Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An analytics firm has explained how the data related to the stablecoins could hint at whether the Bitcoin market top is in or not.

Stablecoins Have Seen Their Market Cap Touch New Highs Recently

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the trend in the combined stablecoin market cap. “Stablecoins” refer to cryptocurrencies that are pegged to a fiat currency (with USD being the most popular choice).

Generally, investors make use of these assets when they want to avoid the volatility associated with other coins like Bitcoin. Traders who invest into stablecoins, however, usually do so because they plan to venture (back) into the volatile side of the sector.

As such, the supply of these fiat-tied tokens is often considered as the available ‘dry powder’ for Bitcoin and other cryptocurrencies. Given this placement of the stables in the sector, their market cap can be worth keeping an eye on.

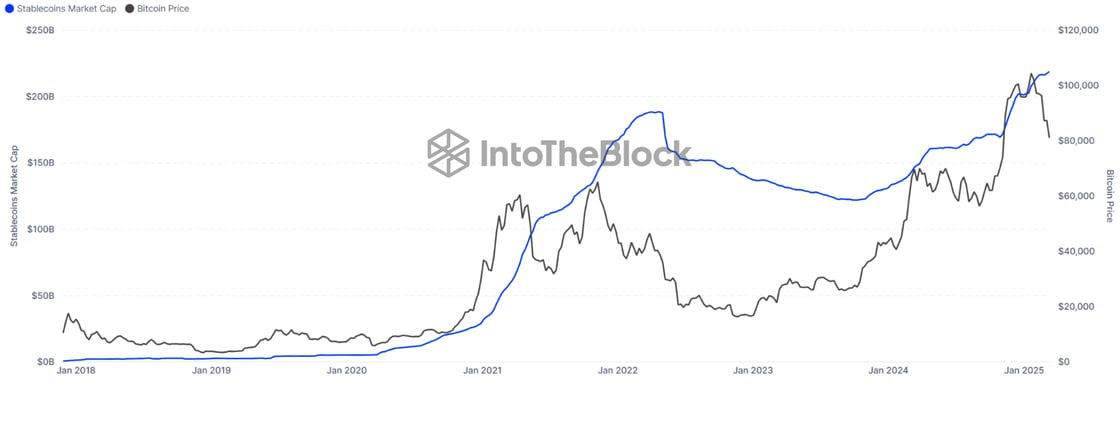

Here is the chart shared by the analytics firm that shows the trend in the stablecoin market cap over the past few years:

As displayed in the above graph, the market cap of the stablecoins has been riding an uptrend recently and exploring new all-time highs (ATHs). Following the latest continuation to the increase, the metric has hit a whopping $219 billion.

To put things into perspective, the market cap of Ethereum (ETH), the second largest asset in the sector, is just under $233 billion. Thus, the stables are less than $14 billion away.

IntoTheBlock has pointed out an interesting pattern related to this indicator. In the chart, it’s visible that the metric’s top last cycle was when it hit $187 billion in April 2022. Evidently, this peak in the market cap of the stables coincided with the start of the bear market.

“Historically, stablecoin supply peaks align with cycle highs,” notes the analytics firm. So far in the current cycle, the indicator has continued to rise, despite the decline in the asset’s price. If the previous trend is anything to go by, this could be an indication that Bitcoin and other coins are yet to enter a bear market.

That said, the latest market conditions haven’t exactly been entirely bullish. The most positive scenario occurs whenever both BTC and the stablecoins enjoy an increase in their market caps. In such a period, a net amount of fresh capital inflows are entering into the sector.

At present, though, the stablecoins have been rising while Bitcoin and others have been falling. This could potentially imply a rotation of capital has been occurring, rather than fresh inflows.

During the mid-2021 correction, a similar pattern emerged, but the market was able to find its footing and the second half of the rally took place. It now remains to be seen whether something similar would happen for Bitcoin this time as well, or if the market will go the way it did in 2022.

Bitcoin Price

At the time of writing, Bitcoin is trading around $84,700, down over 4% in the last seven days.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.