Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Data shows the Ethereum spot exchange-traded funds (ETFs) have seen weekly inflows five times the recent average, while Bitcoin has seen a slowdown in momentum.

Ethereum Spot ETFs Have Seen 154,000 ETH In Inflows This Week

In a new post on X, the analytics firm Glassnode has talked about the latest trend in the netflow related to the US-based Ethereum spot ETFs. The “spot ETFs” refer to investment vehicles that allow an alternate means of exposure to a given asset.

This means that with a spot ETF, a trader can ‘invest’ into an asset without having to directly own it. In the context of cryptocurrencies, this is especially relevant, as the ETFs trade on traditional platforms. Some investors may not want to fiddle with digital asset exchanges and wallets, so the ETFs offer them a familiar path into cryptocurrencies.

The option of the spot ETFs is a relatively recent one in the sector, with Bitcoin’s version gaining approval from the US Securities and Exchange Commission (SEC) at the start of 2024 and Ethereum’s in mid-2024.

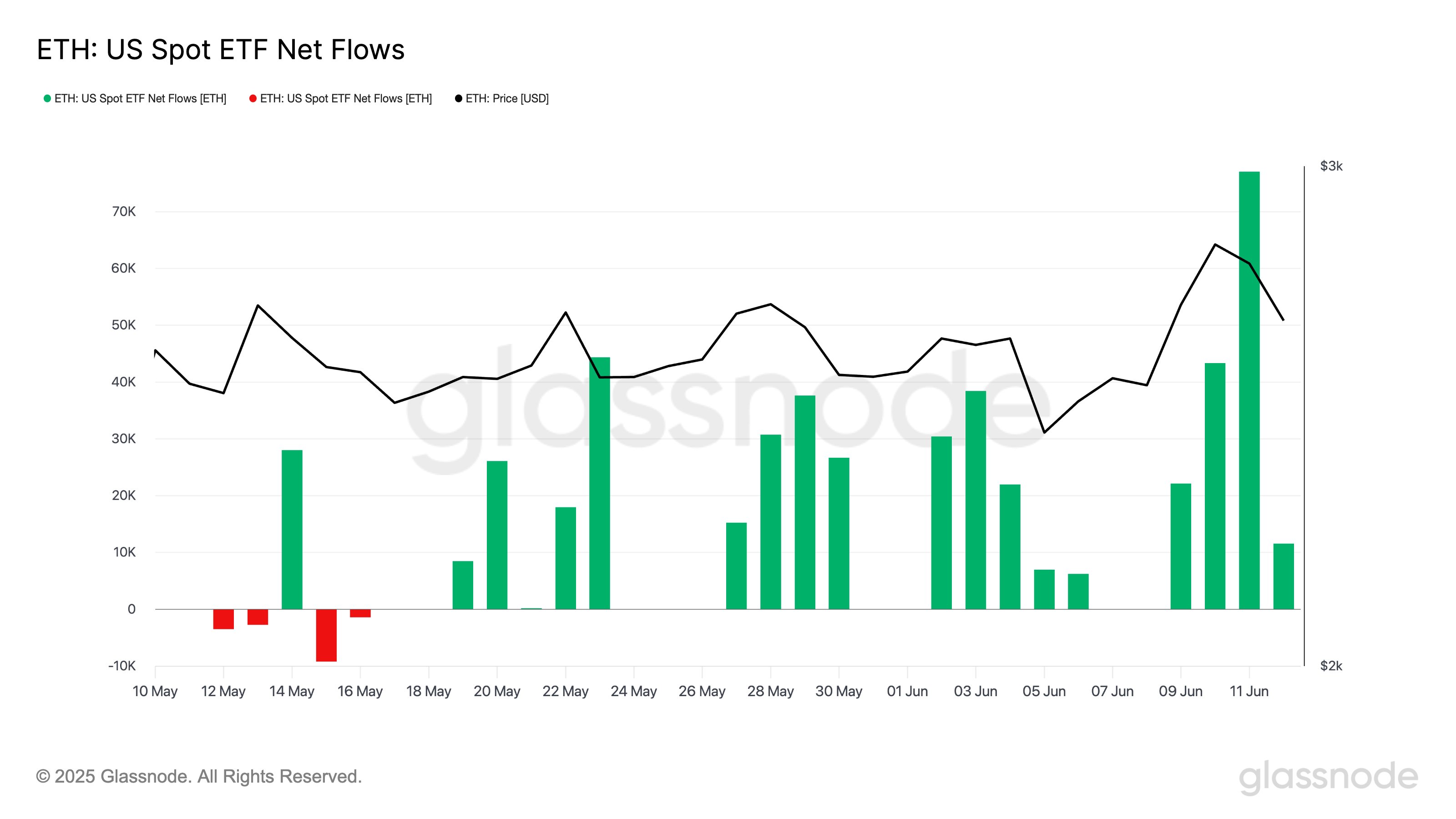

Below is a chart that shows how the netflows related to the latter’s spot ETFs have looked during the past month.

