Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

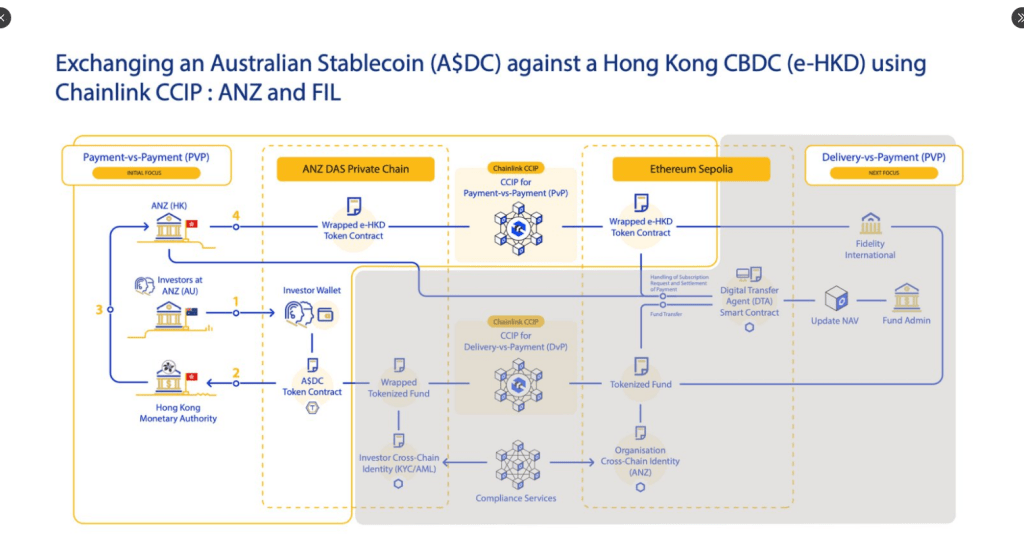

Chainlink is set to play a major role as Hong Kong’s central bank takes a big step in its digital currency tests. Phase two of the e-HKD pilot will try moving tokenized Hong Kong dollars across borders. The plan is to swap e-HKD for A$DC, an Australian dollar stablecoin. This could cut settlement times from days to seconds. It may also show how central banks can work together with blockchain technology.

Hong Kong And Australia Test Digital Cash

According to reports, the project will use Chainlink’s Cross-Chain Interoperability Protocol, or CCIP, to handle transfers. The goal is simple. Move money in real time and make sure both sides get what they expect.

Phase two kicks off with Hong Kong authorities and their counterparts in Australia. They will swap e-HKD for A$DC and aim for instant settlement. Based on reports, this setup could serve as a model for other central banks.

We’re excited to share that Chainlink is facilitating the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin as part of an ongoing use case in Phase 2 of the e-HKD+ Pilot Program.

Congratulations to participants @Visa, ANZ, China AMC, and Fidelity… pic.twitter.com/ts2C6Vt4Ul

— Chainlink (@chainlink) June 9, 2025

Chainlink Tools In Use

Chainlink is not just a name in the mix. It brings two big pieces of tech to the table. CCIP handles the cross-chain messages, acting like a bridge between different blockchains.

The Digital Transfer Agent, or DTA, deals with compliance. It keeps track of who owns what token and makes sure rules in different countries are met. In May, World Liberty Financial tapped Chainlink for cross-chain stablecoin transfers covering USD1. That earlier deal hinted at what’s possible this time around.

Big Names Join The Pilot

Visa and ANZ are helping with payment processing for e-HKD and A$DC. Asset managers Fidelity International and ChinaAMC will also take part. Their job is to manage the tokenized funds on both sides.

This mix of banks, asset managers and tech firms shows the project is more than a small test. It has real money and real risks involved. Reports disclosed that those risks are managed by a Payment-versus-Payment model. This means funds are only released when both sides confirm they have received the other asset.

Market Moves And Reactions

LINK, the token for Chainlink, jumped by 6% after news of the pilot broke. It now trades at $14.70. That rise follows a wider market rally driven by hopes that Bitcoin may hit $110,000 before the week’s end.

According to market data, crypto traders often chase big targets. Short-term gains can be tempting. But they can also lead to quick sell-offs if the main story fades.

Despite the rally, Bitcoin still tracks the equity swings rather closely. There is a mix of bulls and bears in futures data that suggests some people are not yet convinced this run will last.

High volatility can shake out weaker hands at the first sign of trouble. A sudden change in risk sentiment or a fresh macro shock can quickly reverse gains.

Featured image from Imagen, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.