Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Hedera token HBAR is at $0.18801, up nearly 12% in the last week, as it nears a key resistance level that investors are monitoring. The $0.20 level may mark a new era for the token, which has posted consistent gains despite an 18% decline in daily trading volume to $165 million.

Kenya Stock Market Selects Hedera For Digital Exchange

The new price action comes as Kenya’s financial sector makes a major foray into blockchain technology. Media reports the Nairobi Securities Exchange has chosen the Kenya Digital Exchange (KDX) to launch on Hedera’s network. The move is seen to be a key real-world use case for Hedera in the growing category of tokenized assets.

Growing optimism over the future of HBAR is emerging among social media analysts. Charts presented by market commentator Gilmore Estates reveal an HBAR breakout from the consolidation pattern created at the end of 2023.

$HBAR loading its next leg up!

Consolidation looks complete — a breakout toward $2+ is on the horizon.

Hedera’s just getting started. pic.twitter.com/wc9QJuZ0HU

— Gilmore Estates (@Gilmore_Estates) May 1, 2025

Tech indicators like moving average crossovers validate the bullish sentiment together with robust volume, while the token has inked price levels unseen since mid-2022.

In February 2025, HBAR applied for a spot Exchange-Traded Product, equivalent to an ETF on traditional markets. The SEC needs to make the final decision about the application on or before November 11, 2025.

Bloomberg analysts have issued a rating on the chances of approval at 80%, highlighting positive market dynamics and increasing demand from institutional clients. Approval with success would flood Hedera with significant new capital from traditional financial sectors.

Corporate Giants Support Hedera’s Enterprise Platform

As opposed to most cryptocurrency initiatives, Hedera has a governance structure composed of some of the biggest names in the tech sector. This arrangement lends institutional legitimacy to the network, which takes a different technical strategy than other blockchains.

According to reports, Hedera’s technology is rooted in Hashgraph, a Directed Acyclic Graph architecture that supports transactions of high throughput and rapid finality.

Focusing On RWAs

The network has concentrated on real-world applications rather than speculation, such as ESG tokens via its Guardian platform, real estate tokenization with TOKO, and green bonds through Evercity.

Meanwhile, as meme coins and newer blockchain ventures make the news with explosive price action, HBAR is playing a different game focused on infrastructure, regulatory compliance, and business adoption.

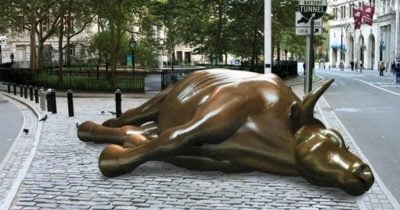

Featured image from Unsplash, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.