Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) has surged over 40% in the past two weeks, trading in the mid-$2,000 range at the time of writing. Notably, several key indicators suggest that the ongoing ETH rally is being driven more by spot market demand than leveraged trading – an encouraging sign of a potentially sustainable bull run.

Ethereum Rally Driven By Spot Demand

After lagging behind other major cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP for much of the past year, ETH is now showing signs of an organic uptrend. According to CryptoQuant analyst ShayanMarkets, the current momentum appears to be primarily spot-driven, rather than fueled by speculative futures trading.

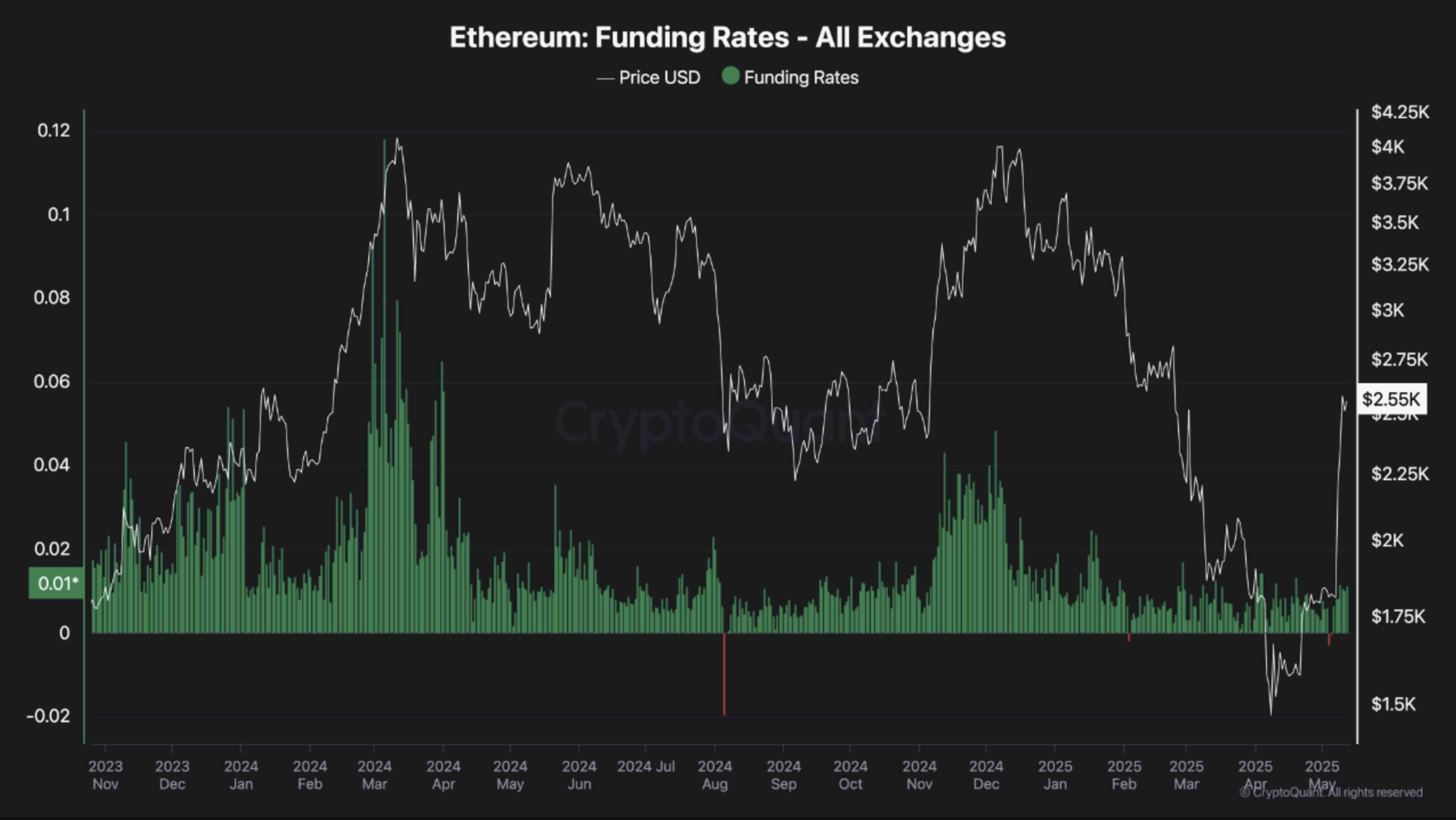

In a recent CryptoQuant Quicktake post, ShayanMarkets highlighted that ETH funding rates have remained ‘relatively flat’ despite the price surge. This is significant because funding rates are typically a reflection of sentiment in the perpetual futures market.

To explain, funding rates are periodic payments exchanged between traders in perpetual futures contracts to keep the contract price aligned with the spot price of the asset. Positive funding rates indicate that long positions are paying shorts, typically signaling bullish market sentiment, while negative rates suggest bearish sentiment.

