Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is trading at its lowest levels since late 2023, struggling to regain momentum after an extended period of selling pressure. Since December 2024, ETH has lost over 57% of its value, failing to reclaim key resistance levels. With the broader crypto market facing macroeconomic uncertainty and persistent volatility, Ethereum’s downtrend appears far from over.

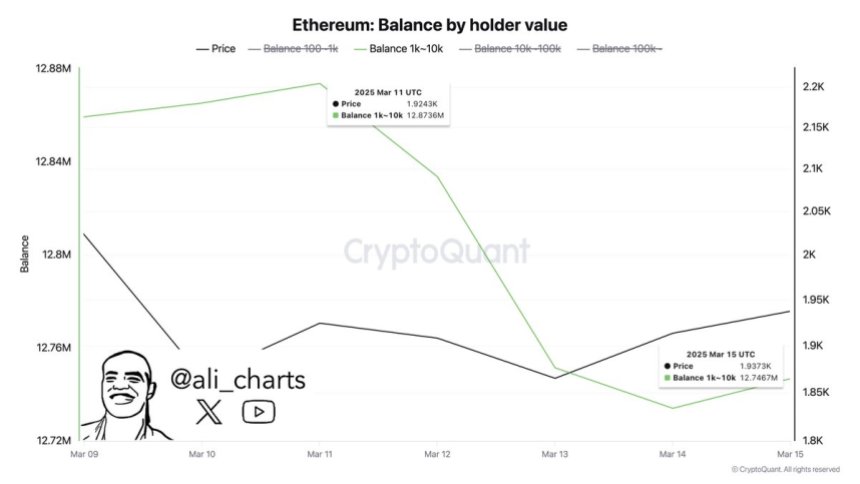

Despite the ongoing decline, on-chain data suggests that large investors may be positioning for a recovery. According to CryptoQuant, whales have moved over 130,000 ETH off exchanges in the past week, signaling a growing accumulation trend. This pattern has been developing since Ethereum started trending downward, suggesting that institutional players and long-term holders are buying the dip in anticipation of future price appreciation.

While short-term sentiment remains bearish, historical data shows that large whale accumulations often precede strong rebounds once selling pressure fades. However, ETH still faces significant resistance, and bulls must reclaim key levels to confirm a potential trend reversal. With market uncertainty still looming, the next few weeks will be critical in determining Ethereum’s next major move.

Ethereum Whale Activity Hints At Optimism

Ethereum has been under massive selling pressure, struggling amid macroeconomic uncertainty and trade war fears that have shaken both the crypto market and the U.S. stock market. ETH is now trading below a multi-year support level, which could act as a strong resistance in the coming weeks. If bulls fail to reclaim key price levels, the stage could be set for a deeper correction.

However, not all indicators are bearish. Despite the ongoing downtrend, some analysts remain optimistic about Ethereum’s long-term prospects. Top analyst Ali Martinez shared insights on X, revealing that whales have moved over 130,000 ETH off exchanges in the past week.

This is significant because large investors typically move their holdings off exchanges when they plan to hold for the long term rather than selling. When whales transfer ETH into private wallets, it often signals accumulation rather than immediate selling pressure. Historically, such trends have preceded market rebounds, as reduced exchange supply can contribute to price stability and future upside potential.

While Ethereum still faces major hurdles, whale activity suggests that smart money is positioning itself for the next move. The next few weeks will be crucial in determining whether ETH can reverse its downward trend or if further declines are ahead.

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.