It has long been said that visiting China from the West is akin to landing in a parallel universe. Pick any major city and most aspects look and feel broadly familiar, yet the fundamentals are different. You can’t hail an Uber or use Google Maps to get around, and your hotel TV won’t have Netflix. Instead, there’s always a domestic alternative. One that is likely newer, bigger, quicker, and perhaps even better than what you’re used to back home.

And so to the Chinese car industry, whose latest opportunity to scare the living daylights out of Europe and the US came at the Auto Shanghai motor show. Held at the world’s second-largest exhibition space, the show saw more than 1,400 cars from 26 countries spread across 13 halls. Some 93 vehicles made their world debut in front of 1 million attendees. YouTubers would later upload whole-show walk-throughs with run times longer than Interstellar.

How many world debuts do you suppose took place at the 2024 Geneva International Motor Show? About a dozen. No wonder it was canceled for 2025.

In Shanghai, BYD-owned Denza showed off its electric Porsche 911 rival.

Photograph: Getty Images

To Western eyes, photos of Auto Shanghai are akin to asking ChatGPT to recreate the glory days of motor shows past. Anyone who strolled the cavernous convention halls of Paris, Frankfurt, Geneva, Detroit, even Birmingham, and gawped at the new and the exciting will recognize the scene. There’s lots of shiny metal and carbon, formed into cars of every conceivable size, shape and social status. But the badges are unfamiliar, model names nonsensical; prices implausibly low, performance claims from another planet.

Admittedly, some cars are dressed in fur like children’s toys, complete with bunny ears and tail, but perhaps that’s just the AI hallucinating. This still largely looks like the sort of auto show Europe and the US hosted every few months in a prepandemic world.

Names like Jetour, Denza, iCar, Changan, Hongqi and Luxeed won’t ring many bells. Keep walking and you’ll catch a reassuring glimpse of Audi, Lotus, Buick, and Volkswagen, but the spark of familiarity they bring is quickly extinguished by a stark realization: They are no longer in Shanghai to show the fledgling locals how it’s done, as beacons of a Western industry riding high on a century of success. They’re surrounded by younger, fitter, and keener rivals with a hunger to put a ding in the universe. And there’s about to be a feeding frenzy.

Award Winners and Oddballs

Highlights of this year’s Shanghai show included the Jetour G900, a range-extended electric SUV with two rear-mounted turbines for use as a boat; an electric Porsche 911 rival from BYD-owned Denza; the award-winning Xpeng M03 Mona; and the Maextro S800, a Maybach-rivaling luxury sedan from Huawei.

Yes, that Huawei. The telecom company oversees the Harmony Intelligent Mobility Alliance (HIMA), which includes car brands like AITO, Stelato, and SAIC, itself another auto group that includes Roewe, Rising Auto, Wuling, and former British sports car maker MG, among others.

The R7 from Luxeed, one of the younger, keener rivals putting a ding in the Western auto industry universe.

Photograph: Getty Images

There was also Luxeed, a brand related to both Huawei and Chery, the latter of which sold over 2.5 million cars in 2024 and is the parent of Jaecoo, Omoda, Lepas and iCar. Those names might not be familiar to you yet, but they soon will be. Many will land on your radar because of their low prices. Dig a little deeper and you’ll find that the Jaecoo 7, a well-priced hybrid SUV, is already selling over 700 units a month in the UK. A nose-diving Tesla registered just 536 cars there in April.

Auto Shanghai had plenty of oddballs too. Ora followed up on its Funky Cat with the Ballet Cat, which curiously borrows much of its styling from the original VW Beetle. Songsan filled its stand with cars inspired by late-’50s Americana, including a seven-door take on the VW Microbus and a proportionally challenged revival of a first-generation Corvette. A handful of cars appeared to be inexplicably dressed as cuddly toys, one sharing its stand with a giant comb. Another, the Baojun Yep, had a massive ice cream cone dunked on its roof for reasons unclear.

The Baojun Yep had a massive ice cream cone dunked on its roof in Shanghai for reasons still unclear.

