Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Open interest in Bitcoin trading is a crucial metric to assess the market’s current sentiment on the digital asset, including potential price movements.

In theory, an increase in Bitcoin’s open interest suggests liquidity, which can also support an ongoing price trend.

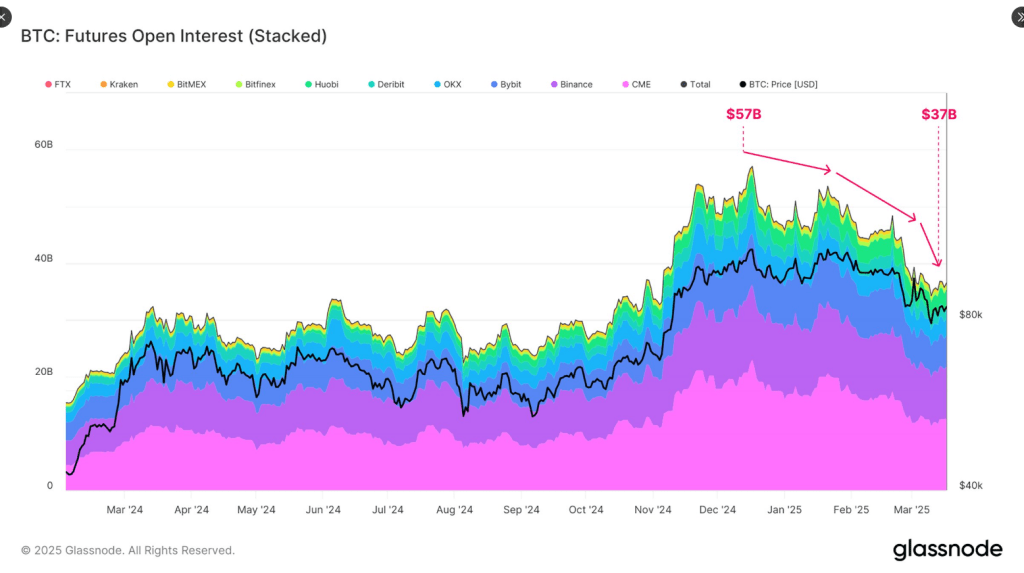

According to the latest Glassnode data, Bitcoin’s OI has dipped from $57 billion to $37 billion, or a loss of 35%, since the world’s top digital asset hit its all-time high.

Interestingly, Bitcoin hit an all-time high of $108,786 on January 20th, the day United States President Donald Trump was inaugurated for a second term.

Bitcoin is trading between $83k and $86k, down more than 22% from its peak, at the time of writing.

Bitcoin Open Interest And Its Possible Impact On Price

Investors and holders use the open interest metric to assess the sentiment and potential market performance of the asset.

A digital asset with a falling open interest means that traders and investors are closing their positions due to uncertainties or lack of confidence or are moving away from leveraged trading.

Futures open interest has dropped from $57B to $37B (-35%) since #Bitcoin’s ATH, signaling reduced speculation and hedging activity. This decline mirrors the contraction seen in on-chain liquidity, pointing to broader risk-off behavior. pic.twitter.com/XPbXiHXlRS

— glassnode (@glassnode) March 20, 2025

In Glassnode’s analysis, the drop in Bitcoin’s OI reflects a broader trend of decreasing on-chain activities and liquidities, where investors have less confidence in the asset.

Bitcoin’s current status suggests that most investors are now looking at short-term trades for quick gains at the expense of long-term positions.

There’s A Shifting In Positions – Glassnode

According to Glassnode, traders and investors are now in the cash-and-carry trade, with a weakening of long positions. It adds that the CME futures closures and ETF outflows reflect a shift in investors’ strategy and also add to the selling pressure.

Also, the availability of ETFs, which have less liquidity than futures, may impact the alpha crypto’s short-term market volatility.

Data Highlights Hot Supply Metric

Glassnode also highlighted the asset’s Hot Supply metric. This is another important metric that tracks the Bitcoin holdings at one week or less.

According to the same Twitter/X thread, the numbers have dropped from 5.9% of the total BTC in circulation to 2.8%, reflecting a drop of more than 50% in the last three months.

The decline in the hot supply suggests that fewer new Bitcoins are traded in the market, reducing the asset’s liquidity.

Glassnode further painted a gloomy picture for Bitcoin by explaining that exchange inflows have dropped from 58,600 Bitcoins daily to 26,900 Bitcoins, a 54% decrease.

This Bitcoin trend suggests weaker demand since fewer assets are moving to crypto exchanges.

Featured image from Olhar Digital, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.