Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Recent positive price action has propelled Bitcoin (BTC) above the short-term holders’ realized price of $91,000. This development has prompted some crypto analysts to question whether BTC’s newfound strength is sustainable – or merely a bull trap ahead of a major pullback.

Is Bitcoin About To Rally Or Will It Double Top?

US President Donald Trump’s recent statement that tariffs on China will be “substantially” lower than the proposed 145% provided a boost to risk-on assets. Both equity and crypto markets responded positively, with BTC up 5.6% over the past 24 hours.

Bitcoin is currently trading in the low $90,000s for the first time since March, renewing hopes for an extended rally that could push it past the $100,000 mark. However, CryptoQuant contributor Avocado_onchain urges caution.

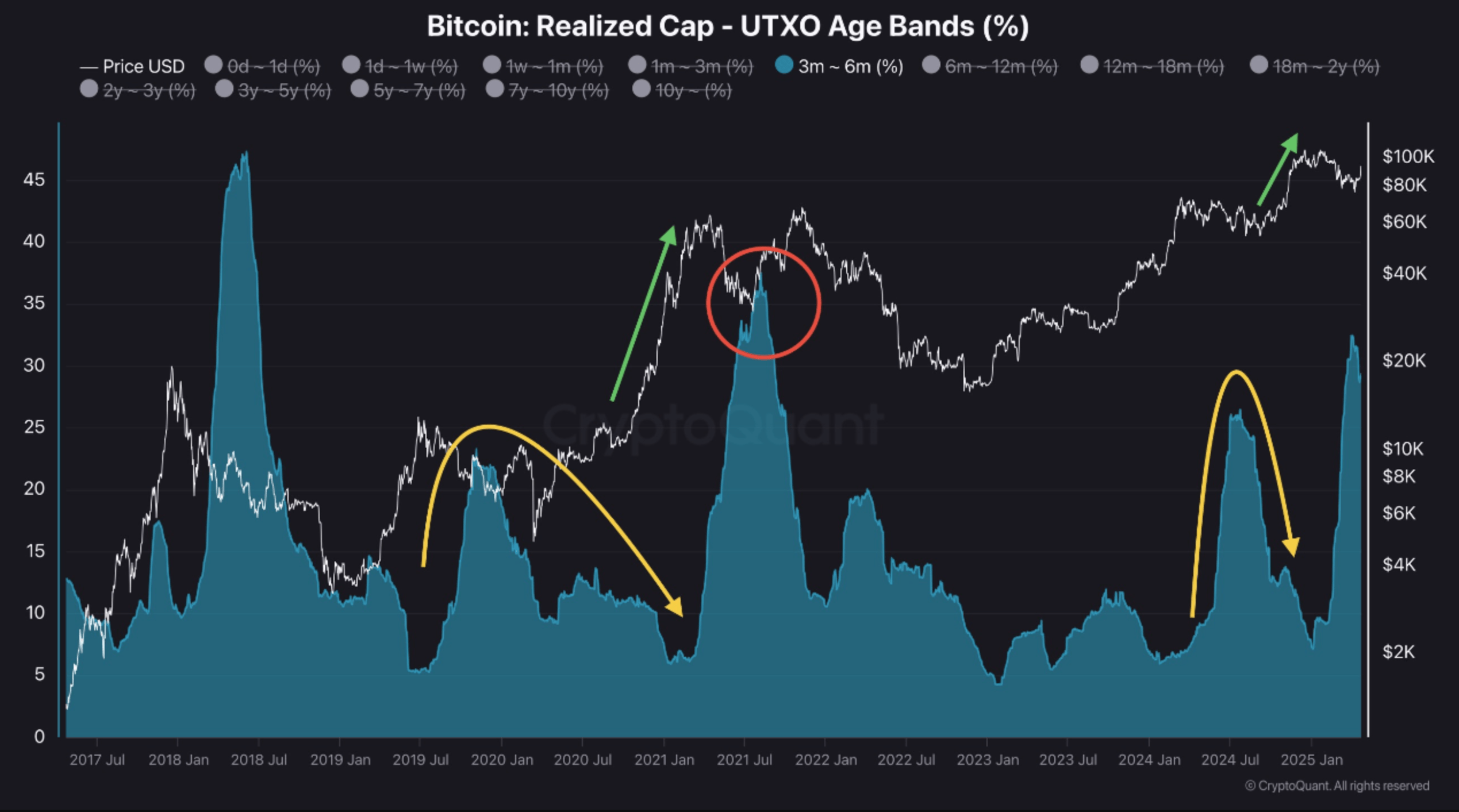

In a recent CryptoQuant Quicktake post, the on-chain analyst provided insights into the behavior of the 1–3 month holder cohort. This group typically enters the market during bullish phases and tends to hold their BTC through price corrections.

The analyst shared the following chart, illustrating how these short-term participants often transition into the 3–6 month holding category – highlighted with a yellow arrow – during extended drawdowns. Conversely, during strong rallies – highlighted with a green arrow – this group tends to take profits by selling to new market entrants.

