Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to trade above the $85,000 mark, signaling a slight upward movement after weeks of price consolidation. As of today, the asset is up 2.2% on the daily chart, giving some traders a reason to anticipate a stronger rally ahead. However, broader timeframes paint a different picture.

Over the last month, Bitcoin is down over 8%, and from its January 2025 all-time high above $109,000, the decline stands at more than 20%.

Public Companies Accumulate BTC While Long-Term Holders Sell

Despite this underperformance, blockchain data provider CryptoQuant has published a breakdown of corporate Bitcoin accumulation in the first quarter of 2025.

The data highlights an aggressive accumulation trend among public companies. In total, these firms added 91,781 BTC to their balance sheets between January and March, suggesting continued confidence in Bitcoin’s long-term value proposition.

Among the most notable buyers, Tether added 8,888 BTC in Q1 2025, bringing its total holdings to 92,646 BTC. MicroStrategy remained the most aggressive acquirer, purchasing 81,785 BTC worth over $8 billion.

Other participants included Semler Scientific (+1,108 BTC), Metaplanet (+2,285 BTC), and The Blockchain Company (+605 BTC).

CryptoQuant also mentioned that Marathon Digital is planning a $2 billion stock sale to fund future Bitcoin purchases, while GameStop is exploring a $1.3 billion convertible note offering to support its entry into Bitcoin investing.

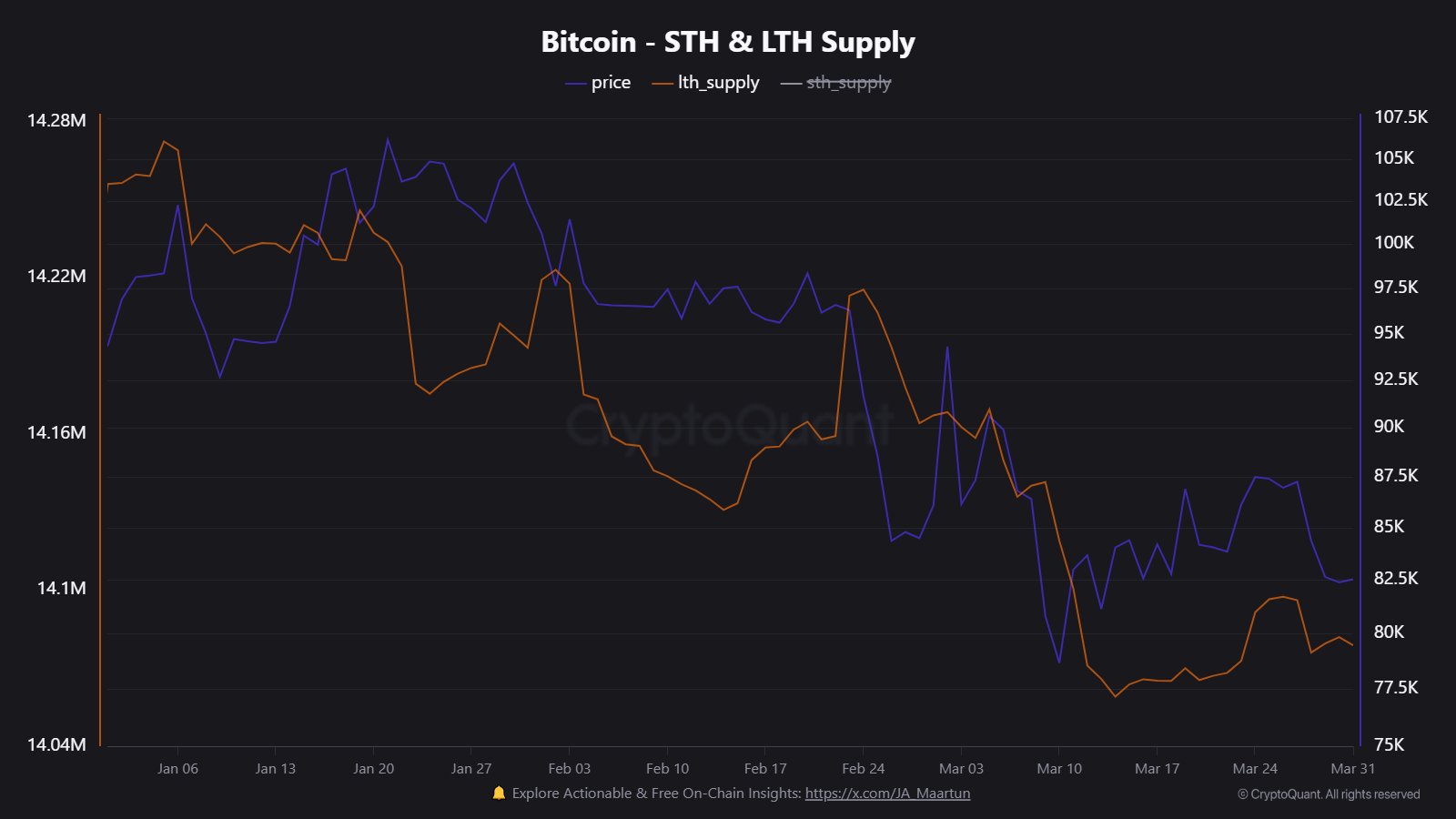

However, this strong demand was not enough to sustain Bitcoin’s price. CryptoQuant reported that long-term holders offloaded around 178,000 BTC during the same period, adding significant sell pressure.

The situation was exacerbated by outflows of approximately $4.8 billion from spot Bitcoin ETFs, which further weighed on price action.

Adding to the sell pressure: $4.8 billion flowed out of Bitcoin ETFs in Q1.

Despite corporate buying, this wave of outflows likely weighed heavily on price. pic.twitter.com/gZZz5RJxdK

— CryptoQuant.com (@cryptoquant_com) April 2, 2025

Key Support Levels for Bitcoin Identified by Analyst

Meanwhile, CryptoQuant analyst BorisVest identified an important support zone between $65,000 and $71,000. This range is derived from two specific metrics: the Active Realized Price and the True Market Mean Price.

The Active Realized Price, currently around $71,000, filters out long-dormant coins to better reflect the behavior of more active market participants. On the other hand, the True Market Mean Price at $65,000 represents a broader average based on recent transaction history.

BorisVest noted that if Bitcoin’s price falls into this zone, it could see strong demand from long-term holders and institutional buyers alike. He suggested that this area may serve as a foundation for further accumulation and potentially act as a springboard for a new upward phase.

Regardless, while some market participants continue to exit their positions, others appear to be taking advantage of the consolidation to accumulate.

Featured image created with DALL-E, Chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.