Photograph: Johannes Neudecker/Getty Images

320 Miles in 5 Minutes

Such fever dreams won’t give Western brands sleepless nights, but the EV technology coming out of China in 2025 certainly will. BYD used the Shanghai show to reveal a charging system powerful enough to deliver 259 miles of range in five minutes, at a peak speed of 1,000 kW—10 times the charge rate of a Mini Cooper.

Soon after, domestic rival CATL went one better with its 1,300 kW of charging power, enough to deliver 323 miles of range in five minutes. For context, Europe’s fastest-charging EVs, like the Porsche Taycan, fill their batteries at a mere 320 kW.

As well as dazzling tech, Chinese automakers are also majoring on small, low-price cars that appeal to Europe, the UK, and even emerging markets. Perfectly decent EVs—on paper, at least—are soon expected to land below the €20,000 ($22,700) barrier. Established marques like Volkswagen, Fiat, and Renault should soon be there too. But with models like the VW ID.1 not due in showrooms until 2027, cut-price alternatives from China’s Leapmotor, Lepas, and Firefly could quickly sweep up all the drivers wondering whatever happened to the Ford Fiesta and Volkswagen Up.

Things Sure Have Changed

It wasn’t always this way. Oh, how we once laughed when each year brought a Chinese motor show filled with poor imitations of European bestsellers.

Rewind a decade—just a single generation in car years—and the cream of Europe’s prestigious brands would reveal world-beating hypercars in the convention halls of Geneva and Paris, while China’s auto shows were, to the West, a laughing stock. Glitzy as they may have been, the show floors of Beijing and Shanghai in the mid-2010s featured flagrant knockoffs of British and European cars. Brands like Changan, BYD, Zotye, and Hongqi revealed vehicles unashamedly aping the latest designs of Mercedes, Ford, Land Rover, McLaren, and Porsche.

One of the hits of this year’s Shanghai show was the Jetour G900, a range-extended electric SUV with two rear-mounted turbines for use as a boat. Yes, a boat.

Photograph: Getty Images

The most infamous of all the copycats was the Landwind X7, which looked so similar to the Range Rover Evoque that, after four years of legal battles, a Chinese court ruled in favor of JLR, demanding the car be taken off sale and the British company awarded compensation.

Six years on, and with JLR absent from Shanghai 2025, China no longer feels the need to copy the West. Instead, it is the US and Europe being forced to play catch-up. Audi hit the Caps Lock key and used Auto Shanghai to reveal the first car of its China-only sub-brand, called AUDI.

Lowercase Audi said AUDI’s new E5 Sportback “offers the very best qualities of Audi, reimagined for and tailored to customers in China.” The German company claimed its engineering prowess is being blended with China’s own digital ecosystems and innovations, and that the AUDI division, which drops the iconic four-ringed logo, marks the beginning of a new era for the company in the region, “ensuring rapid response to the evolving demands of the Chinese market.” It will be interesting to see if this China-flavored AUDI Audi—reversing the trend of Chinese makers increasingly nailing the Western auto taste—is a success.

Audi has hit the Caps Lock key and used Auto Shanghai to reveal the first car of its China-only sub-brand, called “AUDI”, the E5 Sportback.

Courtesy of Audi

Some Western brands might need a rapid-response unit of their own, since not only are their sales falling in China, but the popularity of Chinese upstarts elsewhere is surging. BYD expects to double its overseas sales in a single year, rising from 417,000 vehicles in 2024 to over 800,000 in 2025. With US sales on ice, an increasingly brand-agnostic UK is poised to become a key battleground for BYD, along with Latin America and Southeast Asia.

