Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is trading less than 2.5% below its all-time high near $112,000, signaling growing momentum and the potential start of a new impulsive phase in price discovery. After weeks of steady gains and strong consolidation above the $100K level, BTC appears ready to break higher and extend its macro uptrend. The market is watching closely, as a clean move above $112K could trigger a wave of bullish continuation and renewed institutional interest.

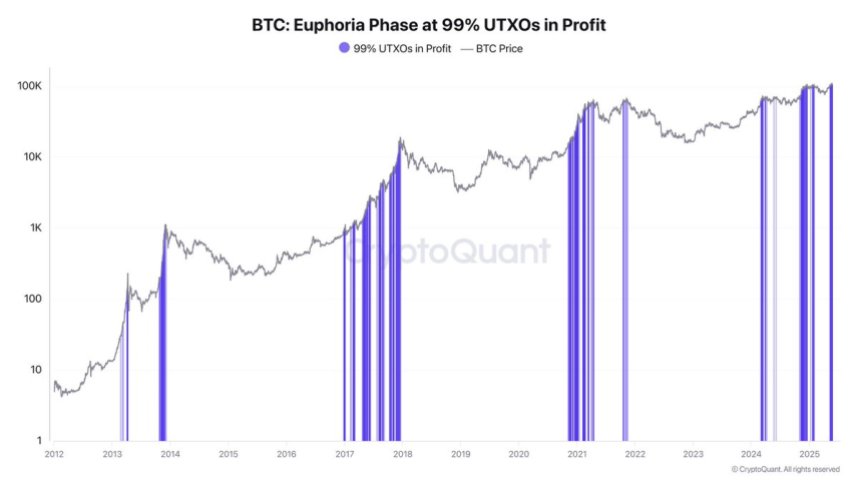

On-chain insights from CryptoQuant add important context to this moment. Specifically, the analysis of UTXOs—Unspent Transaction Outputs—provides a deeper understanding of the state of unrealized profits across the network. UTXOs are the core technical structure that ensures a single bitcoin can only be spent once. But beyond that, they offer critical insight into the profitability of held coins.

Currently, the market is nearing the 99% threshold, meaning 99% of all BTC holdings are in profit. This level historically aligns with periods of market euphoria and strong uptrend, but can also signal potential overheating if sustained too long. As Bitcoin inches toward new highs, this metric reinforces the strength of the rally while reminding investors that such high profitability often comes with increased volatility.

Bitcoin Thrives In Volatile Times As Market Nears 99% Profit Threshold

Bitcoin is showing remarkable strength as it flirts with new highs this week, trading just below $112,000. While global markets react to rising U.S. Treasury yields and persistent inflation, Bitcoin appears to be thriving in the chaos, solidifying its role as both a risk asset and a macro hedge. As traditional markets face pressure, BTC continues to lead with resilience, even as geopolitical and policy-related uncertainty clouds investor sentiment.

Top analyst Darkfost shared fresh insights on Bitcoin’s on-chain condition, focusing on the utility of UTXOs (Unspent Transaction Outputs). UTXOs are the technical mechanism that ensures a single BTC can only be spent once on the blockchain. But beyond that, they serve as a powerful tool for assessing unrealized profits across all held BTC.

One key metric derived from UTXOs is the percentage of BTC supply in profit. Currently, Bitcoin is approaching the critical 99% threshold, meaning nearly all coins are in unrealized gain territory. Historically, this level is associated with periods of market euphoria and sustained uptrends, but it also comes with a warning: elevated unrealized profits often precede spikes in profit-taking.

While BTC’s structure remains bullish, macro uncertainty—especially around the Trump administration’s policy direction—keeps risk-on conviction muted. As Darkfost notes, “We’re not fully euphoric yet, but we’re entering a zone where late buyers should be cautious.”

If the 99% profit signal drops, it may trigger a wave of selling as gains shrink and weaker hands capitulate. For now, though, Bitcoin remains strong, and the uptrend is intact. The market is watching closely because in times like these, BTC tends to move first.

BTC Holds Steady Near Highs As Momentum Builds

Bitcoin is currently trading at $109,679 on the 4-hour chart, consolidating just below its all-time high after reclaiming short-term support. The price recently bounced off the 100 SMA ($105,586) and is now hovering above the 34 EMA ($108,280), signaling continued bullish momentum. All key moving averages are aligned to the upside, reflecting a strong and healthy trend.

Volume has remained relatively stable during the pullback and recovery, suggesting no major distribution phase is underway. The 50 SMA ($107,679) also acted as dynamic support during the recent dip, reinforcing the strength of the $107K–$108K zone.

The $103,600 level, previously a major resistance, continues to serve as solid structural support. As long as BTC remains above this zone, the broader uptrend remains intact. Short-term resistance now sits near the $110,200–$112,000 range. A breakout above this level would likely trigger the next leg higher, potentially toward the $120,000 mark.

With Bitcoin holding above key EMAs and moving averages on the 4-hour timeframe, bulls remain in control. If price continues to build above $108K, the likelihood of retesting and surpassing all-time highs grows significantly in the coming sessions.

Featured image from Dall-E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.