Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto Insight UK has doubled down on a forecast that XRP must endure one last, violent shakeout before launching toward a long-awaited $10 milestone. In his latest video, the British analyst warned that “the most dense liquidity I’ve seen in a long time for XRP” still sits uncollected beneath current spot prices. Until that pool is swept, he argues, the market will not unlock the upside move he ultimately expects to carry the token into double-digit territory.

XRP Needs One Last Flush

“XRP didn’t come down as low as we wanted,” he told viewers. “It did hit the first key area of liquidity, but it didn’t take it all. That makes me think we’ve got continued downside.” In his own trading plan, the analyst has resting bids at roughly $2.01 and $1.95—a zone he believes will be tested once leveraged longs capitulate. Only after that “final flush,” he contends, can a rally toward $10 begin in earnest.

The call comes amid broader cross-asset strength that has so far failed to translate into a sustained altcoin breakout. Silver is challenging decade-old highs near $36 an ounce, uranium contracts are pressing their recent peaks, and the Nasdaq Composite remains within sight of its all-time high. Yet despite what he calls “a broad-based commodities rally,” the analyst maintains that crypto still needs one more washout to clear residual excess.

Macro-political drama, he suggests, is only accelerating that process. He cited the public clash between Elon Musk and US president Donald Trump—sparked by Trump’s proposal for a four-trillion-dollar spending bill and Musk’s claim that Trump’s name appears in sealed Epstein files—as a narrative that briefly rattled risk markets. “If it brings the price to where I want it to go, fantastic,” he said dryly. “That’s all we’re looking at here.”

On Ethereum he sees a similar dynamic. Open interest in ETH futures remains at all-time highs, a sign in his view that institutions are accumulating spot while shorting derivatives to hedge—a trade that could unwind violently should ETH pierce the $2,800 level. “When we get this squeeze to the upside,” he predicted, “we’ll see a fast move back toward all-time highs for ETH, probably toward $4,500 before you know it.”

Bitcoin, for its part, has already waded into the analyst’s preferred liquidity zone just above $100,000. Whether the flagship asset needs another dip, he said, is less important than what happens to its dominance. A brief surge in bitcoin market share toward 65.5% would, in his model, coincide with an XRP capitulation and set the stage for “crazy season,” his shorthand for a full-blown altcoin cycle.

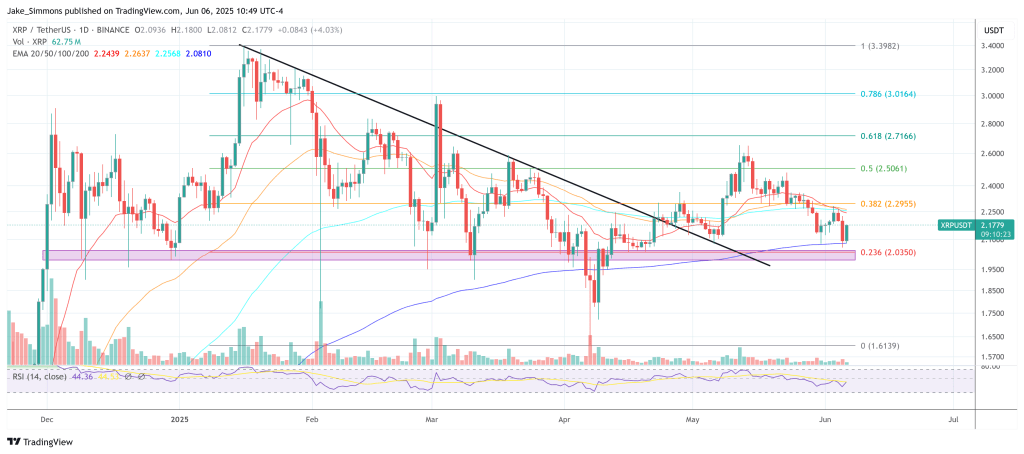

The hinge is XRP liquidity. Viewers were shown heat-map snapshots highlighting concentrated stop-loss orders beneath the May swing low. “People came long here after they thought, ‘Oh, the bottom’s in.’ That’s added to this liquidity below us,” he said. Until that layer is removed, he remains “80% sure” that price will probe lower—even though his own portfolio is almost entirely in spot XRP. “I’m on the side of wanting it to go,” he acknowledged. “If it goes up now, I’m happy. But I’d be highly surprised if we don’t get that push down.”

Still, his end-point is unequivocally bullish. Once the liquidity has been harvested, he foresees a textbook bullish divergence on the daily relative-strength index—“lower low on price, higher low on RSI”—that would ignite what he calls the “next big push.” In that scenario, XRP would not merely revisit its 2021 peak near $3.80; it would overshoot to the analyst’s long-standing $10 target. “Let it send,” he concluded.

At press time, XRP traded at $2.17.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.