Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) continues to trade near its recent all-time high (ATH) of $111,980, activity on major crypto exchanges suggests that institutional investors may be strengthening their BTC holdings. Most notably, Coinbase – the leading US-based crypto exchange – recorded a net outflow of 7,883 BTC, raising speculation about renewed institutional demand and a potential continuation of the rally.

Coinbase Sees 7,883 Bitcoin Outflow

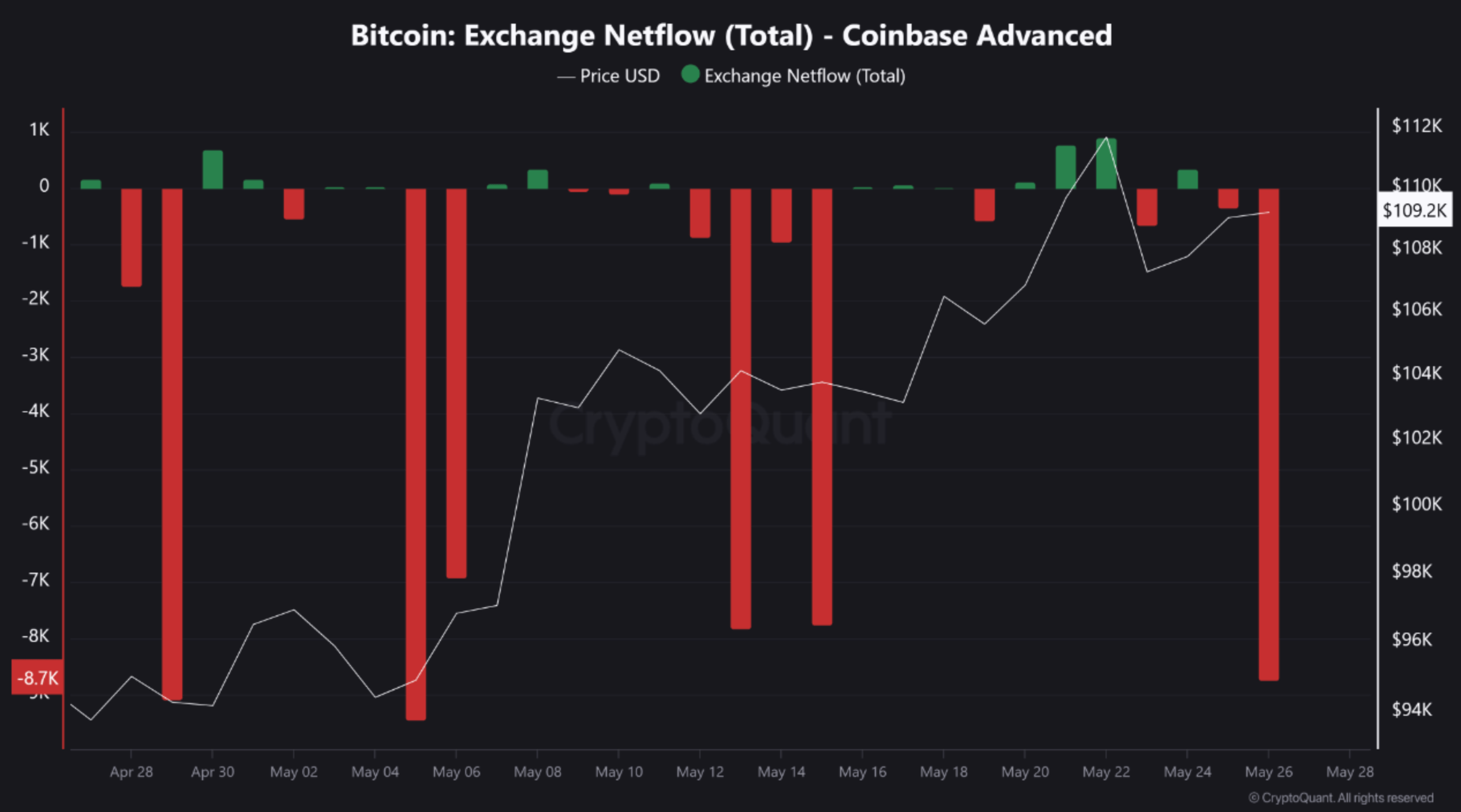

According to a recent CryptoQuant Quicktake post by contributor burakkemeci, Coinbase experienced a daily outflow of 8,742 BTC on May 26. After accounting for BTC deposits, the net outflow stood at 7,883 BTC – marking the third-largest single-day BTC outflow from the exchange in the past month.

For the uninitiated, daily BTC outflow refers to the total amount of Bitcoin withdrawn from an exchange within a day, while net outflow is the difference between BTC withdrawn and deposited – showing the actual net movement of funds. A positive net outflow means more BTC left the exchange than entered, often signaling accumulation.

Historically, large BTC outflows from Coinbase are often followed by institutional announcements or spot Bitcoin exchange-traded fund (ETF) inflows. Since all US-listed spot Bitcoin ETFs – except Fidelity’s – source their BTC from Coinbase, the scale of this transaction suggests potential ETF involvement or a corporate acquisition.

One likely candidate is Strategy, led by Michael Saylor. The company recently disclosed a purchase of 7,390 BTC, bringing its total holdings to 576,230 BTC. Saylor has also hinted at another large acquisition, although only time will tell whether the latest Coinbase outflows are connected to the firm.

Supporting this institutional narrative is the Coinbase Premium Index, which has remained consistently positive over the past month. This metric reflects stronger buying pressure from US-based investors, often linked to institutional demand. The analyst concluded:

These outflows reflect sustained demand from U.S.-based institutions. If this appetite continues, it may lay the groundwork for another leg up in Bitcoin’s price. Especially when fueled by ETF inflows, such moves can lead to sharp price breaks and new highs.

New BTC ATH Soon?

At the time of writing, Bitcoin is trading at $109,589, just 1.9% below its all-time high. However, multiple on-chain and technical indicators suggest that BTC could soon break into uncharted territory.

CryptoQuant contributor ibrahimcosar recently noted that Bitcoin may be targeting the $112,000 mark after forming a double bottom pattern on the hourly chart. Meanwhile, the Bitcoin Spot Taker CVD (Cumulative Volume Delta) has flipped back to positive, signaling bullish momentum.

Moreover, on-chain metrics show that holders are not rushing to sell, even while sitting on significant unrealized gains, suggesting belief in further price appreciation. At press time, BTC trades at $109,589, down 0.3% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.