Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at a critical juncture after breaking above key resistance but failing to sustain momentum toward the psychological $3,000 level. The recent surge brought optimism to the market, yet ETH has now pulled back slightly, struggling to extend gains as global uncertainty weighs on sentiment. With macro pressures mounting and negotiations between the US and China over a potential trade deal in focus, the broader market appears to be awaiting clarity before making its next decisive move.

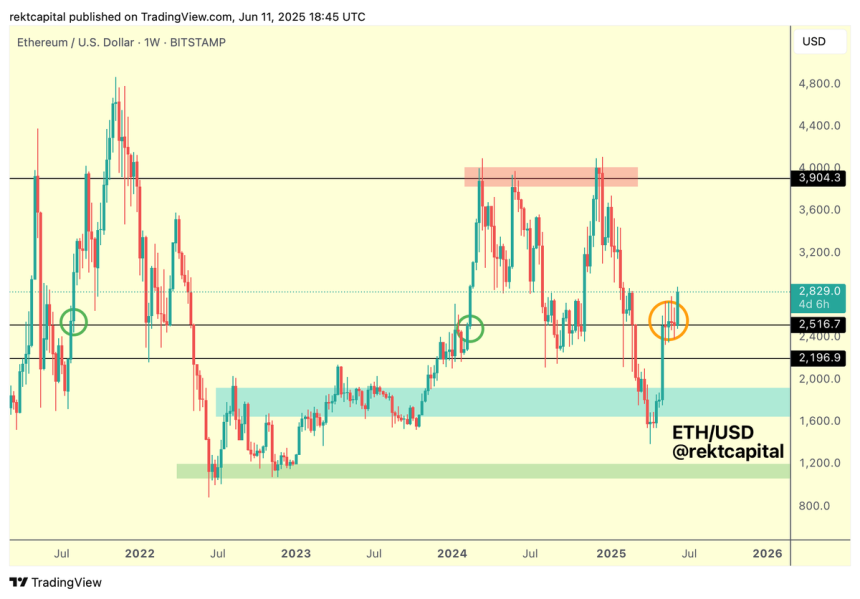

Top analyst Rekt Capital offered historical context to Ethereum’s current setup, pointing to two previous cycles where ETH successfully retested the $2,500 level before launching toward $4,000. In August 2021 and again in early 2024, ETH held $2,500 as strong support (green circles), acting as the foundation for a major breakout rally. This repeating pattern has investors now eyeing the same level with growing interest.

As Ethereum trades near $2,750–$2,800, the coming days could determine whether this current setup mirrors past bullish cycles—or if momentum fades again. With strong support beneath and a clear historical roadmap above, ETH’s ability to reclaim strength could trigger the next leg in what many believe may be the start of altseason.

Ethereum Echoes Past Patterns Ahead Of Potential Breakout

Ethereum has rallied over 100% since its April lows, showcasing powerful momentum and heightened activity at current levels. After briefly tapping a local high near $2,830, ETH has retraced slightly but remains firmly above the $2,750 mark—a key area that now acts as short-term support. The strength of this rebound is fueling growing speculation that Ethereum may not only be preparing for another leg up but also setting the tone for a broader altseason.

Analysts across the board are closely watching ETH’s current consolidation, with many citing historical patterns as a reason for optimism. Notably, Rekt Capital highlighted a recurring pattern that has previously led to significant rallies. In August 2021, Ethereum successfully retested the $2,500 level as support before surging to approximately $4,000. The same thing occurred in early 2024, when ETH once again bounced from $2,500 and rallied to the same zone.

Now, for the past five weeks, Ethereum has repeatedly confirmed the $2,500 level as solid support, forming what appears to be a textbook foundation for another major move. This accumulation phase—mirroring past cycles—has many traders confident that ETH could soon reclaim $3,000 and begin leading altcoins higher.

With macro conditions still uncertain and market participants looking for signals of strength, Ethereum’s behavior at these levels carries added significance. If ETH can maintain its position above $2,750 and build momentum through $2,830, the market could see an explosive shift in sentiment, potentially triggering the next phase of the bull cycle. For now, all eyes remain on Ethereum as it tests the top of its multi-week range with bullish conviction.

ETH Holds Above Breakout Zone After $2,830 Rejection

Ethereum is currently trading at $2,749 on the 4-hour chart, holding above a key breakout zone between $2,700 and $2,740 following a brief rejection at $2,830. After breaking above this multi-week resistance last week, ETH surged into higher territory before pulling back in the last few sessions. Despite this retrace, the price has so far maintained support above the previous resistance area, now acting as a strong demand zone.

This range—highlighted by the yellow box on the chart—served as a ceiling for nearly a month before being flipped into support during the breakout. Ethereum is now consolidating right above this area, and as long as it remains above the 50 and 100 simple moving averages (SMAs), the bullish structure is intact. Volume has started to cool off slightly, suggesting that traders are waiting for a decisive move—either a bounce toward $2,800–$2,900 or a breakdown back below $2,700.

A successful hold of this support zone could confirm the retest and build momentum for another breakout attempt. However, failure to hold $2,700 could see ETH revisit the 200 SMA around $2,570. For now, Ethereum remains technically strong, but traders are watching closely for confirmation.

Featured image from Dall-E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.