Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As the month nears its end, the crypto market turns momentarily red, with Solana (SOL) retesting a crucial support level that could determine its short-term performance. An analyst suggests that holding the current range over the weekend will be key for the long-awaited rally back to $200.

Solana Hits Multi-Week Low

Amid the crypto market pullback, most cryptocurrencies are recording a red Friday, with Bitcoin (BTC) and Ethereum (ETH) momentarily losing some key levels. Solana, one of the cycle’s leading Altcoins, followed the rest of the market and registered a 6% retracement in the daily timeframe.

SOL has seen a significant recovery from its multi-month downtrend, which led the token to hit a 14-month low of $95 during the early April retraces. Over the past month and a half, the cryptocurrency has reclaimed multiple crucial levels, setting the stage for a potential rally.

However, the cryptocurrency has struggled to reclaim the key $180 resistance despite hitting a three-month high of $187 a week ago. A reclaim of this key barrier could push SOL’s price toward the $200 mark, enabling a rally to new highs.

Today’s price action has sent Solana to a 22-day low of $156 after losing its $164-$180 price range and the $160 support zone for the first time since the May 8 breakout.

Trader and analyst Crypto Bullet shared a bearish outlook for Solana, suggesting that the token will underperform for the rest of the year. He highlighted SOL’s trading pair against ETH, noting that the cryptocurrency has been in a rising wedge in the weekly chart since the Q4 2024 rally.

According to the SOL/ETH chart posted by the trader, the cryptocurrency has broken down out of the formation after losing the 0.069 mark. To Crypto Bullet, this signals that “ETH will soon pump way harder than SOL.”

All Eyes On SOL’s Weekly Close

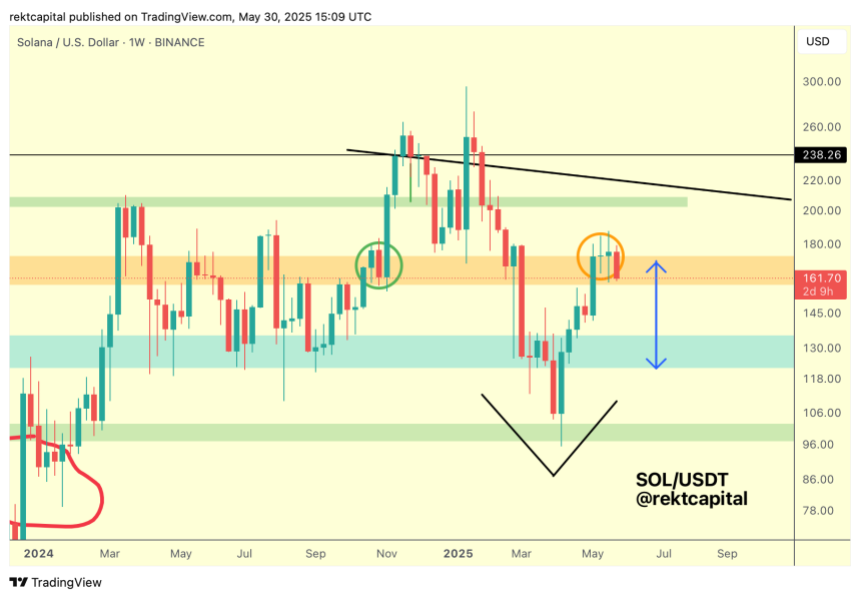

Analyst Rekt Capital pointed out that Solana is attempting to continue Weekly Closing within its Range High resistance, which is key for its long-term rally.

He previously explained that the cryptocurrency re-entered its Post-Halving Re-Accumulation Range after successfully reclaiming the $120 barrier last month and consolidating within the $160-$175 range high.

To the analyst, SOL’s price “needs to continue demonstrating price stability” around this zone, as that is what is “required for SOL to break out from this range into the $200+ levels.”

He affirmed that Solana needs to aim for a retest similar to late 2024, when the cryptocurrency built a base around the Range High ahead of the breakout with multiple weekly closes near the resistance zone, which led to a massive breakout to the $200 mark.

Rekt Capital highlighted that SOL has been successfully retesting this area as support over the past few weeks. However, he warned that cryptocurrency mustn’t close below the current price zone as it would “tease a possible loss of this region as support.”

A drop below this range could lead to a retrace into the Range Low, between the $120-$135 mark. “Price stability at the Orange Range High going forward is thus key here,” he concluded.

As of this writing, Solana trades at $159, an 11.6% decline in the weekly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.