As the market nears the final stages of a rally – highlighted with a red circle – this cohort usually grows significantly in size. When a drawdown begins, these short-term holders often exit the market as prices approach their realized cost basis.

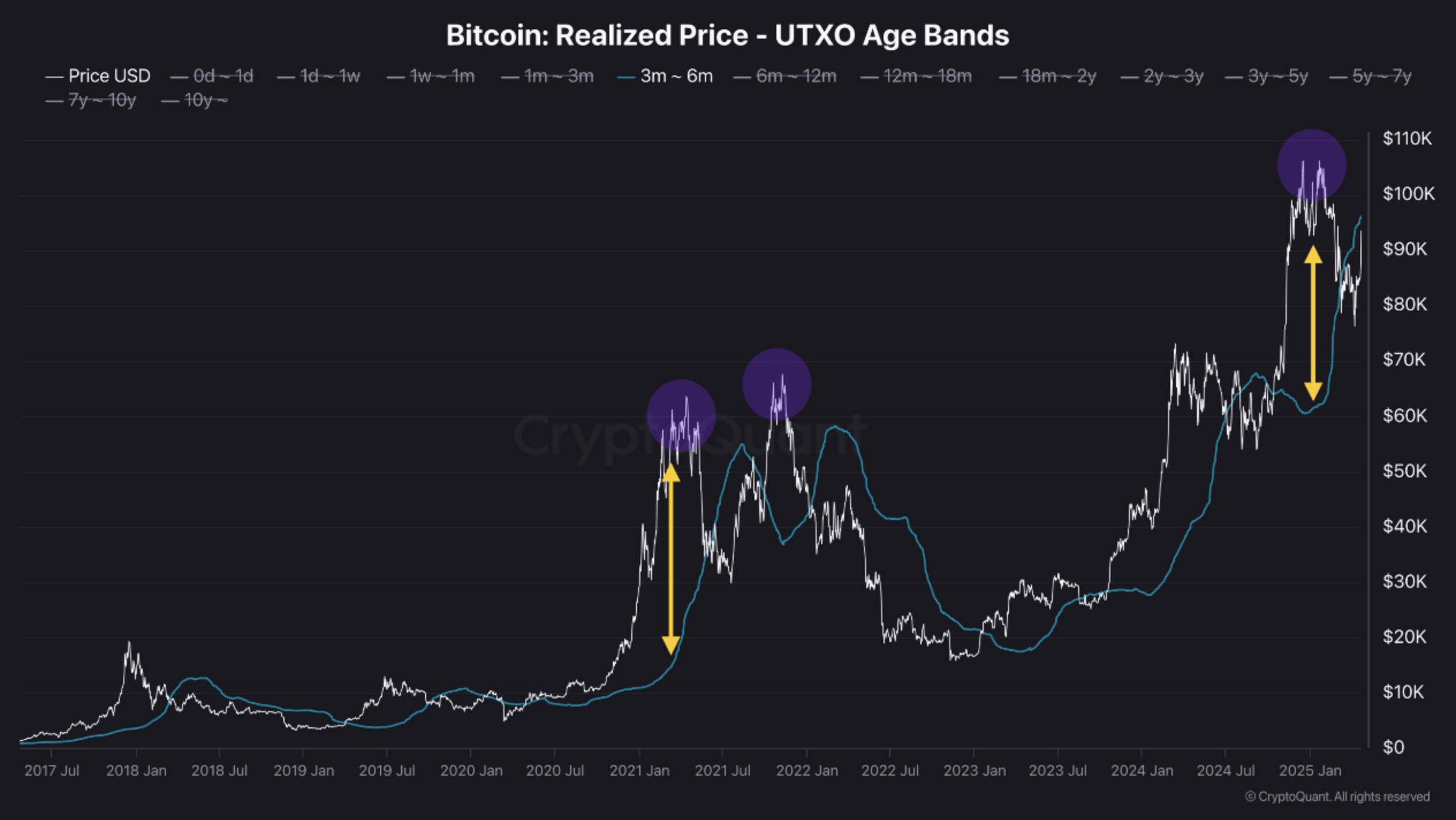

Avocado_onchain also shared another chart showing how the peaks of previous BTC halving cycles have consistently surpassed the average realized price of 1–3 month holders.

Further, the analyst warned that the current market cycle may mirror the double top formation witnessed in 2021. They added:

When Bitcoin hit its all-time high of $109,000 in January 2025, it significantly exceeded this realized price level, suggesting that may have been the first top of a potential double top formation. Hence, rather than chasing the rally, it may be wiser for current holders to adopt a more cautious approach.

Macro Headwinds Could Derail BTC Momentum

The analyst further cautioned that limited market liquidity and macroeconomic factors – such as US-China tariff tensions – could weigh heavily on risk-on assets like BTC. That said, market sentiment can shift rapidly, and the entry of fresh liquidity could reignite a full-scale bull market.

Meanwhile, crypto analyst Xanrox recently warned that BTC’s breakout from a falling wedge pattern may be a whale-driven trap designed to lure retail investors before another leg down. At press time, Bitcoin is trading at $93,754, up 5.6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.