A publicly-traded logistics firm has struck a $20 million deal with an institutional investor to purchase Official Trump memecoins, becoming one of the first companies to anchor its digital asset strategy around the U.S. president’s controversial crypto business.

Freight Technologies CEO Javier Selgas pitched the move as part of an effort to grow U.S.-Mexico commerce—though how a memecoin fits into supply chains remains unclear. The investment also comes as the U.S. Office of Government Ethics examines whether President Donald Trump violates federal ethics rules by offering exclusive access to his coin’s top investors.

What Is Fr8Tech?

Freight Technologies, which refers to itself as Fr8Tech, is a Houston-based company launched in 2015 and trades on NASDAQ. The company aims to use new technologies like artificial intelligence for the optimization of the supply chain processes.

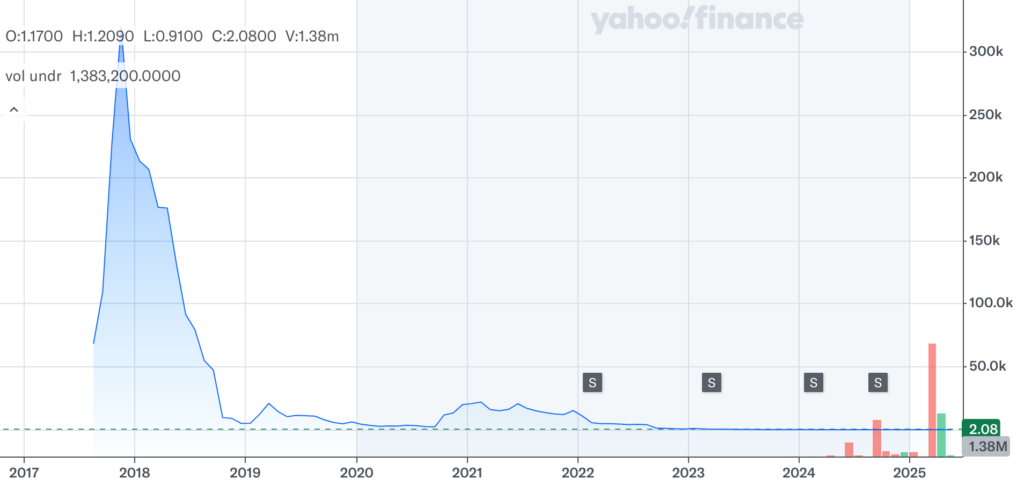

The company’s stock, which trades on the Nasdaq under the ticker FRGT, saw its price plummet back in 2018, during Trump’s first term. Like many other companies, Freight Technologies is now moving forward with a digital asset reserve, deviating from the norm of making Bitcoin (BTC) the primary asset and embracing a memecoin instead.

Social media influence and crypto commentator Mario Nawfal called it the “first-ever” Trump treasury.

No major headlines yet, but $FRGT’s move to back a treasury with $TRUMP is catching CT’s eye—social buzz around $TRUMP is strong, even while the token’s price action is cooling and trading shows short-term downside risk. $FRGT is still under the radar, with little volume or data…

— Alva (@AlvaApp) April 30, 2025

Costly gimmick?

On April 30, Freight Technologies announced the creation of a crypto treasury.

The company agreed to issue convertible notes worth up to $20 million with an institutional investor. The capital is secured exclusively for buying Official Trump (TRUMP) tokens. The first tranche will amount to $1 million.

Selgas, in a prepared statement, referenced Trump’s “America First” principle and tied it to trade efforts between Mexico and the U.S. See below:

At the heart of Fr8Tech’s mission is the promotion of productive and active commerce between the United States and Mexico. Mexico is the United States’ top goods trading partner, with Mexico being the leading destination for US exports and the top source for US imports. As US Treasury Secretary Scott Bessent recently stated, “I wish to be clear: America First does not mean America alone. To the contrary, it is a call for deeper collaboration and mutual respect among trade partners.”

Buying TRUMP is outlined as “an effective way to advocate for fair, balanced, and free trade between Mexico and the U.S..” Still, the company doesn’t elaborate on how a Trump memecoin acquisition will help trade between the two countries or warn readers about the possible risks.

After all, the Trump token — like most memecoins — is highly volatile. Although its price has been up roughly 2% in the past 24 hours, it’s been on a downward trajectory since its launch in January.

Trump memecoin a strange choice

As corporate crypto treasuries become trendy, big-name firms like BlackRock recommend allocating up to 2% of corporate assets in Bitcoin. They argue that BTC is a better store of value than most other digital assets.

According to the Bitcoin Treasuries website, 101 public companies hold Bitcoin.

Considering Bitcoin’s deflationary design and long-term value appreciation, which have been demonstrated throughout its 15-year history, it’s understandable why some companies may choose Bitcoin as one of their corporate assets.

So far, Official Trump has no use case other than incentivizing investors to buy more to be invited to a private dinner with Trump on May 22. $TRUMP saw its value spike over 50% following the promotion.

Critics also warn that the “pay to play” aspect of Official Trump raises ethics concerns and could even be used as a bribery tool.

“Something that hasn’t been much discussed — creating a bunch of personal memecoins opens the door to secretive foreign buyers trying to curry influence with our leaders,” Nic Carter of Castle Island Ventures said on X back in January. “If you hated Hunter Biden’s anonymous art sales, you should hate this too.”

Something that hasn’t been much discussed – creating a bunch of personal memecoins opens the door to secretive foreign buyers trying to curry influence with our leaders. If you hated hunter biden’s anonymous art sales, you should hate this too.

— nic carter (@nic__carter) January 20, 2025

Last month, Democratic Senators Adam Schiff and Elizabeth Warren called for a federal ethics investigation into Trump’s promotion of the coin. In a letter to the U.S. Office of Government Ethics, the senators allege that Trump may have violated federal ethics rules by offering access to his administration in exchange for financial investment.

Freight Technologies has not indicated that it seeks access to the White House by holding Trump memecoins. In the days following the company’s announcement, the FRGT stock price grew 111.21% on May 2. The stock closed Friday at $2.08 per share.

The Trump memecoin price seems unaffected by the news.

Signs of a bubble?

Bubbles make sense when they burst, so it’s premature to state that corporate crypto treasuries are the bubble. However, some observers feel that a sudden spike of interest in crypto among public companies draws comparisons with the dot-com bubble.

Worth reminding the only *real* public companies that have adopted bitcoin as a corporate treasury are $TSLA, $COIN and $XYZ

Everybody else sits somewhere on the spectrum between Charles Ponzi and https://t.co/3CghbTay3b

— Pledditor (@Pledditor) May 2, 2025

If we look closely, we will see that it’s early to speak about a strong trend or any notable crypto fever among public companies. As more companies acquire Bitcoin, most are relatively small companies that spend humble amounts on it.

Strategy, a company holding over 500,000 bitcoins, started to accumulate BTC in 2020. Tesla made a Bitcoin investment in 2021, driving the asset’s price. Strategy became the dominant Bitcoin buyer among public companies. The rest of the public companies hold smaller BTC bags—no need to panic.

As for the Fr8Tech news, the company currently has the financing “earmarked” for purchasing Official Trump, so we’ll see what happens when the purchase is officially made. It’s also not the only token sparking the company’s interest.

Earlier in April, Fr8Tech disclosed an acquisition of $5.2 million of FET Tokens from Fetch Compute, Inc. in exchange for over 2.3 million shares.