From the graph, it’s visible that the Ethereum US spot ETFs have been witnessing net inflows for the last few weeks, a sign that there has been demand for the coin from the traditional investors.

“This week alone, they’ve seen 154K ETH in inflows – 5x higher than their recent weekly average,” notes Glassnode. “For context: the biggest single-day ETH inflow this month was 77K ETH on June 11th.”

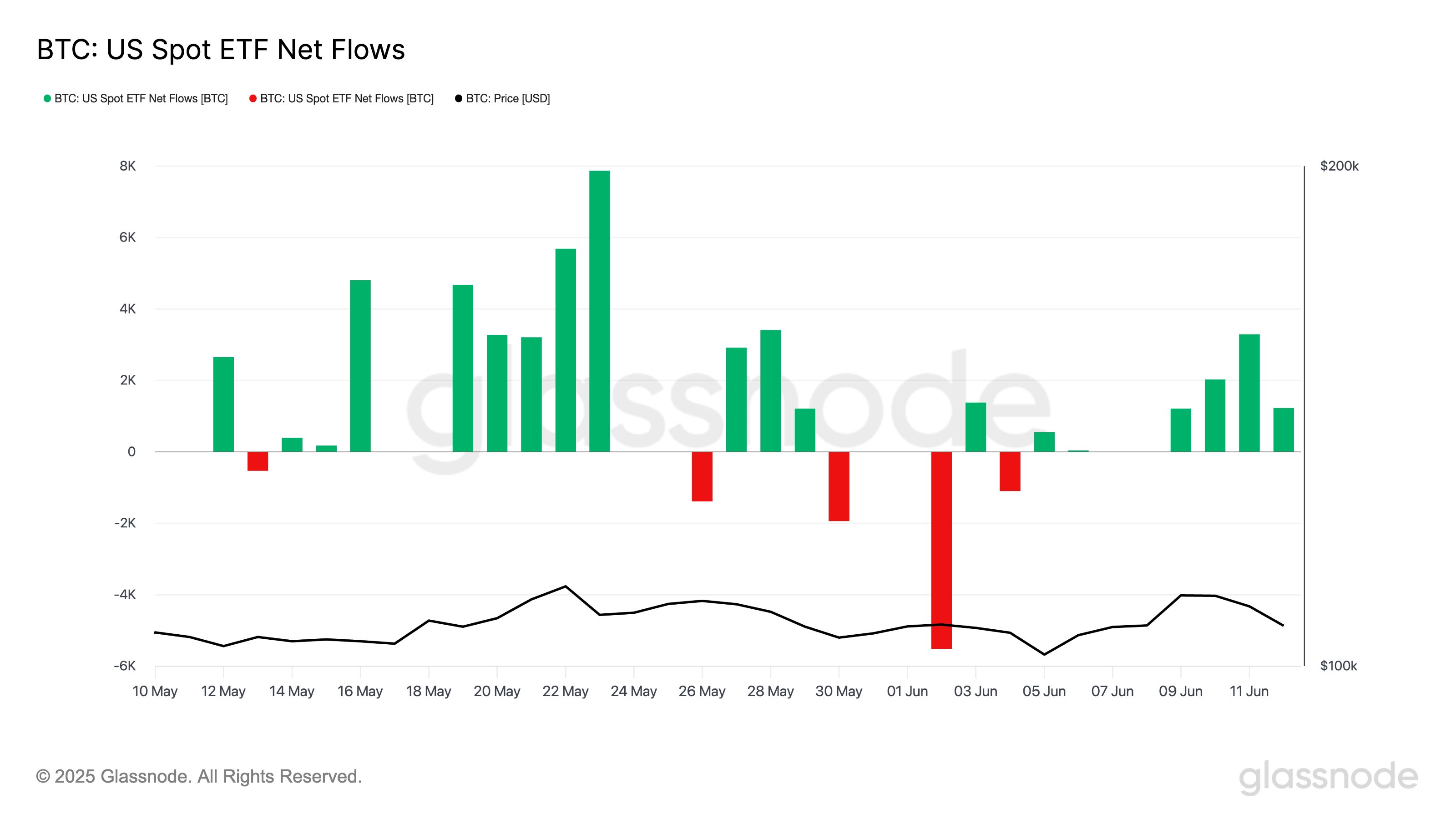

While the trend has been that of growth for Ethereum, it has looked a bit more mixed when it comes to the number one digital asset, Bitcoin.

As displayed in the above graph, the Bitcoin US spot ETFs have also seen positive netflows this week. The scale of the inflows, however, hasn’t been anything impressive, as only around 7,800 BTC has entered into the ETFs.

This is above average, but far lower than the highs witnessed in May, when at one point the daily inflow had reached a peak of 7,900 BTC, more than the inflows for the entire current week.

Last week, the Bitcoin spot ETFs witnessed an outright negative netflow, so it seems the momentum has recently just been slower for the asset. In contrast, things have looked much more green for Ethereum indeed.

ETH Price

While Ethereum has been seeing consistent ETF inflows, its price has still underperformed against Bitcoin over the past day as it has dropped to $2,540, a decline of 7% compared to BTC’s 2% loss.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.