Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price outlook remains sky-high after Strategy founder Michael Saylor told Bloomberg on Tuesday that a market freeze won’t come back. He argued that growing demand and limited daily supply point straight to a rally toward $1 million.

Supply And Demand Pressure

According to Saylor, miners release only about 450 BTC each day. That adds up to roughly $50 million at today’s price of around $109,859.

He said once that $50 million is snapped up by buyers, there’s no choice but for the price to climb. His view rests on the idea that active demand now matches or exceeds what miners sell.

High Price Targets

Based on reports, asset manager ARK Invest recently boosted its bull case for Bitcoin from $1.5 million to $2.4 million by the end of 2030. Saylor went even further.

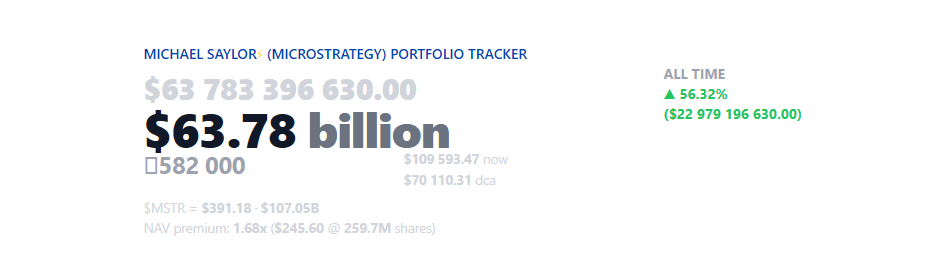

He said that as long as Bitcoin doesn’t head to zero, it’s bound for $1 million. His own firm has picked up 582,000 BTC since 2020. That stash is worth nearly $64 billion, according to Saylor Tracker data.

Institutional And Political Support

Saylor pointed to big names backing Bitcoin. He mentioned US President Donald Trump, US Treasury Secretary Scott Bessent and SEC chair Paul Atkins as signs that the asset has won its toughest battles.

He also noted that banks are lining up to offer custody services. And he praised Bitcoin ETFs from BlackRock and others for buying coins daily.

Volatility Warning

Saylor didn’t shy away from a cautionary note. He suggested that if Bitcoin hits $500,000 or $1 million, a fall to about $200,000 could follow. That’s almost a 60% drop from the peak. His point was that big price swings are part of Bitcoin’s history—and likely its future.

Beyond miner sales and whale wallets, analysts say wider market moves matter too. Spot and futures trading often top $10 billion a day, so $50 million of fresh buys might only nudge the price.

Regulation could swing the other way if concerns over energy use or consumer protection grow. And rival cryptocurrencies keep popping up with new features.

What Comes Next

Reports disclose the real test will be whether steady new buyers can outpace both miner supply and selling by holders looking to bank profits.

Saylor’s figures make a strong case for continued upside. But investors who build a plan around a $1 million Bitcoin should brace for big dips along the way.

In the end, daily demand, political moves and how the rest of the financial world reacts will decide if those eye-popping targets really come to pass.

Featured image from Getty Images, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.