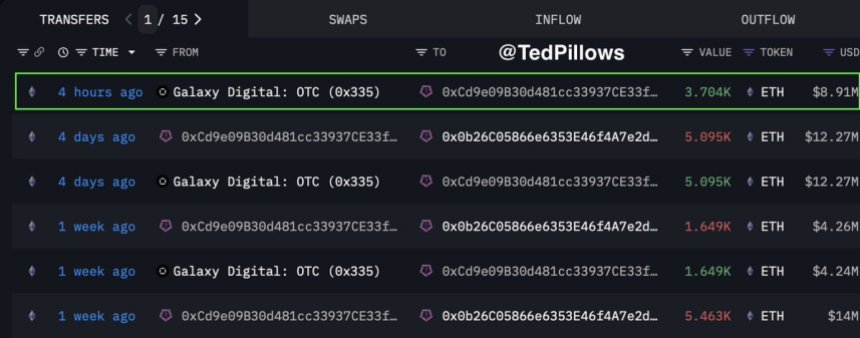

According to data shared by top analyst Ted Pillows, a major whale or institutional entity purchased another $8.91 million worth of ETH, continuing an aggressive accumulation streak. Over the past three weeks, this same entity has reportedly bought $422 million in Ethereum, signaling strong conviction despite recent market stress. This wave of accumulation suggests that long-term players may view the current price zone as a key opportunity, reinforcing the idea that Ethereum could be building a base for its next major move once broader conditions stabilize.

Ethereum Surges As Ceasefire Ignites Market Optimism

Ethereum surged over 14% following reports of a ceasefire agreement between Israel and Iran, providing a much-needed relief rally after weeks of geopolitical tension and uncertainty. The news sparked a wave of bullish momentum across the market, with ETH rebounding sharply from recent lows near $2,100 to trade firmly above the $2,400 mark. Bulls, who had lost control amid panic selling, are now showing signs of strength as the market prepares for its next decisive move.

Despite this rebound, caution remains. The broader macroeconomic environment continues to tighten, with rising concerns over a potential US recession, high Treasury yields, and sustained hawkishness from the Federal Reserve. These factors could weigh on risk assets in the weeks ahead, putting Ethereum’s rally to the test. Nonetheless, optimism is building, especially around the possibility of the long-awaited altseason—one that many believe will be led by Ethereum.

Adding fuel to this narrative is the growing trend of whale accumulation. According to insights shared by analyst Ted Pillows, a major whale or institutional entity has just acquired another $8.91 million worth of ETH. This purchase adds to a staggering $422 million in Ethereum accumulated over the past three weeks.

Such aggressive buying suggests that large players are positioning themselves for a major move ahead, likely expecting Ethereum to be at the forefront of the next market cycle. As ETH consolidates above key levels, the accumulation trend could act as a foundational force supporting higher prices, especially if macro and geopolitical risks stabilize.

ETH Reclaims $2,400 Following Sharp Rebound

Ethereum has reclaimed the $2,400 level after a swift rebound from a breakdown near $2,100. The recent candle structure on the 3-day chart shows a strong wick to the downside, followed by a recovery, reflecting the impact of geopolitical developments, most notably the ceasefire between Iran and Israel. This bounce prevented a deeper selloff and has brought Ethereum back above a key psychological level.

Looking at the chart, ETH remains under pressure from the 100-day and 200-day moving averages, currently acting as resistance around the $2,638 and $2,779 zones. Price also recently broke a short-term descending trendline and is now attempting to consolidate above it. This suggests the potential for a trend reversal if bulls can sustain momentum and push through the moving average cluster.

Volume remains subdued but shows signs of recovery, signaling early interest returning after the fear-driven flush. A break and close above the $2,600 range would likely open the path to retest the $2,800 zone, which was a major supply area in previous months.

Featured image from Dall-E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.