Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) recorded slight gains as the Consumer Price Index (CPI) inflation rate for February came in lower than expected. The softer inflation reading fuelled hopes of interest rate cuts by the US Federal Reserve (Fed), potentially benefiting risk-on assets.

Bitcoin Jumps As Inflation Cools

According to data from the US Bureau of Labor Statistics, the CPI increased by 0.2% in February on a seasonally adjusted basis, bringing the annual inflation rate down to 2.8%. This figure not only fell below economists’ projection of 2.9% but also marked a decline from January’s 0.5% monthly increase.

Additionally, the core CPI – an inflation measure excluding food and energy prices – rose 0.2% month-over-month, underperforming most forecasts of 0.3%. On an annual basis, core CPI came in at 3.1%, slightly below the 3.2% consensus.

The lower-than-anticipated inflation data has reignited investor optimism, with hopes the Fed may pivot to a more dovish monetary policy by cutting interest rates to boost market liquidity. Lower interest rates typically favor risk-on assets like stocks and cryptocurrencies.

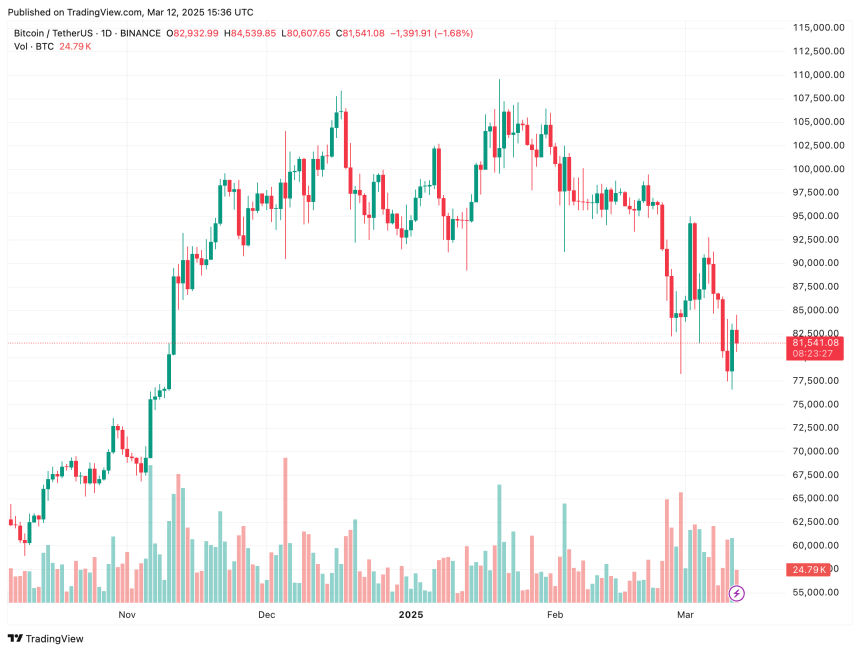

Following the data release, BTC posted modest gains, climbing from approximately $81,000 to $84,500. Leading memecoin Dogecoin (DOGE) also saw a 2.9% rise in the past 24 hours.

It’s worth noting that last month, BTC declined after CPI data came in hotter than expected. Since then, US President Donald Trump’s economic policies – particularly high trade tariffs on countries like Canada, Mexico, and China – have further hindered bullish momentum for digital assets.

Earlier this month, BTC experienced one of its sharpest declines, dropping from around $94,700 on March 2 to as low as $76,800 on March 11. Over the same period, the total crypto market cap shrank by approximately $600 billion, falling from $3.2 trillion to approximately $2.6 trillion at the time of writing.

BTC Price Projected To Make Recovery

While the current bearish trend has dragged BTC and other cryptocurrencies to multi-month lows, industry experts believe digital assets are likely to rebound in the later quarters of 2025.

For instance, crypto entrepreneur Arthur Hayes recently suggested that while BTC may face further declines in the short term, central banks will likely resort to quantitative easing to stabilize stock markets – a move that could also help risk-on assets recover their losses.

Similarly, recent analysis by CryptoQuant contributor ibrahimcosar forecasts that despite the current downturn, BTC is poised to reach $180,000 by 2026. A weakening US dollar is also likely to hasten the price recovery. At press time, BTC trades at $81,541, reflecting a 0.6% gain over the past 24 hours.

Featured image created with Unsplash, charts from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.