In Ethereum’s case, flat funding rates during this recent rally indicate that the upward price action is being powered by genuine buying in the spot market, not speculative leverage. This makes the uptrend less prone to sudden reversals triggered by mass liquidations. As ShayanMarkets noted:

Still, for the bullish momentum to be sustained and validated, funding rates should begin to rise, reflecting increased confidence and more aggressive positioning by futures traders.

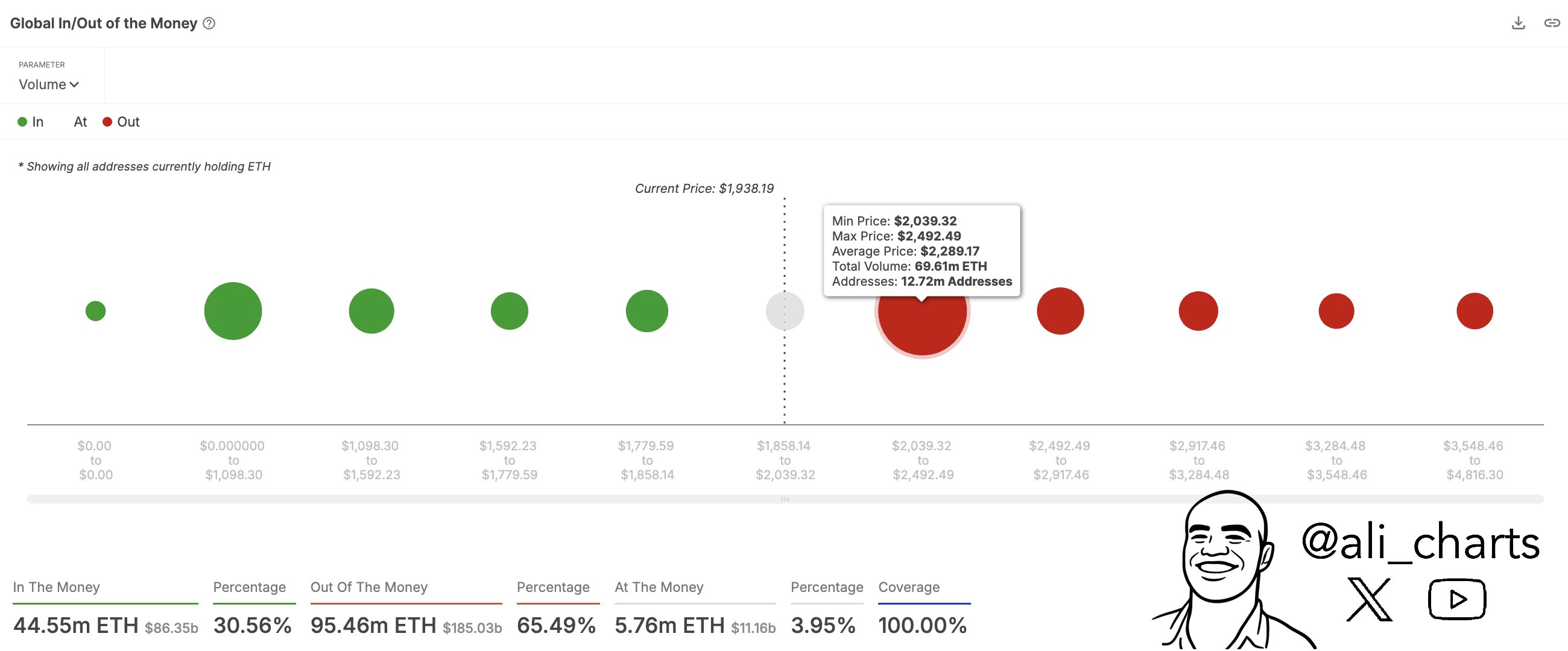

Meanwhile, other analysts predict further upside for ETH. For instance, noted crypto analyst Ali Martinez recently remarked that if ETH can decisively break through the $2,380 resistance level, then it could enter a new bull rally.

In his latest X post, Martinez emphasized that ETH’s new critical support range lies between $2,060 and $2,420. The analyst noted that close to 10 million wallets hold more than 69 million ETH between these levels.

New ETH ATH On The Horizon?

Although Ethereum remains well below its all-time high (ATH) of $4,878 reached in November 2021, many market watchers believe a new ATH for the second-largest cryptocurrency by market cap could be on the horizon.

In the same vein, crypto analyst Titan of Crypto recently noted that ETH is following a V-shape recovery. The analyst shared the following weekly chart that compares BTC and ETH price action, predicting that ETH is likely to follow BTC’s trajectory.

Meanwhile, analyst Ted Pillows outlined five bullish factors that could push ETH to $12,000 in 2025 – including favorable regulatory developments and strong inflows into spot exchange-traded funds (ETF). At press time, ETH trades at $2,555, up 3% in the past 24 hours.

Featured image created with Unsplash, charts from CryptoQuant, X, and TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.