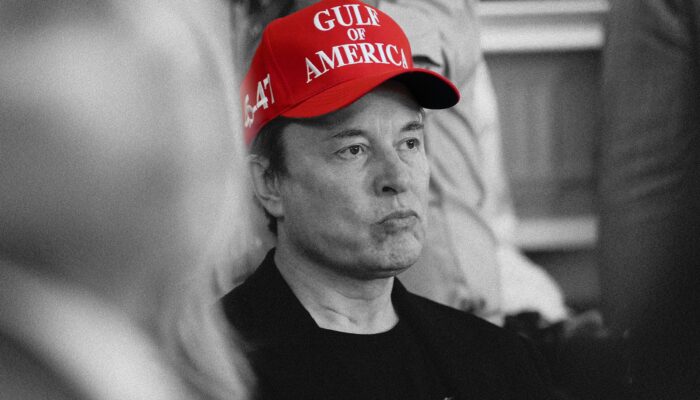

Elon Musk’s biggest headache has also found success in Australia, where BYD sales hit 40,000 units in 2024 (matching those of a Tesla rapidly heading in the opposite direction), and are on track to double in 2025. Where Tesla has failed to expand its two-vehicle lineup, BYD has grown from one model in Australia in 2022, to six just three years later.

China’s Smart Western Hiring Spree

It’s easy to credit Beijing’s massive investment in China’s nascent auto sector as a prime contributor to its success. But China’s closing of the gap to, and in many cases overtaking, US and European carmakers isn’t due to cash and copying alone. Just as the Japanese and Korean brands did before them, the Chinese have hired smartly.

Luxury sedan maker Hongqi took on Rolls-Royce design head Giles Taylor as its own global vice president of design in 2018. Similarly, Bentley design chief Stefam Sielaff headed to Geely in 2021, while 2024 saw Jozef Kaban—whose pencil gave us the era-defining Bugatti Veyron—swap Audi for MG, a part of Chinese giant SAIC. Stellantis UK managing director Maria Grazia Davino moved to BYD that same year, and JuanMa Lopez, who spent a decade as head of exterior design at Ferrari, moved to Xpeng.

The Chery iCar C23 is a small off-road EV priced at the equivalent of $13,000—and hits the UK in 2026.

Photograph: Gao Yang/Getty Images

Back to Shanghai, and the hits kept on coming. The Nio ET7 promised 620 miles of range from a battery bigger than that of a Rolls-Royce Spectre. The Huawei AITO M9 SUV has a projector screen for entertaining passengers in the second and third rows. The Chery iCar C23, a small electric off-road with the approach and departure angles of a mountain goat, is priced at the equivalent of $13,000 (and is coming to the UK in 2026, to the delight of Suzuki Jimny fans).

Headed to the Australian market for under $30,000, the Deepal E07 gave the Tesla Cybertruck a lesson in practicality, with the ability to transform its cargo area from the interior of an SUV to the open bed of a truck.

Riding the Wave

And it wasn’t just a show for EVs. Gas-powered cars shared the floor with all manner of hybrids, range-extended EVs that use engines as generators, and even old-school, stick-shift trucks with turbo-diesel engines ready to conquer emerging markets with rock-bottom prices.

At the other end of the market, Hongqi showed off vehicles with the thick carpets, dashboard artwork, and limitless customization normally reserved for Rolls-Royce. Its Guoyue luxury minibus even riffs on Rolls’ headliner filled with twinkling LED stars.

Songsan filled its Shanghai stand with cars inspired by late-’50s Americana.

Photograph: Zhe Ji/Getty Images

But focusing on what China’s still bunging into the photocopier misses the point. Here is an auto industry that—after substantial government support, it must be reiterated—is booming like no other. And, most worryingly of all, it’s an industry no longer content with serving its own enormous market.

Chinese brands are already making serious inroads across Australia and Europe. In May, it was reported that, for the first time, BYD sold more cars on the continent than Tesla in the previous month. BYD only entered Europe in 2020, and it waited two years before even expanding beyond Norway and the Netherlands.

Tesla’s growth at the start of this decade was equally staggering, but from the US there has been no follow-up act. Faraday Future was a failure, Slate Auto is fun but niche. Cash-hemorrhaging Lucid and Rivian are yet to touch foreign shores, and meanwhile behind BYD the tide has just gone out, and a tsunami is about to hit.