Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

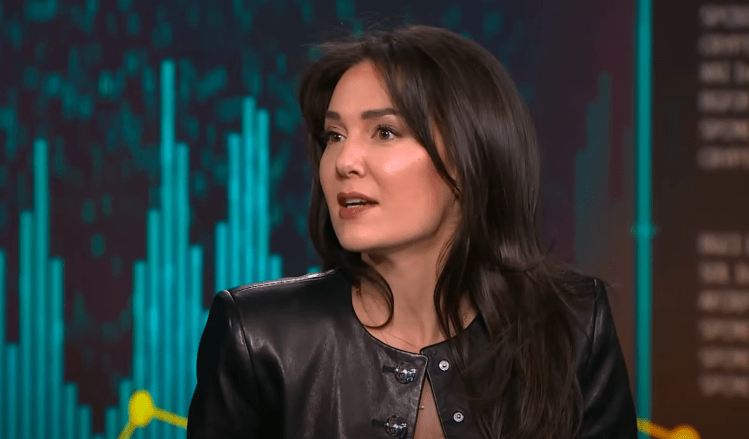

Over the past two weeks, Bitcoin and the broader crypto market have seen a slight recovery. However, Crucible Capital General Partner Meltem Demirors struck a cautious tone on the future of the crypto rally. In an interview on Bloomberg on March 25, Demirors addressed everything from trading volumes and ETF inflows to concerns about “hidden leverage” in the crypto ecosystem.

“It’s a tale of two cities. Sentiment is positive. You see a lot of enthusiasm about the Trump administration policy direction,” she said, referencing the renewed buzz around crypto in political rhetoric. “But if we look at markets, volumes are abysmal. We’re back to trading levels we saw pre-election.”

While media coverage surrounding pro-crypto signals from President Trump and World Liberty Financial has created a burst of excitement, Demirors highlighted the need to separate hype from tangible market activity. She noted that so far, the data suggest limited buying pressure—raising serious questions about where any lasting bid for Bitcoin and other crypto assets will come from.

Discussing 2024’s performance triggers, Demirors emphasized the role of institutional ETF trading strategies in shaping demand: “We had ETF buyers. If we look at the ETF buyers based on 13F filings from December, the majority of those are firms that are farming the basis trade, right? They’re not long-term holders. It’s not mom and pop going out and buying in their brokerage.”

She explained that these firms often “buy the ETF and then short Bitcoin,” capturing price spreads rather than seeking fundamental exposure. The dynamics surrounding MicroStrategy’s convert arbitrage—where big institutional players leverage MicroStrategy’s publicly traded Bitcoin holdings—further complicate market flows. Demirors flagged “growing concerns about a potential black swan if that trade unwinds.”

In recent sessions, certain altcoins have logged short-lived rallies that, on the surface, might imply renewed appetite among traders. Demirors was quick to contextualize these moves: “If we take out Bitcoin and Ether, [there’s been] no change in market cap of that long tail of crypto and no change in trading volume, it’s been flat. Just the names are rotating. So it’s a game of musical chairs.”

Market observers have been buzzing over President Trump’s online comments and closer ties between major financial players—such as Cantor Fitzgerald and Tether—amid broader regulatory conversations in Washington. Demirors, however, suggested that these developments are merely part of the cycle: “Is this value accretive? We’re taking liquidity out of the crypto ecosystem, putting it into the banking sector or putting it into the pockets of the creators of these coins. So is that value accretive to boosting volume in Bitcoin and the broader crypto complex? Not necessarily.”

Still, she reiterated optimism about Bitcoin’s resilience, pointing to Bitcoin dominance hovering around 70%—a multi-year high.

However, she also expressed concerns about hidden leverage in the system. From potential unwind scenarios involving MicroStrategy’s Bitcoin holdings to large distributions from Mt. Gox creditors and the defunct FTX platform, Demirors sees a possible wave of selling pressure: “We’ve got Mt. Gox starting to distribute coins. FTX is distributing coins, so we’ve got potential net sellers and distributions that may become net sellers. Where are the inflows coming from? Who else is left to buy?”

The question of what could reverse the tide remains open, especially amid disappointing volume data. “I’m a simple girl,” Demirors added. “Every time I talk, I say it’s all about the flows.”

At press time, BTC traded at $87,926.

Featured image from YouTube, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.